Chinese automakers, led by BYD, are rapidly reshaping the global electric-vehicle market and challenging long-established brands such as Volkswagen, Toyota, BMW—and even Tesla, according to the Wall Street Journal.

Once dismissed by Western buyers, Chinese EVs are now gaining wide acceptance. “These Chinese cars look fantastic,” one shopper said while browsing a BYD model in London, reflecting a broader shift in perception.

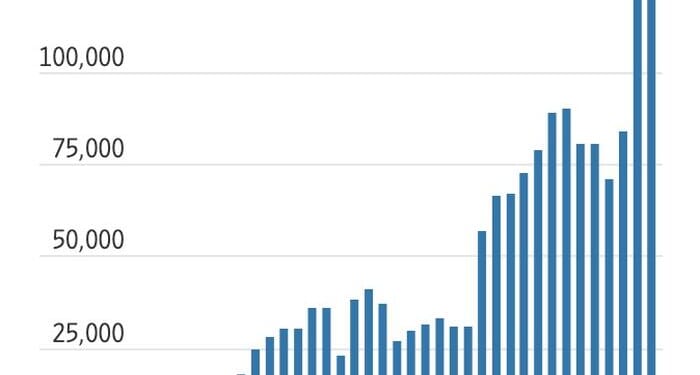

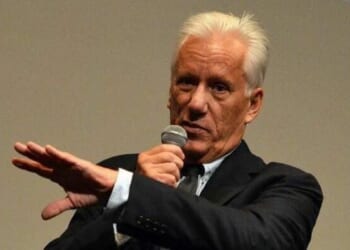

BYD has emerged as the most powerful symbol of China’s rise in electric vehicles. The company replaced Tesla as the world’s biggest EV seller and delivered more than one million vehicles outside China in 2025—more than double the previous year. China, meanwhile, surpassed Japan in 2023 to become the world’s largest auto exporter, shipping more than seven million vehicles last year.

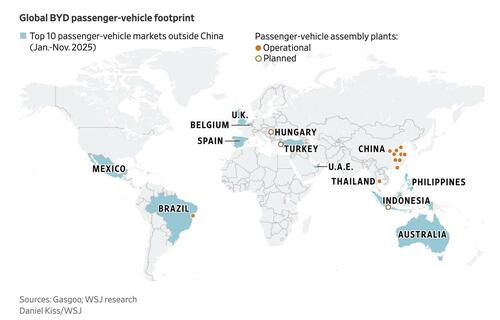

“BYD wants to become one of the most relevant players in Europe, and in a very short period,” said Alfredo Altavilla, an industry veteran advising the company.

Chinese brands now hold about 7% of Western Europe’s auto market, selling more than 500,000 vehicles in the first three quarters of 2025. Their growing presence is putting pressure on European leaders such as Volkswagen, which has already lost ground to Chinese competitors in China and now faces them on its home turf. VW said it had “confidence in our products and our ability to innovate.”

China’s dominance is fueled by massive manufacturing capacity. The country can produce more than 46 million vehicles annually, far more than domestic demand. “You need to go global,” said Klaus Zyciora. “If you are not a manufacturer that is able to bring five million units annually to the market, you will have a hard time.”

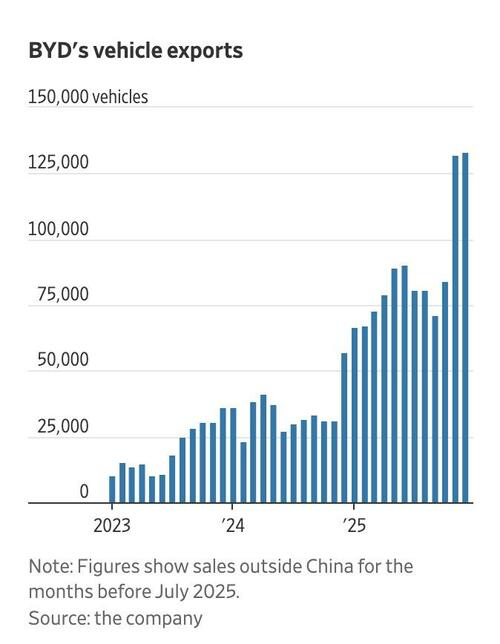

The WSJ writes that exports have become essential to absorbing this overcapacity. BYD is expanding aggressively, aiming for 2,000 European dealerships by 2026 and opening or planning factories in countries including Hungary, Turkey, Brazil, Thailand, and Indonesia. The company raised $5.6 billion to support its global push.

Political barriers remain one of the biggest obstacles. Chinese EVs face steep tariffs in the U.S., the European Union, and Mexico. In Europe, BYD vehicles are subject to duties of up to 27%. In the U.S., restrictions on Chinese software and national security concerns have effectively blocked imports.

Still, some governments are easing resistance. In Canada, officials recently reduced tariffs on Chinese EVs as part of a broader partnership with Beijing. In the U.S., President Trump signaled openness to Chinese automakers that produce locally, saying, “Let China come in.”

To bypass trade barriers, Chinese companies are increasingly building vehicles abroad. This strategy allows them to preserve access to major markets while maintaining cost advantages.

BYD’s rise has been driven not only by scale but also by strategy. After a slow start in Europe, the company shifted from premium pricing to more affordable models and recruited experienced Western executives. Local hiring and market-specific products helped accelerate growth.

“If we focus our strategy on EVs only, we will become another Tesla, with all the bumps, the ups and downs,” Altavilla said.

Chinese manufacturers are also moving upmarket. “They will learn to upgrade, and then they will come in there as well,” said Volvo CEO Håkan Samuelsson, warning that premium brands may soon face intensified competition.

In emerging markets such as Mexico, Chinese automakers have become major players by offering feature-rich, low-cost vehicles. Analysts say they are expanding demand for electric cars in regions where affordable EVs barely existed before. “They are creating a market for affordable EVs that didn’t exist,” said Justin Fischer.

BYD’s overseas growth has helped offset intense competition at home, even as profit margins fluctuate. Despite selling more than 4.6 million vehicles globally last year, the company faces pressure from rivals inside China and slowing domestic demand.

Yet the broader trend remains clear: Chinese automakers are no longer niche exporters. With scale, cost advantages, government backing, and improving technology, they are positioning themselves as global leaders.

As Altavilla put it, BYD aims to become “a real European automaker.” More broadly, China is positioning itself to dominate the next phase of the global auto industry—putting Tesla and traditional Western manufacturers under sustained pressure.

Loading recommendations…