Before we all get too excited, bear in mind that this is November’s data – so still horribly stale (and also missing October’s data point entirely) – but it’s all we have for now, so let’s dive in…

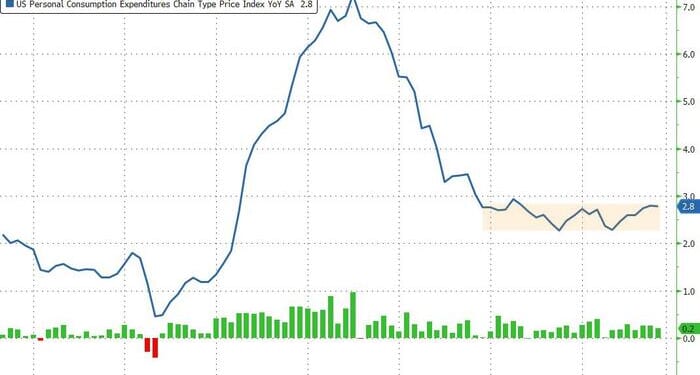

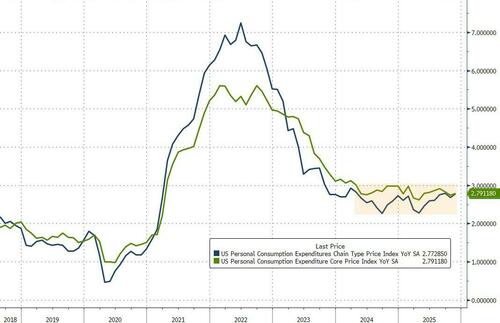

The Fed’s favorite inflation indicator – Core PCE – rose 0.2% MoM (as expected), which leave it up 2.8% YoY (as expected), slightly lower than September’s +2.9%…

Source: Bloomberg

Bear in mind that this morning’s third look at Q3 GDP printed a +2.9% YoY for Core PCE.

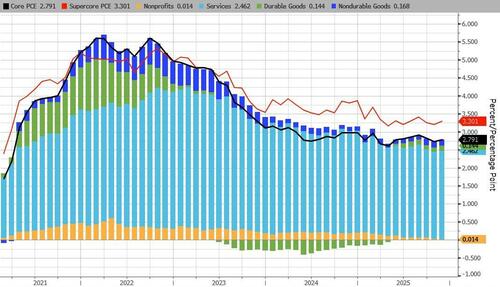

Under the hood, the biggest driver of Core PCE remains Services costs – not tariff-driven Goods prices…

Source: Bloomberg

Headline PCE rose 2.8% YoY (es expected), stubbornly refusing to show any signs of runaway Trump tariff costs…

Source: Bloomberg

The closely-watched SuperCore PCE rose 0.2% MoM which ticked up the YoY rise to 3.1%…

Source: Bloomberg

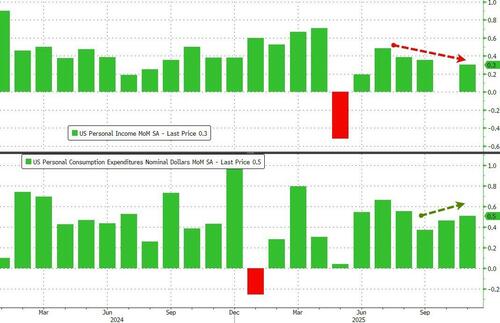

Meanwhile, amid rising prices, Americans’ spending outpaced incomes once again…

Source: Bloomberg

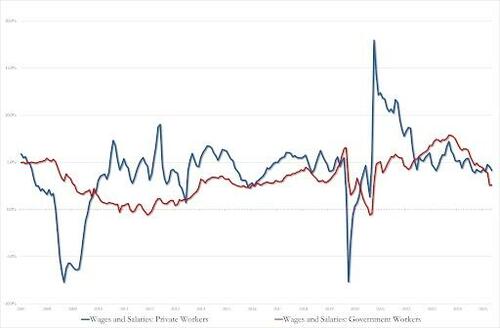

…with wage growth slowing for all:

-

Private worker wages and salaries: 4.1% YoY, down from 4.5%, lowest since June 2025

-

Govt work wages and salaries 2.6%, tied for lowest since March 2021

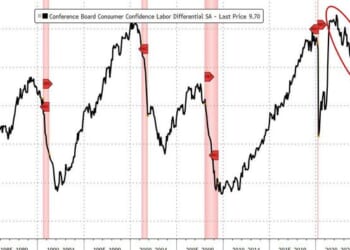

TL/DR: While this data is admittedly stale, it shows no signs of 1) tariff-driven inflation or 2) a suffering consumer.

Loading recommendations…