Authored by Greg Hunter’s USAWatchdog.com

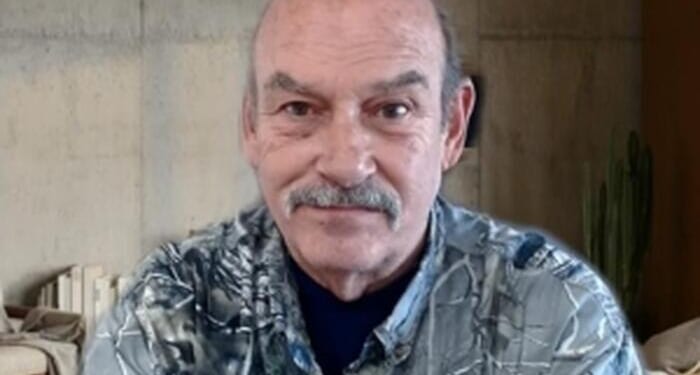

Financial writer and precious metals expert Bill Holter (aka Mr. Gold) said at the beginning of November that there was “more risk in the financial system now than any time ever.”

There are so many ways the system can break down it’s hard to keep track, but let’s start with exploding silver prices that happened at the end of last week. Holter says,

“In a 48-hour period of time, silver was up over $5 per ounce. It’s pretty clear and pretty obvious that something behind the scenes is breaking.

We know that the lease rates have exploded. We know that the borrow rates on SLV have exploded.

We also know that in the last 5 to 7 years, silver has been in a deficit… At this point, you are looking at a 400-million-ounce deficit on an annual basis, and global production is 850 million ounces…

The rumor is somebody has put in a $20 billion order, which would mean 400 million ounces.

If that is the case, that order cannot be met, and that will create shark infested waters…

If somebody stands for delivery and it looks like it may be difficult for them to get delivery, then everybody is going to stand for delivery because they know that their contracts are worthless.”

What would happen if there is an actual failure to deliver in the silver market? Mr. Gold says,

“If that gets confirmed, then that one day you will see a huge spike, but markets won’t open after that. That will cascade. What will happen is all the COMEX contracts for both silver and gold will default.

That will spill over to the rest of the CME (Chicago Mercantile Exchange). It has contracts on US Treasuries and stocks. They have contracts on everything. If the silver contracts blow up and the gold contracts blow up, how much confidence are you going to have on pork bellies or stocks…

The derivative market is $2 quadrillion. In the future, you are going to measure your wealth by how many ounces of silver and how many ounces of gold you own…

Once you get a failure to deliver, you will get a Mad Max scenario. Failure to deliver will melt down all derivatives.

The world runs on credit, and credit runs on faith. If you break faith, then you have a real problem in the financial markets and the real economy.”

In closing, Holter warns, “The problem is there is very little collateral left. Everything has been borrowed against already.”

Holter is not alone in his thinking about huge risk in the system. It appears billionaire investors Jeff Gundlach and Ray Dalio agree with Holter, and they are warning of liquidity problems. For the first time in their successful careers, they are both buying physical gold.

On a total system stopping derivative meltdown, Holter says, “Most people think it is not possible, and it can’t happen. Mathematically, a meltdown in derivatives that melts everything down is coming. It’s over. Mathematically, it’s over.”

There is much more in the 41-minute interview.

Join Greg Hunter of USAWatchdog as he goes One-on-One with financial writer and precious metals expert Bill Holter/Mr. Gold as the risk in the financial system increases for 12.2.25.

Loading recommendations…