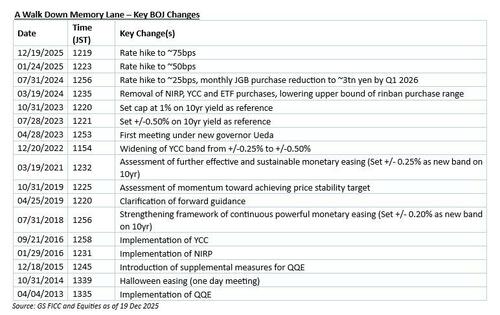

In the last central bank decision of 2025, the BOJ lifted its key rate to 0.75% from 0.50% in a widely anticipated and telegraphed move, taking borrowing costs to their highest level in three decades. It wasn’t enough, however, and after an initial kneejerk move, the yen plunged while yields soared as the market concluded that what Ueda did was too little, too late, and the hike was too vague to press the hawkish case.

As such, the market doves are back in control, and forcing the BOJ to either double down and puts Japan’s money where its mouth is, or lose control of either the currency or the bond market, or eventually, both.

In a recap of what the BOJ did, Bloomberg writes the following:

- Ueda said risks tied to the impact of US tariffs appear to be easing and pointed to solid wage growth momentum next year year, a condition for more sustained inflation.

- Both the BOJ statement and Ueda’s remarks implied there’s room to raise rates further, while offering assurance that conditions would remain accommodative. That reinforces expectations of a gradual and data-dependent tightening path.

- Ueda also said the policy rate remains some distance from the lower-end of a neutral range and added he would like to recalculate that if the opportunity arises, signaling openness to further tightening but also a desire for greater confidence in the framework before moving more decisively.

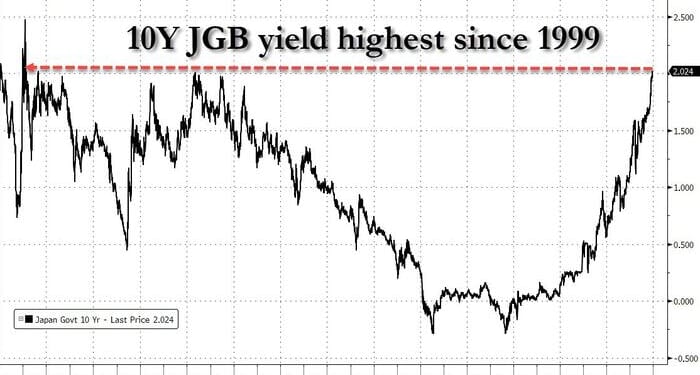

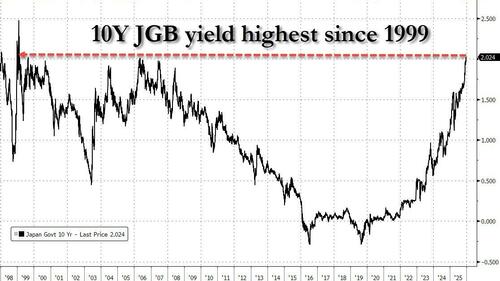

As BBG notes, by lifting the policy rate to a three-decade high of 0.75% on Friday, Ueda continued his historic march toward restoring normality to Japan’s monetary policy and the economy after decades of unconventional steps and underperformance. The only problem: Japan will never survive in a world where monetary policy is even remotely “normal ” and as a result, government bond yields immediately climbed to the highest levels since the 1990s, an indication that the BOJ policy space is now narrower than ever.

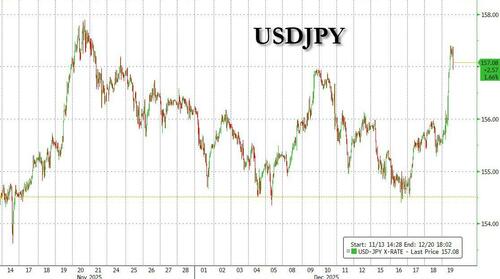

And indeed, Bloomberg admits that while Ueda had telegraphed Friday’s move ahead of time, he didn’t offer similar clarity about what comes next, and that’s left yen bears chomping on the currency instead of backing away. The yen slid more than 1% against the dollar, to around 157.40, in the hours after Ueda’s press conference.

“Listening to what he said, I honestly couldn’t tell at all when the next rate hike might be,” said Teppei Ino, Tokyo head of global markets research at MUFG Bank. “He didn’t really say anything about the neutral rate — there was simply no guidance at all.”

Addressing the hawkish side, Goldman’s Kai Wen Lim writes that the statement removed language that growth and inflation will stagnate due to tariffs, coupled with hawkish voices on the board and a clear acknowledgement that real rates are still low, all leaned on the more hawkish side despite a lack of new details. The reaffirmation bolstered bearish sentiment causing futures to sell off ~4bps while BOJ pricing also inched higher across the curve from March onwards, with June and July seeing the most traction implying market expectation of the next hike being ~6 months away.

On the other hand, classic “buy the rumor, sell the fact” phenomenon was observed in USDJPY, with the pair initially weakening a touch on initial headlines before surging and swiftly breaking past the 156 handle (and then 157) with investors likely thinking interest rate differentials remain very high, coupled with the disappointment over the lack of clearer guidance on the timing of the next hike.

A rather pragmatic take was shared by Goldman Delta One head, Rich Privorotsky who pointed to the breakout in Japanese 10 year yields above 2% – rising 5bps to 2.02%, the highest since 1999 – as the market was convinced the BOJ remains behind the curve.

But the latest twist – which is what the cartoonish BOJ is so known for – was the lack of a pre-commitment to future hikes, and the continued vagueness on timing.

“The market had expected a hawkish hike from the BOJ, with the expectation of clarifying its stance on narrowing the neutral rate range and future rate hike path,” ING Bank’s Min Joo Kang and Chris Turner wrote in a note. “However, both the BOJ and Ueda remained quite vague on this matter, which likely caused disappointment in the market.”

As a result, the whole JGB curve twisted higher and bear steepening while the JPY is weakening, precisely the opposite of what the BOJ wanted to achieve! According to Privo, on the margin “the price action would suggest BOJ still behind the curve (run it hot).” Japan equities are higher led by Japan banks, momentum and construction. Keep an eye on longer dated rates for hints on whether the BOJ is about to lose control of the bond market.

Many market players had been expecting the governor to back up their consensus view that Ueda will keep raising rates every six months.

Some of them even thought he might hint at how far the BOJ wanted to hike rates, by referring to the neutral interest rate. Instead, the professor-turned-central bank governor struck a pragmatic note, saying the bank would edge closer to neutral rather than trying to pinpoint in advance where it is.

That creates a headache for Japan’s Finance Ministry, which spent some $100 billion last year to prop up the currency when it weakened to around 160 per dollar — not far from where it is now.

“The yen’s slide is likely to heighten caution about the risk of intervention,” Ino said.

The market moves point to some of the difficulties Ueda faces in the second half of his term. In his first two-and-a-half years, the governor exceeded expectations by transforming policy at the BOJ and raising rates.

Ueda now risks damaging that reputation even more – and infuriating Prime Minister Sanae Takaichi – if he hikes rates too fast and the economy collapses, while the yen craters. But moving too slowly could prolong the inflation damage for households, and leave the Finance Ministry with work to do in the currency market.

What’s more, a return to yen intervention may also prompt further blowback from President Donald Trump’s administration in the US, which sometimes appears frustrated by Japan’s cautious monetary policy.

Nobuyasu Atago, chief economist at Rakuten Securities Economic Research Institute and a former BOJ official, notes that US Treasury Secretary Scott Bessent is clearly in favor of correcting yen weakness through BOJ policy rather than intervention.

“Governor Ueda likely thinks that yen weakness will enable him to keep raising rates,” said Atago. “But that takes him further away from policy normalization that responds to the bedding-in of inflation based on domestic demand, not external shocks.”

For now, the only thing that’s clear is that rates are likely to increase again unless of course the economy collapses next.

According to Bloomberg, the question now is how far Ueda can go. Just two years ago, economists projected that the bank would only reach 0.5% in this hiking cycle. Now, if the central bank can hike every six months, Ueda would be walking out of the BOJ building in April 2028 with the rate at 1.75% and a reputation for working miracles in Japan.

“The hurdle just gets higher and higher,” Kazuo Momma, a former BOJ executive director in charge of monetary policy, told Bloomberg. Although the BOJ doesn’t know where the neutral rate is, each hike brings the bank closer to it, he said. Among 48 economists surveyed in December, the median forecast points to two more hikes. But more than 20 of them expect three or more.

Ueda has repeatedly said that he prefers to hike and monitor the impact rather than map out his endgame. And he’s reiterated time and again that he will continue to raise rates if the economy and prices play out as the bank expects.

In Friday’s policy statement, the BOJ stated that the real rate remains at a “significantly” low level.

“That suggests the next rate hike will still be an adjustment of monetary easing and that’s hugely important,” Momma said. “This implicitly says that the BOJ thinks 1% isn’t the neutral rate.”

In other words, as long as the BOJ keeps referring to rates at “significantly” low levels, the central bank remains a ways off the neutral rate. That also fits in with Ueda’s view that his rate hikes aren’t yet tightening moves, but are instead the adjustment of accommodative conditions. With inflation still way above borrowing costs, it’s hard to argue otherwise.

Commenting on the paradoxical plunge in both the yen and yields, Bloomberg FX strategist Vassilis Karamanis said that this was “not a paradox but a reflection of positioning and timing” (well, maybe it was a little bit of a paradox). He explains why:

Yen weakness after the Bank of Japan’s interest rate increase shouldn’t surprise. Neither should the risk of intervention if thin liquidity turns an orderly grind into a disorderly move.

The BoJ did what yen bulls have been long waiting to see, but it didn’t hand them a clear victory. The central bank raised its benchmark rate by a quarter point to 0.75%, the highest in 30 years, and kept the door open to further increases if the outlook holds. The message was that officials are growing more confident inflation can be sustained around target.

And yet the first price reaction looked like a reminder that FX is rarely polite. The yen weakened, with USD/JPY pushing through the 156 area even as Japanese yields rose, with the 10-year yield topping 2% for the first time since 2006. That’s not a paradox but a reflection of positioning and timing.

Above all, this was widely expected. When the market walks into a meeting already priced for 25 basis points, “hawkish BOJ” has to mean more than just delivering the hike. It needs to mean conviction on the pace, and right now, the bar for that conviction is high because the BOJ communicates gradualism given there was no upgraded assessment of the economy. Governor Kazuo Ueda said that it’s difficult to determine the neutral rate ahead of time, and that the pace of adjustment of easing depends on the economy and prices.

This gradualism matters because the yen’s core problem isn’t whether Japan can hike, but whether it can hike fast enough to overwhelm the funding-currency reflex. Carry and hedging behavior have inertia. You can tighten policy and still watch USD/JPY grind higher if the market thinks the next move is “sometime in 2026” rather than next quarter, especially while the US-Japan rate gap remains wide enough to keep the carry trade alive.

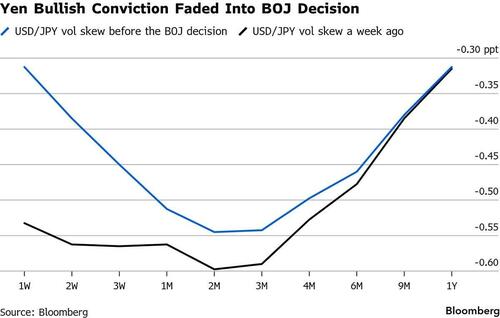

Options were flagging that risk into the meeting. The chart below shows USD/JPY skew flattening versus last week, a sign traders were less willing to pay up for yen strength protection across the front end. And CFTC positioning tells a similar story: hedge funds weren’t in a rush to cover shorts.

The macro backdrop isn’t giving the yen a clean runway either. Fiscal stimulus expectations and Japan’s heavy debt load keep the bond market sensitive, and currency weakness can still function as a release valve rather than a red line. Which brings us to the part yen traders need to respect into year end: intervention risk.

The market loves to talk about 160 as if it’s a magic number but I’m not so sure officials also do so. While in theory their framework is supposed to be about speed, disorder and volatility, and not a single level, recent episodes show thresholds can be blurry in practice. And as holiday conditions can turn a routine move into an ugly one quickly, levels and volatility may not matter much, and we could see a preemptive move from the Ministry of Finance as the one in November 2024.

Liquidity is thinning into year-end. If USD/JPY starts to gap on air pockets rather than fundamentals — remember, the rate gap has been narrowing for three years now — the theme can turn from BOJ gradualism to MOF tolerance. That’s why the post-hike yen selloff is not the shocking part. That would be assuming officials will wait patiently for 160 or above if the market hands them disorder first.

Loading recommendations…