US stock futures are lower with tech stocks lagging as Intel plunged 14% after the chipmaker warned it was struggling with manufacturing problems leading to poor Q1 guidance. As of 8:00am ET, S&P and Nasdaq futures are down 0.1% but off session lows (and well off session highs), paring losses as Nvidia shares gained after Bloomberg reported Chinese officials have told the country’s largest tech firms they can prepare orders for Nvidia’s H200 AI chips. Mag 7 are mixed with NVDA leading gains after Chinese officials were said to have told the country’s largest tech firms, including Alibaba Group Holding Ltd., they can prepare orders for Nvidia Corp.’s H200 AI chips. Bond yields are mostly unchanged; USD is flat. Japan’s top currency official declined to comment on whether the government stepped into the market after USD/JPY plunged over 150 pips in just a few minutes. The pair swiftly bounced and is now around 158.30 having topped 159 during the Bank of Japan press conference after Governor Ueda didn’t offer any clear signal that an early rate hike was possible. The pound sits atop the G-10 FX pile, rising 0.2% against the greenback after PMI topped estimates and hawkish remarks from BOE’s. Commodities are mostly higher led by Oil (+1.5%); both base metals and precious metals are higher with silver trading just under $100/oz. The key macro focus today were global PMIs.

In premarket trading, Magnificent Seven stock are mixed: Nvidia gains 1.5% after Chinese officials were said to have told the country’s largest tech firms, including Alibaba Group Holding Ltd., they can prepare orders for Nvidia Corp.’s H200 AI chips (Tesla -0.1%, Microsoft +0.04%, Amazon +0.1%, Alphabet +0.01%, Apple -0.08%, Meta -0.5%)

- Solar stocks are extending gains after Elon Musk commented on solar-powered satellites in his Davos talk on Thursday. Array Technologies (ARRY) +2%, First Solar (FSLR) +1.4%.

- Booz Allen (BAH) rises 5% after the defense contractor boosted its adjusted earnings per share guidance for the full year, with the new outlook beating the average analyst estimate.

- Capital One Financial Corp. (COF) falls 2% after the bank reported adjusted earnings per share for the fourth quarter that missed the average analyst estimate, driven by higher-than-expected costs. The firm also said it agreed to acquire Brex.

- CSX Corp. (CSX) gains 2% after the freight transportation company provided some guidance for 2026, including low single-digit revenue growth.

- Intel (INTC) plunges 13% after Chief Executive Officer Lip-Bu Tan gave a lackluster forecast and warned that the chipmaker was struggling with manufacturing problems. The stock closed Thursday at the highest level since 2022.

- Intuitive Surgical (ISRG) gains 1.5% after the medical equipment firm reported adjusted earnings per share for the fourth quarter that surpassed estimates. Analysts note that the results were largely in line with the company’s pre-announcement.

In corporate news, Amazon.com is gearing up to ax thousands more corporate employees, ratcheting up efforts to streamline bureaucracy. Apple accused the European Commission of using “political delay tactics” to postpone new app policies as a pretense to investigate and fine the iPhone maker. TikTok and its Chinese parent ByteDance have closed a long-awaited deal to transfer parts of their US operations to American investors, securing the popular video app’s future in the US and avoiding a nationwide ban.

Even with the S&P just shy of all time highs, investors have been quietly trying to sidestep bouts of volatility driven by US policies, highlighted this week by Trump’s push to assert greater control over Greenland. While the outlook for US stocks remains strong, traders are also looking elsewhere for pockets of calm and opportunity.

“I hope that the geopolitical situation starts to ease so that the market can focus on substance versus noise,” said Andrea Gabellone, head of global equities at KBC Global Services. “Full-year 2026 guidances are, in my view, the most crucial piece of data the market has been waiting for quite some time, given valuations and growth expectations.”

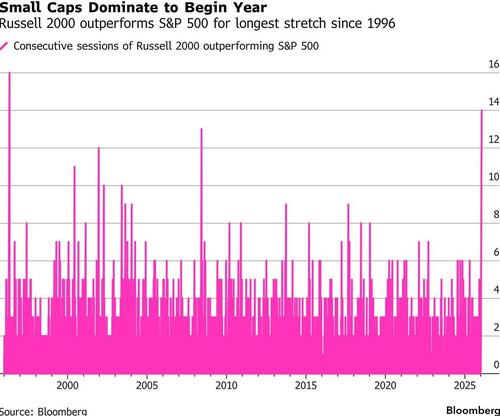

Small caps extended a winning streak over large-cap cohorts amid concern about a possible AI bubble and bets that an economic recovery will filter to broader swathes of the economy. The Russell 2000’s outperformance of the S&P 500 in 2026 is the longest such streak in 30 years.

“Typically, safe bonds and Treasuries have been a source of diversification during times of uncertainty, but particularly Treasuries haven’t provided any cushion over the past days,” said Philipp Lisibach, head of strategy and research at LGT Private Banking. “That’s also why gold continues to rally.”

In Asia, the Bank of Japan maintained its benchmark rate and issued higher inflation forecasts. While Governor Kazuo Ueda suggested that inflation will weaken below 2% soon, he also left open the possibility of an early rate hike. “The challenge is balancing rate hikes to support the yen without slowing growth,” wrote Min Joo Kang, senior economist at ING Bank. “Timing is uncertain, but we now see a June hike as the base case.”

Elsewhere, the US wants to rewrite its defense agreement with Denmark to remove any limits on its military presence in Greenland, people familiar with the matter said. And the Kremlin said the “territorial issue” remains unresolved after Putin held late-night talks with US envoys Steve Witkoff and Jared Kushner about the latest plan to end Russia’s war on Ukraine. Talks continue between US, Russian and Ukrainian representatives in the United Arab Emirates on Friday and Saturday.

Trump said he has finished interviewing candidates to serve as the next Fed chair and reiterated that he has someone in mind for the job. His shortlist includes National Economic Council Director Kevin Hassett, BlackRock executive Rick Rieder, current Fed Governor Christopher Waller and a former governor, Kevin Warsh.

The Stoxx 600 falls 0.1%. Telecoms and energy sectors outperform, while travel and consumer product shares lag. The focus fell on the Amsterdam debut of armored vehicle and munitions maker CSG NV. The stock opened 28% higher after the largest-ever initial public offering globally for a pure-play defense firm, highlighting growing appetite for the sector. Here are the biggest movers Friday:

- Ericsson shares surge as much as 12% after the telecom equipment maker reported stronger-than-expected sales in the core networks division, driven by mission-critical projects

- Siemens Energy gains as much as 2.6% to a record high after UBS raised its recommendation to buy from sell and lifted its PT to €175 from €38

- SFS Group shares gain as much as 7.4%, hitting their highest level since May, after analysts said the Swiss tool and component supplier delivered stronger growth than expected in a challenging market

- SSP shares climb as much as 4.1%, the most in a month, after the travel food and beverage outlet operator reported first-quarter results which showed continued positive trading momentum and reassured analysts

- Watches of Switzerland shares rise as much as 6.4% to the highest level since February 2025 after the luxury watch seller acquired Deutsch & Deutsch, a retailer with four showrooms and Rolex distribution in Texas

- Castellum gains as much as 2.6% after Goldman Sachs upgraded its view on the Swedish property firm to buy from neutral in a review of the European real estate sector, where it also upgrades Colonial to neutral from sell

- Babcock International shares drop as much as 3.8% after the support services company said CEO David Lockwood is retiring and will be succeeded by the head of its Nuclear division, Harry Holt

- Edenred shares fall as much as 3.2%, while Pluxee declines as much as 4.7% as UBS downgrades both French-listed meal-voucher stocks, saying the regulatory “tide is turning” against the sector

- C&C Group shares plunge as much as 18%, briefly slumping to their lowest level since 2009, after the alcoholic beverage maker said trading has been worse than expected

Earlier, Asian stocks gained for a second consecutive session, erasing their losses for the week, as fears over tariffs and Greenland faded.

The MSCI Asia Pacific Index gained 0.4% on Friday, with Alibaba, MediaTek and TSMC among the biggest boosts. Korea’s Kospi advanced to a fresh record near the 5,000 level. Stocks also gained in Taiwan, Japan and Hong Kong. The regional gauge is on track to end the week steady after rising for four straight weeks. Investors are shifting focus back to earnings and the outlook for the artificial intelligence trade after US President Donald Trump backed off from putting tariffs on European nations due to tensions over Greenland. Meanwhile, most central banks in the region are cutting rates and economic growth is expected to improve. Equities rose in Tokyo as the yen weakened after the Bank of Japan held interest rates steady as expected. The Straits Times Index rose to a record as Singapore started handing out some of the S$5 billion it plans to invest in local stocks to selected fund managers.

In FX, Japan’s top currency official declined to comment on whether the government stepped into the market after USD/JPY plunged over 150 pips in just a few minutes. The pair swiftly bounced and is now around 158.30 having topped 159 during the Bank of Japan press conference after Governor Ueda didn’t offer any clear signal that an early rate hike was possible. The pound sits atop the G-10 FX pile, rising 0.2% against the greenback after PMI topped estimates and hawkish remarks from BOE’s Greene that also weighed on shorter-dated gilts.

In rates, the yield on 10-year US Treasuries hovered near the highest since September, holding small gains with long-end yields about 2bp richer on the day, flattening the curve. European bonds underperform following UK retail sales and European PMI gauges. US stock futures little changed while crude oil is up nearly 2%.US yields are 1bp-2bp richer across the curve with 2s10s and 5s30s spreads flatter by about 1bp; 10-year near 4.23% is 1.7bp lower on the day with German counterpart little changed and UK cheaper by about 1bp. Focal points of US session include S&P Global US PMIs and University of Michigan sentiment gauge, as well as next week’s supply — both corporate and Treasury coupon auctions scheduled to start Monday.

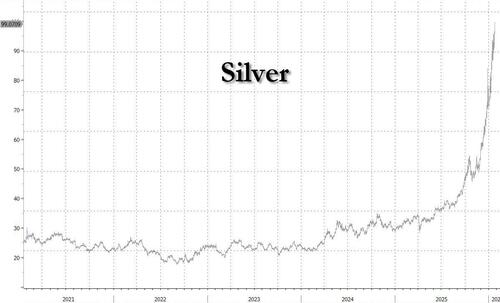

In commodities, spot silver rises 2.5% while gold erased an earlier gain to trade lower. Silver rose just shy of $100 and will likely surpass the key level today…

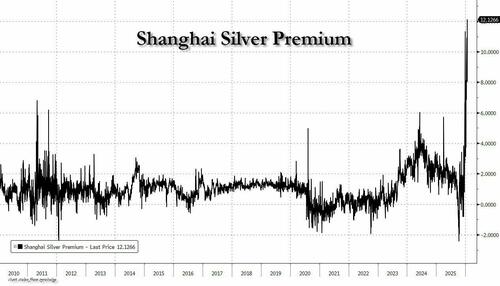

… as the Shanghai silver premium jumped 50% overnight to a record 12.

Precious metals are expected to remain in demand should investors continue to diversify away from US assets in response to erratic US policy and heightened geopolitical risk.Renewed concern about the possibility of US military action against Iran is spurring oil prices. WTI crude futures rise 1.7% to near $60.40; and Brent is at $65 in New York.

Today’s economic calendar includes January preliminary S&P Global US PMIs (9:45am), November Leading Index, January final University of Michigan sentiment (10am) and Kansas City Fed services activity (11am). Friday is slower for company earnings, with SLB slated to report before the market opens. Capital One’s fourth-quarter revenues came in slightly higher than expected, but EPS missed, and the bank agreed to buy Brex, a fintech company focused on corporate expense management and accounting, for $5.15 billion.Next week is the busiest of this earnings season, when companies speaking for more than a third of the S&P 500’s total market value will report.

Market Snapshot

- S&P 500 mini -0.1%

- Nasdaq 100 mini -0.1%

- Russell 2000 mini -0.2%

- Stoxx Europe 600 -0.3%

- DAX -0.2%

- CAC 40 -0.5%

- 10-year Treasury yield -1 basis point at 4.24%

- VIX +0.5 points at 16.16

- Bloomberg Dollar Index little changed at 1201.56, euro -0.2% at $1.1735

- WTI crude +1.4% at $60.2/barrel

Top Overnight News

- Russia said it will hold security talks with the U.S. and Ukraine in Abu Dhabi on Friday, but warned after a late-night meeting between President Vladimir Putin and three U.S. envoys that a durable peace would not be possible unless territorial issues were resolved. RTRS

- The US wants to rewrite its defense agreement with Denmark to remove any limits on its military presence in Greenland, people familiar said. It currently says the US must “consult with and inform” the two. Donald Trump also mused on social media about invoking NATO’s collective defense clause to protect the US’s southern border. BBG

- Trump on Thursday said he does not like the idea of letting people use 401(k) retirement funds for a down payment on a house, even though it was floated by his own chief economic adviser, Kevin Hassett. RTRS

- Trump thanks Chinese President Xi for working with the US and ultimately approving the TikTok deal, adds that Xi could have gone the other way.

- Treasury Secretary Scott Bessent said in an interview Thursday that the U.S. relationship with China has reached a “very good equilibrium” where disagreements are less likely to turn into full-scale economic conflict as they did last year. Politico

- Chinese officials have told the country’s largest tech firms they can prepare orders for Nvidia’s H200 AI chips, people familiar said, suggesting Beijing is close to formally approving imports. Nvidia shares jumped (NVDA +128 bps premkt). BBG

- BOJ keeps key policy rate steady at 0.75% as widely expected. The BOJ retained its hawkish inflation forecasts on Friday and stressed it will remain vigilant to price risks from a weak yen, signaling that policymakers intend to keep raising still-low borrowing costs in a politically charged atmosphere. RTRS

- China could set this year’s GDP target at 4.5-5% (vs. “about 5%” in the last three years), signaling a tolerance for modest growth deceleration as it works toward rebalancing the economy. SCMP

- Eurozone flash PMIs for Jan are mixed, with a shortfall in services (51.9 vs. the Street 52.6) and modestly better manufacturing (49.4 vs. the Street 49.2), and the details were mixed too (new orders rose, although employment deteriorated while inflation intensified vs. Dec). S&P Global

- The US urged grid operators to tap backup power, including from data centers, as a record winter storm threatens blackouts nationwide. Texas is under particular stress, while airlines brace for disruption. BBG

- US House passes package of FY26 funding bills in a major step towards averting government shutdown on Jan 31st; sending to Senate for final votes.

- US House Speaker Johnson said there is no GOP consensus on whether to use tariff revenue to send $2k checks out.

Trade/Tariffs

- EU official said India and EU will announce a free trade agreement as soon as next week.

- EU Official announces that the India-EU FTA will lead to substantially lower tariffs.

- The Trump administration pushed out 2 key officials focused on countering technological threats from China, the WSJ reported citing sources; this has raised concerns among US security hawks about the softer stance towards China.

- Spanish PM Sanchez said the US is provoking tension in the Transatlantic, EU have the instruments to respond proportionally to coercion.

- The EU is moving to revive its US trade deal after President Trump backed away from his tariff threat tied to Greenland.

- US President Trump said the people who brought the tariff legislation against the US are strongly China-oriented; the US is going so well, giant growth and investment with almost no inflation.

BOJ

- BoJ maintains its short-term interest rate at 0.75%, as expected; 8-1 vote split with Takata voting for a 25bps hike.

- BoJ Governor Ueda (post-policy presser) said headline inflation soon to undershoot 2%; not yet at the stage to mull if goal achievement is coming earlier. Will conduct monetary policy in such a way as to ensure they do not fall behind the curve. Will keep raising rates if the economic outlook is realized. It will take a while before the full impact of tightening is seen across the economy, conditions remain accommodative after the December move. Will conduct nimble market operations to respond to irregular moves; will work closely with the government on long-term rates. Operations could be conducted to encourage stable yield formation. Must pay attention to even small FX moves as underlying inflation approaches 2%.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded entirely in the green, though without a clear sector-led driver, as regional sentiment stayed broadly constructive. ASX 200 posted modest gains, supported by strength in mining and metals as gold, silver and platinum extended their bid. A strong PMI print — with both manufacturing and services pushing further into expansion — added to the positive tone. Nikkei 225 gapped higher at the open but later pared part of its advance, pressured by chip stocks after weak Intel earnings. Offsetting some of the drag, videogame names outperformed, with Nintendo (+5%) boosted by strong US Switch 2 sales data. Following the BoJ rate decision, the Nikkei was unreactive as rates remained unchanged. Hang Seng and Shanghai Comp opened higher, with the Hang Seng outperforming after Alibaba (+3.6%) was reported to be preparing the listing of its chipmaking arm. Metals strength following fresh records in gold and silver also supported both indices.

Top Asian News

- Chinese President Xi had a phone call with Brazilian President Lula, Xinhua reported. China is willing to cooperate with Brazil in different areas.

European bourses are trading largely on the backfoot, in contrast to the broadly positive action seen overnight. European sectors are trading mostly in the red. Leading sectors are Telecommunications (+1.1%), Energy (+1.2%) and Healthcare (+0.4%). Telecommunication has been given a boost by Ericsson (+8.3%) after the Co. reported strong Q4 earnings, whilst stronger crude prices has underpinned the Energy sector. On the flip side, Construction (-0.9%), Travel (-1.0%) and Financial Services (-0.5%) lag – no fresh newsflow driving the move.

Top European News

- Germany’s core budget had borrowing of EUR 66.9bln instead of the allocated EUR 81.8bln, according to sources. Sources also reported that total investment hits record level of EUR 86.8bln in 2025.

- French parliament finds confidence in PM Lecornu (i.e. the no-confidence motion failed); another motion to follow shortly.

FX

- DXY is incrementally firmer this morning and trades within a 98.25-98.48 range, which is towards the lower end of the prior day’s confines. Newsflow for the index is lacking this morning, with all attention on the upcoming trilateral meeting between US-Russia-Ukraine; Trump reminded that “anytime we meet, it is good”.

- JPY currently the top G10 performer this morning. Earlier, the BoJ kept rates steady (subject to dissent) and upwardly revised their 2026 inflation forecasts – spurring upside in the JPY at the time, but gradually waned into the Ueda meeting. The Governor avoided any overt hike signal, but noted that they are wary of a “rapid” rise in yields, also adding that they “must pay attention to even small FX moves” (strengthening JPY).

- Thereafter, a significant bout of pressure was seen in USD/JPY, soon after Ueda concluded its presser. In more detail, USD/JPY fell from 159.10 to 157.32 in an immediate reaction, before gradually scaling back to around 158.00 mark where the pair currently resides. Some had touted intervention, though Bloomberg’s Cudmore suggested the move is a rate check (i.e. the MOF calling round to see where banks think the JPY should be). In response, Finance Minister Katayama declined to comment if they intervened in the FX market, instead reiterating that they are watching FX moves with a high sense of urgency.

- G10s are mixed against the Dollar. GBP is towards the top of the pile, with upside facilitated by a hotter-than-expected Retail Sales report (which also included upward revisions to the prior); PMI figures this morning also paint a positive activity picture in the region. Thereafter, Cable took another leg higher to a session peak of 1.3532 after BoE’s Greene said, “forward indicators for wage growth are even more concerning than inflation expectations”, with other commentary generally striking a typical hawkish tone.

- Elsewhere, EUR is mildly lower; earlier slipped to session lows on the subdued French PMI metrics (Services surprisingly contracted), but then jumped on the upbeat German figures.

Fixed Income

- JGBs are lower by c. 40 ticks at the moment, with downside of just under 50 at most at a 131.32 session low. Action that comes after the BoJ and Ueda’s presser where, in short, the narrative is that April is the earliest point for a hike, as Ueda specifically referenced seeing price behaviour for that period as a “factor to mull a hike”. Though, JGBs remain markedly clear of their WTD 130.66 trough and by extension yields are off WTD highs. Nonetheless, the week’s action, driven by fiscal commentary and the BoJ, has sparked a modest shift in market pricing; with 21bps of tightening currently implied by June vs c. 18bps last week; for April, its 14bps currently vs 11bps last week.

- USTs a tick or two higher in a very thin 111-19 to 112-23 band, awaiting the trilateral summit re. Ukraine (timing TBC), flash PMIs and the potentially imminent Fed Chair announcement.

- Bunds, in contrast, are a tick or two lower. But, also in a narrow 127.64-84 band. Modest two-way action on but no real move to the January Flash PMIs, as political uncertainty re. France and the latest geopolitical/tariff gyrations potentially making some of the responses redundant.

- OATs are broadly in-line with core benchmarks. Towards the mid-point of 121.10 to 121.27 parameters. Earlier, the French parliament found confidence in PM Lecornu (as expected), though he is still subject to another no-confidence motion. Into this, the OAT-Bund 10yr yield spread has widened a touch, out to 63bps, but within comfortable and familiar territory.

- Gilts outperform. Gains of 32 ticks at best to a 91.68 high, currently holding around 10 ticks off that. Upside despite the strong December Retail Sales release and upward revisions to the November Y/Y components. Data that appears to have been overshadowed by a reassessment of the political risk after Thursday’s Burnham-induced sell-off; as more commentators pick up on the detail that Burnham’s path to becoming an MP is tricky, and largely dependent on the pro-Starmer Labour NEC.

- However, the move for Gilts unwound after strong UK PMIs and hawkish commentary from BoE’s Greene, points that were enough to take the benchmark to near enough flat on the day.

Commodities

- In short, the commodity space awaits the trilateral summit between Ukraine, Russia and the US today and potentially into tomorrow. Timing and details around the meeting are currently light, though we do know the attendees. From Ukraine, Umerrov, Budanov, Arakhamia and Hnatov. From Russia, Kostyukov; note, Dmitriev is also in the UAE, unclear if he will partake. From the US, Witkoff and Kushner.

- Crude is firmer by just under a USD a barrel. Towards highs of USD 60.22/bbl and USD 64.93/bbl for WTI and Brent, respectively. Upside that is more a consolidation from the downside seen on Thursday than a fundamentally-driven move higher.

- XAU pulled back in the early European morning. A move that, interestingly, occurred alongside downside in US equity futures at the time. As such, the move is perhaps profit-taking from recent gains; we also note similar action in silver at the time, though XAG remains firmer on the day. Spot gold briefly broke below USD 4.9k/oz, after hitting USD 4967/oz overnight.

- Base metals feature gains in 3M LME Copper. Upside that seemingly occurred alongside strength in China overnight. At best 3M LME to USD 12.97k/T. Note, Shanghai Futures Exchange is to adjust price limits and margin ratios for nickel, aluminium, lead, zinc, and stainless-steel futures as of the 27th January settlement.

- China’s Shanghai Futures Exchange will adjust price limits and margin ratios for nickel, aluminium, lead, zinc, and stainless-steel futures following the 27th of January closing settlement.

- China is reportedly set to offer CNY-denominated liquefied natural gas futures contracts as early as February, according to sources.

- Goldman Sachs lowers its Summer’26 Henry Hub forecast to USD 3.75/MMBtu (prev. USD 4.50/MMBtu), maintains 2027 forecast at USD 3.80/MMBtu.

- US President Trump said Venezuelan oil will be divided up.

Geopolitics: Ukraine

- Russia’s Kremlin said discussions in Abu Dhabi will happen today and will continue tomorrow if necessary. Russia’s sovereign assets frozen in the US amount to a little less than USD 5bln. Not looking to go into details on the “Anchorage Formula” for peace agreement with Ukraine.

- Ukrainian President Zelensky said he discussed with US President Trump additional air defence missiles, and provisions for PAC-3 & anti-ballistic missiles.

- Ukraine President Zelensky said he is waiting for US President Trump, a date, and a place for the signing of security guarantees.

- Russia’s Kremlin said Greenland proposal and Board of Peace were discussed with US envoys; talks were constructive. Without solving the territorial issue, there is no prospect of long-term settlement in Ukraine.

- Russian envoy Dmitriev called the meeting between President Putin and US envoys important.

- Russia’s Kremlin said the talks between President Putin and US envoys have concluded.

- US President Trump said Russian President Putin, alongside others, will have to make concessions to end the war in Ukraine. Putin and Zelensky want to make a deal. Ukraine war doesn’t affect the US, it affects Europe.

- EU Commission President von der Leyen said Europe will continue to work on Arctic security, step up investments in Greenland and Arctic-ready equipment and deepen cooperation with partners in the region. Well-prepared with measures if tariffs are applied. Europe should use defence spending ‘surge’ on Arctic-ready equipment. Close to prosperity deal with the US and Ukraine.

- US President Trump said the US will work with NATO on Greenland security; there are good things for Europe within the framework. On the trilateral meeting with Ukraine and Russia, said “anytime we meet, it is good”. There will be something on Greenland in 2 weeks.

- Russian defence ministry reported strategic bomber patrols conducted over Baltic Sea.

Geopolitics: Middle East

- Israeli officials reportedly express concern that they could be targeted in retaliation by Iran in response to a US strike, FT reported citing sources.

- US President Trump, on Iran, said they have a big force going towards Iran; watching Iran very closely and would rather not see something happen on Iran; will be doing a 25% secondary tariff on Iran.

Geopolitics: Others

- US President Trump posted that the Board of Peace withdraws its offer for Canada to join.

- US President Trump posted “Maybe we should have put NATO to the test: Invoked Article 5, and forced NATO to come here and protect our Southern Border from further Invasions of Illegal Immigrants”.

- US House narrowly rejects resolution to limit President Trump’s war powers in Venezuela.

- US President Trump said Chinese President Xi will come to the US towards the end of the year.

- NATO’s Rutte and Denmark’s PM is to meet on Friday morning.

- Russian defence ministry reported strategic bomber patrols conducted over Baltic Sea.

US Event Calendar

- 9:45 am: United States Jan P S&P Global US Manufacturing PMI, est. 52, prior 51.8

- 9:45 am: United States Jan P S&P Global US Services PMI, est. 52.9, prior 52.5

- 9:45 am: United States Jan P S&P Global US Composite PMI, est. 53, prior 52.7

- 10:00 am: United States Nov Leading Index, est. -0.2%

- 10:00 am: United States Jan F U. of Mich. Sentiment, est. 54, prior 54

DB’s Jim Reid concludes the overnight wrap

The market recovery continued yesterday, as easing geopolitical risks and a strong batch of US data led to growing optimism on the near-term outlook. That meant the S&P 500 (+0.55%) rose for a second day running, moving back within 1% of its record high. And for some assets, it was almost like the selloff never happened, with the VIX index of volatility (-1.26pts) back at 15.64pts, which is beneath its levels prior to Saturday’s tariff announcements, whilst US HY spreads (-4bps) closed at their tightest level since 2007, at 250bps. So it was a strong day for the most part, and the risk-on tone also sent 2yr Treasury yields (+2.4bps) to a 6-week high of 3.61%. Nevertheless, there’s still a lot of focus on the precise details of what the framework over Greenland will include, and there was lingering caution that the geopolitical risk hasn’t entirely gone away. So gold prices (+2.16%) kept up their recent momentum, rising to $4,936/oz by yesterday’s close, and they’ve posted a further gain up to $4,966/oz this morning.

In terms of the Greenland situation, there weren’t any explicit updates yesterday, but multiple press outlets reported that the talks between President Trump and NATO Secretary General Mark Rutte had focused on reopening the 1951 agreement between the US and Denmark over Greenland’s defence. Bloomberg reported that it would involve the stationing of US missiles, with the US seeking to remove any limits on its military presence in Greenland, whilst Trump himself said in an interview on Fox Business that “essentially, it’s total access.” Trump was also asked if the US would acquire Greenland, and he said “It’s possible. But in the meantime, we’re getting everything we wanted, total security.” Meanwhile, after the de-escalation the previous day, there were limited news from a summit of EU leaders, with Commission President von der Leyen saying the bloc would engage with the US in a “firm but non-escalatory” manner.

With fears ebbing about a military or economic escalation, this was very positive for global risk assets yesterday. Moreover, European markets did particularly well, because they finally reacted to Wednesday evening’s news that Trump wouldn’t impose 10% tariffs for several countries on Feb 1. Indeed, that reaction saw the STOXX 600 (+1.03%) post its best day in over two months, and there was a clear response among assets more sensitive to a military or trade escalation. So defence stocks struggled as a military escalation was viewed as less likely, and Rheinmetall (-3.40%) was the worst performer in the German DAX. Conversely, there was an outperformance from sectors like automakers that would have been more affected by tariffs, and Volkswagen (+6.51%) was the top performer in the DAX.

Whilst the geopolitical news was the main driver of the rally yesterday, sentiment also got a boost from a strong batch of US data, which cemented confidence in the near-term outlook. Most notably, the weekly initial jobless claims were at just 200k in the week ending January 17 (vs. 209k expected), which in turn pushed the 4-week moving average to a 2-year low of just 201.5k. In addition, the Q3 GDP print was also revised up a tenth, now showing growth at an annualised +4.4% before the government shutdown began. And the PCE inflation data for October and November was in line with expectations, with both headline and core PCE running at +0.2% for both months.

That data boosted confidence in the near-term outlook, and it meant that investors continued to dial back their expectations for rate cuts this year. Indeed, just 43bps of Fed cuts are now priced by the December meeting, the fewest so far this year and down -2.6bps on the day. So in turn, that helped to push up Treasury yields higher, especially at the frontend, with the 2yr Treasury yield (+2.4bps) up to 3.61%, whilst the 10yr yield (+0.6bps) reached 4.25%. That risk-on tone was echoed among US equities too, with the S&P 500 (+0.55%) powered by a strong advance for the Magnificent 7 (+2.11%), which posted its biggest gain of 2026 so far.

Overnight, the Japanese yield curve has flattened after the Bank of Japan delivered a somewhat hawkish-leaning decision. They left their policy rate at 0.75% as expected, after hiking at the previous meeting. However, it was an 8-1 vote, with a dissent in favour of another 25bp hike, whilst the outlook report raised their inflation outlook as well. So the median expectation for core-core CPI has risen by two-tenths to +3.0% in fiscal 2025, whilst the fiscal 2026 forecast is also up two-tenths to +2.2%, with fiscal 2027 up a tenth to +2.1%. And looking forward, the outlook report reiterated their desire to keep hiking rates, saying that “real interest rates are at significantly low levels”, and that if the forecast were realised then they would “continue to raise the policy interest rate”. In turn, that’s seen the 2yr Japanese yield (+3.1bps) reach a post-1996 high of 1.23%, but the 30yr yield (-1.9bps) is down to 3.62%. We also had the December CPI report shortly beforehand, which showed headline CPI decelerating to +2.1% (vs. +2.2% expected) due the impact of government subsidies.

Otherwise in Asia, equity markets have generally moved higher for the most part, which comes as the flash PMIs have painted a resilient picture of global economic activity as we begin 2026. So Japan’s composite PMI moved up to a 17-month high of 52.8, Australia’s hit a 5-month high of 55.5, whilst India’s moved up to 59.5. So that backdrop has seen further gains for the Nikkei (+0.16%), the Shanghai Comp (+0.28%) and the Hang Seng (+0.47%), whilst South Korea’s KOSPI (+0.47%) is on track for another record high. Meanwhile, US equity futures are also positive, with those on the S&P 500 (+0.19%) pointing towards further gains. However, the CSI 300 (-0.45%) has lost ground, and we also found out overnight that the People’s Bank of China set the daily reference rate for the yuan at 6.9929 per dollar, which is the first time since 2023 that the reference rate has been below 7.

Elsewhere, we’ve seen fresh records for commodities, with gold (+2.16%) closing at another record of $4,936/oz yesterday, and overnight it’s reached an intraday peak of $4,967/oz. So it’s in touching distance of the $5,000 level, and bear in mind it was only in October that it crossed the $4,000 level. Similarly, silver (+3.42%) closed at a new record of $96.24/oz yesterday, and overnight it’s also hit an intraday record of $99.36/oz. Otherwise, Brent crude fell -1.81% to $64.06/bbl, following positive comments on peace talks from Ukraine’s President Zelenskiy after meeting Trump in Davos, as well as the news that exports of Kazakh oil via a Black Sea oil terminal in Russia should soon recover from recent disruption caused by Ukrainian drone strikes. Further talks between US, Ukraine and Russia officials are expected in Abu Dhabi today and tomorrow.

Earlier in Europe, UK gilts underperformed their European counterparts yesterday, with the 10yr yield up +1.7bps on the day to 4.47%. That came in response to the news that Greater Manchester Mayor Andy Burnham could have a path back into Parliament, as a vacancy opened up to become MP in the Greater Manchester seat of Gorton and Denton. Gilts reacted to that because Burnham is seen as a plausible challenger against PM Keir Starmer, whose position has come under increasing pressure over the last year, and Burnham has previously said that the UK is “in hock to the bond markets” and called for higher public borrowing. It’s unclear yet if Burnham would be a candidate in that by-election, but gilt markets have been closely following political developments, as we saw last July when there was a big selloff driven by speculation about Chancellor Reeves’ position and whether the fiscal rules might be loosened under a new chancellor.

Finally yesterday, we also had the minutes from the ECB’s last meeting in December, where they kept their deposit rate at 2%. They showed that the ECB wanted to keep their options open, saying that “it was important for the Governing Council to maintain full optionality in either direction for future meetings”. Looking forward, it also said that “the softening of downside risks since September meant that maintaining interest rates at their current level represented a fairly solid path under the baseline outlook”. Against that backdrop, yields on 10yr bunds (+0.5bps) rose by a small amount, and those on 10yr OATs (-2.8bps) and BTPs (-1.6bps) fell back.

Looking at the day ahead, data releases include the January flash PMIs from the US and Europe, the University of Michigan’s final consumer sentiment index for January, and UK retail sales for December. Otherwise from central banks, we’ll hear from ECB President Lagarde and the BoE’s Greene.

Loading recommendations…