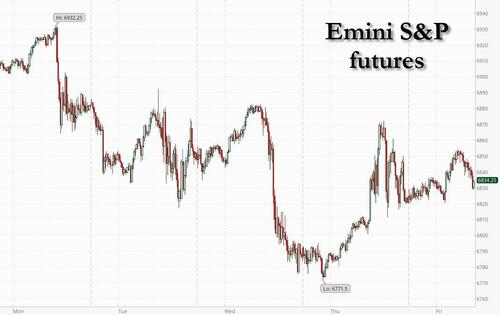

Stocks look set toclose out a choppy week on a steady note, building on Thursday’s gains, spurred by cooler inflation that backs the case for lower borrowing costs. As of 8:00am, S&P 500 futures were 0.1% higher while Nasdaq 100 contracts were up 0.2% after the WSJ reported that OpenAI is set to raise $100BN in fresh capital (from sov wealth funds) removing near-term funding pressures across the AI sector. In premarket trading Oracle is up 6%, off session highs, with the rest of the Mag 7 complex mostly higher. In a risk-on set-up, bitcoin is also higher, while Treasuries are down. Gold is hovering near its highest ever, and a separate Goldman team reckons its record-setting rally still has legs, and could push the yellow metal above $5000. US economic calendar includes November existing home sales, December University of Michigan sentiment (10am), and Kansas City Fed services activity (11am). Fed’s Williams is scheduled to appear on CNBC at 8:30am.

In premarket trading, Mag 7 stocks are mostly higher (Nvidia +1%, Tesla +1%, Amazon +0.4%, Alphabet (GOOGL) +0.2%, Microsoft +0.1%, Apple -0.2%, Meta Platforms -0.1%). Cloud infrastructure stocks including CoreWeave (CRWV) are staging a rebound after the sector sold off on financing concerns in the AI supply chain. CoreWeave climbs 5%.

- AGCO (AGCO) slips 1% after Barclays cut the recommendation on the agriculture equipment company to underweight, saying that tariffs threaten its ability to meet margin estimates.

- Defense stocks remain in focus after European Union leaders reached an agreement to loan Ukraine €90b ($105b) for the next two years, aiming to strengthen Kyiv’s hand at the negotiating table and keep the war-torn country afloat.

- KB Home (KBH) falls 5% after the company’s fiscal fourth-quarter profit missed analysts’ estimates. The mid-point of the outlook range for fiscal 2026 housing revenue also lagged expectations

- Nike (NKE) slumps 11% after the sportswear retailer’s third-quarter guidance disappointed investors, with its turnaround hampered by weak sales in China and the Converse brand.

- Oracle (ORCL) is 5.6% higher after TikTok told employees that its parent company, ByteDance, had signed binding agreements to create a US joint venture majority owned by American investors, led by the cloud computing giant.

- WhiteFiber (WYFI) gains 20% following the announcement of a 10-year co-location agreement between its subsidiary Enovum Data Centers Corp. and Nscale Global Holdings.

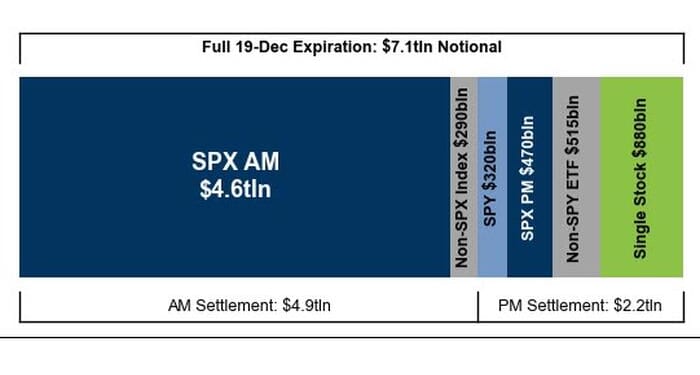

As noted yesterday, individual stock prices could be erratic on Friday during the largest options expiry day ever, with $7.1 trillion of notional open interest rolling off across the US options market, according to data from Citigroup. Trading volumes may be inflated by index rebalances at the close.

The December opex tomorrow will be the largest ever with over $7.1 trillion of notional options exposure expiring, including $5.0 trillion of SPX options and $880 billion notional of single stock options. pic.twitter.com/amb3HDbcwX

— zerohedge (@zerohedge) December 18, 2025

Oracle, which in recent months emerged as a fulcrum point of concerns that the AI rally had become overheated, rose more than 5% in premarket trading. The company is leading a group of investors that signed binding agreements to bring TikTok’s US operations under an American-controlled venture. It would also be a direct beneciciary of OpenAI tapping Abu Dhabi sovereign wealth funds.

Stocks have swung in recent weeks as optimism over the outlook for Fed rate cuts and a robust economy have clashed with fears that the AI-driven rally is vulnerable to a correction. Some strategists warn that while the broader backdrop remains favorable, volatility may persist. “While the conditions for a Santa rally are broadly in place, markets may need a fresh catalyst,” said Francisco Simón, European head of strategy at Santander Asset Management. “In that context, a renewed positive trigger — potentially linked to encouraging news in the AI space — could help reignite momentum.”

Global stocks that rose higher than ever in 2025 are set for further gains next year, according to Goldman Sachs strategists; but don’t expect returns to be quite as strong. Company earnings should drive dollar returns of 13% from a broadening bull market in 2026, rising to 15% if you include dividends, according to a Goldman team led by Peter Oppenheimer. Fed rate cuts and positive growth should extend the economic cycle and support risk assets, though the rally’s next phase may be choppier.

Still, investors are showing little sign of losing their appetite for equities, with the US seeing a 14th week of inflows, at $77.9 billion, in the week ended Dec. 17, according to Bank of America. Tech contributed to inflows for the first time in three weeks, suggesting that fears over potentially overblown AI stock valuations have diminished. Michael Hartnett said investors are positioned for “run-it-hot” acceleration in PMIs and EPS on easing rates, drops in tariffs and tax cuts (more on that later).

At the same time, gold is hovering near its highest ever, and a separate Goldman team reckons its record-setting rally still has legs. Commodities analysts including Daan Struyven and Samantha Dart also forecast weakness in oil prices to persist next year.

In the biggest central bank decision overnight, the BOJ lifted its key rate to the highest level in more than three decades – as expected – and signaled that further hikes could be in the offing. Japan’s 10-year yield climbed to the highest level since 1999, with the BOJ making clear that the tightening cycle will continue if the economy performs as expected.

“The market had expected a hawkish hike from the BOJ, with the expectation of clarifying its stance on narrowing the neutral rate range and future rate hike path,” ING Bank’s Min Joo Kang and Chris Turner wrote in a note. “However, both the BOJ and Ueda remained quite vague on this matter, which likely caused disappointment in the market.”

European equities tread water, with the Stoxx 600 flat despite solid gains in Asia, including a 1% advance in the Nikkei. European markets hover near a record on Friday, as optimism around further monetary policy easing buoyed sentiment in the final full trading week of the year. Utilities stocks outperform while consumer stocks lag after US peer Nike warned of weak China sales. Here are some of the biggest movers on Friday:

- Semapa shares rises as much as 25%, the most in more than three years, after the Portuguese conglomerate agreed to sell its cement unit Secil to Spain’s Cementos Molins.

- DCC shares climb as much as 4%, the most since October, after the company said it successfully completed a £600 million tender offer.

- Puma shares dip as much as 3.5%, leading sportswear stocks lower, after US giant Nike warned sales will decline this quarter, partly due to weakness in China and its Converse brand.

- WH Smith shares drop as much as 6.2% after pretax profit guidance for 2026 came in below analysts’ expectations and the the travel retailer said it was under investigation in the UK over an accounting error in its North American business.

- Ipsen shares fall as much as 3.8% after the company said a mid-stage trial evaluating its experimental oral drug for an ultra-rare bone disease did not meet its primary endpoint.

- Computacenter shares tumble as much as 1.5% after the IT company was downgraded at Peel Hunt, with analysts saying the current valuation already bakes in much of the upside potential over the next 12 months.

Earlier in the session, Asian equities rose, paring weekly losses, as cooling US inflation data reinforced bets on Federal Reserve interest-rate cuts and lifted technology stocks. The MSCI Asia Pacific Index rose as much as 0.8% on Friday, on course for its biggest gain since Dec. 12, as markets across the region advanced. Tencent Holdings, SoftBank Group Corp. and Toyota Motor Corp. led the gains. For the week, the gauge was down 1.9%, marking its worst five-day period in a month. Meanwhile, the Bank of Japan hiked borrowing costs to 0.75%, the highest level since 1995, as expected. Stocks rose.

In FX, the yen slid to the bottom of the G-10, with dollar-yen at 157, as the BOJ’s 25-bps rate hike and Ueda’s presser failed to deliver the stronger tightening message traders expected. The Bloomberg Dollar index is up 0.2%.

Rates follow Japan, where the 10-year yield broke above 2% for the first time since 1999. US 10-year rates climb 3bps with the curve bear steepening, while gilts lag bunds after the BOE’s hawkish cut. US yields cheaper by 1.5bp to 3bp across the curve in a bear steepening move, with 2s10s and 5s30s spreads wider by 1.2bp and 1bp on the day. US 10-year yields trade up to around 4.15%, with bunds and gilts cheaper by an additional 1.5bp and 2bp in the sector. Elsewhere, French 30-year yields hit their highest level since 2009 after budget talks were pushed into 2026. There were more losses seen across bunds and gilts after a flood of European data which included France and Germany PPIs and UK retail sales

In commodities, o\il climbs on reports that Ukraine has hit a Russian shadow fleet oil tanker. Spot gold falls roughly $6 to near $4,327/oz. Silver climbs 0.8% to ~$66. Bitcoin ekes out more gains, up some 3.2% to around $88,000.

US economic calendar includes November existing home sales, December University of Michigan sentiment (10am), and Kansas City Fed services activity (11am). Fed’s Williams is scheduled to appear on CNBC at 8:30am

Market Snapshot

- S&P 500 mini +0.3%

- Nasdaq 100 mini +0.5%

- Russell 2000 mini +0.3%

- Stoxx Europe 600 +0.1%

- DAX +0.2%

- CAC 40 +0.1%

- 10-year Treasury yield +2 basis points at 4.14%

- VIX -0.7 points at 16.17

- Bloomberg Dollar Index +0.2% at 1209.44

- euro little changed at $1.1715

- WTI crude -0.6% at $55.84/barrel

Top Overnight News

- What will 2026 bring? Goldman economists expect another year of 2.8% growth, above the Bloomberg consensus of 2.5% and with individual forecasts that are at or above consensus for most major economies. As has typically been the case since the pandemic, the bank is most optimistic (relative to consensus) in the US. Growth is likely to average 2.6% in 2026, well above the consensus of 2.0% and up from an estimated 2.1% in 2025. Just under 0.2pp of the pickup reflects the mechanical impact of the government shutdown, which depresses the level of GDP in 2025 Q4 and boosts 2026 Q1 growth. GS also expects a fundamental acceleration because of three forces: Reduced tariff drag, tax cuts, and easier financial conditions.

- Homeland Security Secretary Noem said at President Trump’s direction, she is immediately directing the USCIS to pause the DV1 program.

- Trump to make an announcement at 13:00ET on Friday and deliver remarks on the economy at 21:00ET.

- OpenAI is seeking up to $100 billion in new funding at a valuation as high as $830 billion, above earlier estimates. WSJ

- Trump’s administration has launched a review that could result in the first shipments to China of Nvidia’s second-most powerful AI chips. Trump this month said he would allow sales of Nvidia’s H200 chips to China, with the U.S. government collecting a 25% fee, and that the sales would help keep U.S. firms ahead of Chinese chipmakers by cutting demand for Chinese chips. RTRS

- The BOJ raised its benchmark rate to 0.75%, the highest in 30 years, and said more increases are in the pipeline if conditions allow. Former BOJ official Kazuo Momma said rates may hit 1.5% in 2027. Ten-year JGB touched their highest since 1999, and the yen weakened. BBG

- UK government borrowing fell in November, with the budget deficit standing at £11.7 billion — £1.9 billion less than a year earlier. Separately, retail sales fell for a second straight month. BBG

- EU leaders committed to lend Ukraine 90 billion euros, or around $105 billion, to help the country keep fighting Moscow’s invasion but failed to agree on a plan to use frozen Russian assets for the loan. WSJ

- Americans seeking jobs face another tough year in 2026, with unemployment staying high despite solid growth, according to economists’ predictions. The unusual mix probably reflects AI-driven investment that isn’t adding jobs. BBG

- The world is awash with oil, and prices are poised to keep falling. Producers are ramping up output, putting a record 1.3 billion barrels in open seas. The glut may push average WTI down to $52 next year. BBG

- TikTok’s long-delayed split from ByteDance is underway, with the company saying it signed binding deals to form a US joint venture controlled by American investors led by Oracle. ORCL +475bps premkt. BBG

- Nike shares slumped premarket (-10.5% premkt) after the company projected a sales decline this quarter amid persistent weakness in China and at its Converse brand. BBG

BOJ

- BoJ raised rates by 25bps to 0.75%, as expected, with the decision unanimous, while it stated interest rates are expected to remain at significantly low levels and will continue to raise policy rate if the economy and prices move in line with forecasts.

- BoJ Governor Ueda (post-policy press conference) said Japan’s economy is recovering moderately, albeit with some weakness. Will make a decision on rate hike after checking the impact on the economy. Will conduct market operations swiftly, under exceptional circumstances in market. Delaying a rate hike could force a significant hike later. There is still some distance to lower the limit of neutral rate estimate. Several BoJ members mentioned that recent JPY weakness may affect prices going forward, and warrants attention. Members suggested that the weak JPY is possibly affecting underlying inflation.

- Japanese Economy Minister Kiuchi said they respect the BoJ’s decision but they need to be mindful of economic outlook.

- Japanese Economy Minister Kiuchi said FX is affected by various factors, determined at markets. Important for currencies to move in stable manner reflecting fundamentals. Closely watching market moves with a high sense of urgency, including long-term yields.

Other Central Banks

- BoE Governor Bailey said he is confident that inflation will be close to target by late spring, giving a good reason to expect a bit more downward path on rates.

- ECB’s Escriva says there are no reasons for any change in interest rates in any direction.

- ECB’s Sleijpen says policy is in a good place but we must maintain a data-dependent and meeting-by-meeting approach.

- ECB’s Muller said it is too early to speculate what will happen in six months, imagines a scenario that weaker growth and further disinflation could justify more easing but the opposite could also be imagined, via Econostream.

- ECB’s Kocher said they have not decided what course to take on rates, when asked if there are no more rate cuts coming. Rates could be cut or raised, depending on developments.

- ECB’s Rehn said outlook for growth and inflation remains highly uncertain due to trade war and geopolitical tensions. Reiterates meeting-by-meeting approach and ECB maintains full freedom of action and optionality.

- ECB’s Kocher said there are many risks to growth and inflation to the up and downside. said they want to keep all options open to be able to react to the volatile situation. They are where they want to be on rates.

- ECB Wage tracker suggests lower wage growth and gradual normalisation of negotiated wage pressures in 2026. ECB wage tracker with unsmoothed one-off payments at 3.0% in 2025 and 2.7% in 2026.

Trade/Tariffs

- US President Trump told NBC “We’re making so much money with tariffs”, people would start getting the payments “very soon”. “Within the next few days, it’ll all be out”.

- US President Trump administration initiated multi-agency review of NVIDIA (NVDA) H200 licenses for sales to China, according to sources cited by Reuters.

- China’s Commerce Ministry urges India to correct wrong practice on Telecom tariffs. China files WTO case against India over ICT tariffs and Photovoltaic subsidies.

- China’s Commerce Ministry has launched an investigation into some rubber products from the US, South Korea and the EU. Adds to keep anti-dumping duty rate of up to 222%. Will terminate anti-dumping measures against UK rubber imports from December 20th.

- EU’s von der Leyen said “we have reached out to our Mercosur partners and agreed to postpone slightly the signature”, adds she is confident EU has sufficient majority to approve the Mercosur trade deal.

- French President Macron said work must continue on EU-Mercosur deal after delay, adds safeguards clause must be adopted by EU Parliament and accepted by Mercosur nations. He said, with new safeguard and mirror clauses to be implemented in January, it would be a “new” Mercosur-EU deal. France asked for CAP budget to be maintained.

- Chinese auto parts company Wangxiang agrees to pay USD 53mln to resolve US Justice Department lawsuit over imported components.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly higher as the region took impetus from the positive handover from Wall Street, where the major indices gained following softer CPI data and strong Micron earnings, while the attention overnight turned to the BoJ, which unsurprisingly hiked rates for the first time since January. ASX 200 was underpinned by outperformance in tech and financials, but with gains capped as mining, resources and materials sat at the other end of the spectrum. Nikkei 225 rallied amid tech strength and with some banks supported as yields gained amid the widely-expected BoJ rate hike, in which the central bank raised its key rate by 25bps to 0.75%, which is the highest in 30 years. Hang Seng and Shanghai Comp conformed to the upbeat mood amid tech strength, and after the PBoC continued to opt for a double-pronged liquidity operation, while it was also reported that TikTok signed a deal to sell its US entity to a joint venture controlled by American investors.

Top Asian News

- Japanese Finance Minister Katayama said will consider fiscal sustainability to some extent in compiling next fiscal year’s budget, adds aim to boost market confidence by lowering debt to GDP ratio.

European bourses (STOXX 600 U/C) opened around the unchanged mark, and have remained on either side of the mark since. European sectors hold a slight positive bias. Autos leads, followed by Insurance whilst Consumer Products lags; the latter pressured in tandem with post-earning losses in Nike (-10.5%).

Top European News

- Bundesbank cuts growth forecast for 2026 to 0.6% (prev. 0.7%) and raises 2026 inflation forecast for Germany to 2.2% (prev. 1.5%). Nagel: “Starting in the second quarter of 2026, economic growth will strengthen markedly, driven mainly by government spending and a resurgence in exports.” and adds that “….while progress will be subdued initially, it will then slowly pick up.”.

- French Prime Minister Lecornu said parliament will be unable to vote on a budget for France before the end of the year. Starting on Monday, he will meet with key political leaders to consult with them on the steps to be taken.

- Joint Committee from French National Assembly and Senate cannot reach compromise text on 2026 budget, according to a Committee member.

- Swedish Think Tank NIER sees 2025 GDP at 1.6% (sept. fcst. +0.9%), 2026 GDP 2.9% (sept. fcst. 2.6%).

FX

- DXY is mildly firmer and trades at the upper end of a 98.41 to 98.70 range. Really not much driving things for the USD this morning, and with the upside largely facilitated by the JPY weakness. On that note, the BoJ raised rates by 25bps to 0.75% as expected. The decision was unanimous, and it stated that interest rates are expected to remain at significantly low levels, and the bank will continue to raise the policy rate if the economy and prices move in line with forecasts. The presser thereafter, spurred another bout of pressure in the JPY where Ueda avoided explicitly guiding markets towards another rate hike. Though he did highlight that the BoJ will conduct market operations swiftly, under exceptional circumstances in market. Interesting comments from the Governor came as he stated that several BoJ members mentioned that recent JPY weakness may affect prices going forward, adding that this warrants attention, given some believe that it could be affecting inflation. This spurred some very slight strength in the JPY at the time, which later pared.

- EUR is essentially flat and trades within a 1.1704 to 1.1728 range. Markets have had a slew of ECB speakers to digest this morning, but really not adding much to the agenda. ECB’s Kocher suggested that they are where they want to be on rates, a comment reiterated by Sleijpen.

- GBP is also flat, within a 1.3364 to 1.3387 range. Traders seemingly taking breather following the upside seen in the prior session, following a hawkish cut at the BoE. Since, Governor Bailey has provided some commentary. On Thursday he said that he is “very” encouraged by the process in returning inflation to target; comments which were largely reiterated once again earlier this morning.

Fixed Income

- JGBs began the overnight session on a slightly firmer footing, but then came under marked pressure after the BoJ policy decision, where the Bank hiked rates by 25bps as expected. The decision was unanimous, with the accompanying commentary reiterating that it will continue to raise the policy rate if the economy and prices move in line with forecasts. Bond traders appear to be focused on the BoJ’s comments related to higher wages heading into the new year – and ultimately on remarks that the Bank will continue to raise rates in line with expectations. Perhaps focus for JGBs focus on the fiscal side of things, with the BoJ seemingly waiting for economic developments, which will be subject to volatility under PM Takachi’s cabinet.

- USTs traded rangebound throughout the overnight session and have continued to trade sideways throughout the European morning. Currently lower by a handful of ticks and within a 112-17+ to 112-23 range. Ahead, US President Trump is scheduled to make an announcement at 13:00EST/18:00GMT on Friday and will deliver remarks on the economy at 21:00EST/02:00GMT.

- Bunds and Gilt action has also been exceptionally lacklustre; currently holding a slight downward bias, within a 127.16 to 127.52 and 90.94 to 91.20 range, respectively. A few ECB speakers this morning, but not really any pertinent commentary thus far; Kocher reiterated that interest rates are at a good place. Back to the UK, Gilts mildly underperform – continuing the post-BoE hawkish move seen in the prior session. Some remarks from BoE Governor Bailey earlier who suggested that he is confident that inflation will be close to target by late spring, giving a good reason to expect a bit more downward path on rates. Ultimately, no move in Gilts on the remarks.

Commodities

- Crude benchmarks remain contained in tight ranges as the European session gets underway amid a lack of crude-specific newsflow. WTI oscillates in a USD 55.67-55.99/bbl range while Brent holds below USD 60/bbl comfortably as European trade continues. Recent comments via US President Trump, who said that “I do not rule out a war with Venezuela”, according to NBC, had little impact on the complex.

- Spot XAU saw initial downside at the start of the APAC session, continuing the reversal lower after failing to hold beyond USD 4350/oz during Thursday’s US session. XAU fell to a trough of USD 4310/oz and since, remains in a c.USD 40/oz band throughout the European morning.

- 3M LME Copper lead the gains across the metals complex as the risk tone stateside rebounded, which boosted Asia-Pac equities. The red metal opened unchanged but gradually rose, in line with APAC equities. This helped 3M LME Copper break Thursday’s high of USD 11.79k/t and continue to a peak of USD 11.83k/t as the European session gets underway.

- Phillips 66 (PSX) reported emissions event at Sweeney refinery and petrochemical complex in Texas on December 17th.

Geopolitics

- Russian President Putin said we do not see Ukraine being ready for talks, ready and want to end the conflict via peaceful means. Continue to create a safe zone on the border with Ukraine.

- Belarus said “We are preparing to start the combat shift of the Russian Oryshnik missile system”, via Al Arabiya.

- Russia’s Dmitriev said regarding EU summit decision that it was a ‘major blow to EU warmongers led by failed Ursula’ and voices of reason in the EU blocked the illegal use of Russian reserves to fund Ukraine.

- EU’s Costa said leaders agreed to roll over sanctions against Russia, adds Ukraine will only repay EU loan once Russia pays reparations and the EU reserves its right to make use of the immobilized assets to repay loan.

- German Chancellor Merz said Ukraine will receive an interest-free loan of EUR 90bln with these funds sufficient to cover military and budgetary needs for the next two years, and the EU will keep Russian assets frozen until Russia has compensated Ukraine. said: We expressly reserve the right to use Russian assets for repayment if Russia fails to pay compensation in full compliance with international law.

- EU’s Costa said we have a deal to finance Ukraine, and the decision to provide EUR 90bln of support to Ukraine for 2026-2027 was approved.

- EU official said it seems there is the possibility of unanimity to use headroom of EU budgets to provide funding for Ukraine. EU leaders want work to continue on the technical and legal aspects of the instruments establishing a reparations loan.

- EU considers using joint debt to loan up to USD 106bln dollars to Ukraine, according to Bloomberg.

- European Council President Costa proposed to EU leaders to address Ukraine’s immediate pressing financial needs through an EU borrowing solution, according to two EU diplomats.

- Russia’s President Putin says US President Trump is making frank efforts to end the conflict in Ukraine. Says Russia has been asked to make compromise on Ukraine, in which Russia agreed to. The ball is on the West and Ukraine’s court.

- Ukraine has hit Russian shadow fleet tanker in the Mediterranean sea for the first time, according to Reuters citing SBU source. SBU’s aerial drones hit the Qendil vessel, causing critical damage. However, vessel was empty at the time of the attack.

- Contacts between Israel and Syria have not made much progress, according to Al Arabiya quoting US sources.

- Germany’s Competition Authority approves the merger of Palo Alto (PANW) and Israel’s Cyberark software.

- US ambassador to Israel said the US is not considering supplying Turkey with F-35 jets (LMT), which is not on the table under current US laws, via Sky News Arabia.

US Event calendar

- 8:30 am: Fed’s Williams Appears on CNBC

- 10:00 am: Nov Existing Home Sales, est. 4.15m, prior 4.1m

- 10:00 am: Nov Existing Home Sales MoM, est. 1.22%, prior 1.2%

- 10:00 am: Dec F U. of Mich. Sentiment, est. 53.5, prior 53.3

DB’s Jim Reid concludes the overnight wrap

This is my last EMR of 2025, but Henry will keep it going for a couple of days next week. Thank you for reading and interacting this year and for all the votes in the Extel survey which went well for us again when results were published last week. See you in 2026 for another fun-packed ride through markets. As is tradition, I’ve listed my favourite TV shows of the year at the end alongside my film and album of the year. My wife and I try to watch an hour’s TV when I’m not travelling. It’s getting more difficult as the kids get older and have to be taxied around in the evening, a trend I fear will only get worse. I look forward to hearing your disagreements with the list!

Before I sign off for the year, it’s fair to say that it’s been an incredibly eventful 24 hours in markets, and overnight there’s been no let-up as the Bank of Japan have just delivered a 25bp hike that’s taken rates to a 30-year high of 0.75%. That follows a decision from the ECB to hold rates yesterday, which cemented expectations that they’d finished cutting, along with a hawkish BoE cut that led investors to dial back the prospect of rapid rate cuts next year. But even as those central banks had various hawkish elements, it was a completely different story for the US, as the CPI print was beneath all expectations, leading to a decent Treasury rally as investors priced in faster rate cuts for 2026, even if there were huge doubts about the data’s validity given the shutdown. So it was a day of competing narratives, but for risk assets, the prospect of more Fed cuts and the reaction to Micron’s earnings helped the S&P 500 (+0.79%) rebound after 4 consecutive declines, whilst Europe’s STOXX 600 (+0.96%) hit a new record.

We’ll start with that overnight news from Japan, where the BoJ delivered the 25bp rate hike that was widely expected, and pointed to more ahead. For instance, their statement said that real interest rates were “at significantly low levels”, and if their outlook was realised, they would “continue to raise the policy interest rate”. So that’s pushed Japanese bond yields higher this morning, with the 10yr yield (+4.8bps) currently at 2.01%, which would be its highest closing level since 1999. Indeed, we also had the latest CPI print overnight for November, which showed headline CPI at 2.9% as expected, having now been above 2% consistently since April 2022. That landscape of above-target inflation has provided the BoJ the space to deliver multiple rate hikes now, and they said that “it is highly likely that the mechanism in which both wages and prices rise moderately will be maintained”.

Nevertheless, equities in Asia have still rallied overnight, given the BoJ hike was expected and investors think Fed cuts are more likely following the CPI print. So that’s supported gains across the major indices, including for the Nikkei (+1.11%), the KOSPI (+1.07%), the Hang Seng (+0.66%), the CSI 300 (+0.51%) and the Shanghai Comp (+0.50%). And looking forward, US equity futures are stable, with those on the S&P 500 down just -0.01%.

All that follows a hugely eventful session yesterday, with a big boost thanks to that weak US CPI report, which featured the lowest year-on-year core CPI print since early 2021. However, it’s worth noting that there were several pieces of missing data because of the shutdown, and the methodological issues meant that investors treated it with some caution. For instance, a lot of people looked at the shelter numbers with serious doubt, as they saw a huge drop-off that’s more usually consistent with recessions. For instance, the 2-month annualised change for Owners’ Equivalent Rent (so accounting for the missing October report and this November print) came in at just +1.6%, the lowest since the Covid-19 pandemic. Similarly, the 2-month annualised change for rents of +0.8% was the weakest since the aftermath of the GFC in 2010.

However, even with those data issues, the print was still viewed as soft enough to make Fed rate cuts more likely next year. Indeed, headline CPI was still down to +2.7% year-on-year (vs. +3.1% expected), whilst core CPI was at +2.6% (vs. +3.0% expected). The weak print meant investors priced in more Fed rate cuts, with the amount expected by the December 2026 meeting up +1.6bps on the day to 62bps. So that helped Treasuries to rally across the curve, with the 2yr yield (-2.3bps) down to 3.46%, whilst the 10yr yield (-3.1bps) fell to 4.12%.

Moreover, that offered a big support to equities, with a further boost from Micron (+10.21%) after its earnings announcement the previous day, making it the top performer in the S&P 500. So collectively, that saw the S&P 500 (+0.79%) bounce back from its recent selloff, alongside gains for the NASDAQ (+1.38%) and the small-cap Russell 2000 (+0.62%). Just over 50% of the S&P’s constituents traded higher on the day, with gains led by consumer cyclical subsectors like Autos (+3.2%), Media (+1.6%), and Consumer Discretionary Retail (+1.6%). The laggards were the more defensive names that had a bid in recent days like Consumer Products (-1.5%) and Staples (-0.7%). Finally, Energy (-1.4%) also saw a pullback as oil prices fell nearly -1.4% intraday to finish flat after opening higher on more Venezuela headlines. By the close, Brent crude was only slightly higher (+0.23%) at $59.82/bbl.

Earlier in Europe, the main headlines came from the ECB, who left their deposit rate at 2% as expected. Nevertheless, there was a hawkish tone, and the updated forecasts showed stronger growth and stickier core inflation (at 2.2% for 2026), so that was seen as outweighing the expected undershoot of headline inflation, which wasn’t mentioned at all by President Lagarde. Yet despite recent speculation around an ECB hike next year, this shifting macro tone didn’t translate into a more hawkish policy signal, with Lagarde repeating the line that they were keeping all policy options open. And later in the day, Bloomberg reported that ECB officials expected that the cycle of rate cuts was most likely done, with talk of rate hikes seen as premature. So the decision reaffirmed our economists’ view that the easing cycle is likely over, and they see the Governing Council as determined to retain a neutral policy signal for now. Looking forward, they maintain their view that the ECB’s next move will be a hike, but they don’t see that as likely to materialise in 2026

Against this backdrop, European bonds rallied across the continent, thanks to the soft US CPI print and the absence of more hawkish ECB rhetoric. So that helped yields on 10yr bunds (-1.4bps), OATs (-1.6bps) and BTPs (-2.9bps) move lower. And for equities there was also a strong performance, with both the STOXX 600 (+0.96%) and Spain’s IBEX 35 (+1.15%) at new records, alongside gains for the DAX (+1.00%) and the CAC 40 (+0.80%) as well.

Shortly before the ECB, the Bank of England delivered a 25bp cut as expected, taking their own policy rate down to 3.75%. Yet even though the decision was a cut, it was interpreted in a hawkish light by markets. First, because it was only passed on a narrow 5-4 vote, with the rest wanting to leave rates unchanged. And second, in the statement they added that “further policy easing will become a closer call.” So that suggested the bar was rising to further cuts, and front-end gilt yields sold off in response, with the 2yr gilt yield up +4.2bps, whilst the 10yr yield saw a smaller increase of +0.6bps. See our economist’s review here.

To the day ahead now, and US data releases include existing home sales for November, and the University of Michigan’s final consumer sentiment index for December. Meanwhile in Europe, there’s UK retail sales for November, and the European Commission’s preliminary consumer confidence indicator for the Euro Area in December. Otherwise from central banks, we’ll hear from the Fed’s Williams, and the ECB’s Wunsch, Kocher, Rehn, Simkus, Kazaks, Sleijpen, Pereira, Cipollone and Lane.

Loading recommendations…