With the year still not yet four weeks old, it’s already been a constant firehose of news volatility, even as market volatility has remained relatively contained, DB’s Jim Reid writes this morning. Consider: we’ve moved from Venezuela to Japan, via Iran and Greenland, with a range of other themes running in the background. These now include President Trump on Saturday threatening 100% tariffs on Canada if China strikes a trade deal with them, and the odds of another US government shutdown after January 30th (Friday) jumping on Polymarket from 8% on Friday to 78% this morning. This followed Senate Democratic leader Schumer warning that they will block the spending package unless Republicans defund Homeland Security after a Border Patrol shooting at a protest in Minnesota on Saturday linked to the immigration crackdown.

If that weren’t enough, Rick Rieder’s odds of becoming the next Fed Chair surged from around 33% as Europe closed on Friday to over 60% at one point over the weekend, before settling at 47% this morning. The perception in markets is that he would be more market friendly than the previous front runner, Kevin Warsh, who is now trading at 29% on Polymarket. He was at 65% last Monday. Finally in the UK, Andy Burnham was yesterday blocked by the ruling Labour Party from contesting an imminent by-election. Burnham is seen as a potential challenger to PM Starmer with lots of party support. Gilts may see some relative relief this morning as Burnham had said last September that the UK needs to “get beyond being in hock to the bond markets”.

With all this going on it’s perhaps no wonder that Gold (+8.52%) was within two-tenths of a percent of its best week since 2008, marginally behind one week in 2020. It’s up another +1.7% this morning and has flown past $5000 for the first time. However the Dollar has just had its worst week for 8 months, falling against all its peers, and has continued to weaken this morning.

So there are plenty of balls in the air right now, but the one perhaps most urgently needing careful handling is Japan. On Friday afternoon in Europe, ZeroHedge broke news that the New York Fed had conducted a “rate check” on USD/JPY on behalf of the US Treasury. This morning, the Japanese yen is around +1%, trading at ~154 against the dollar, marking its strongest position since November. Various official have refused to confirm or deny overnight any intervention so far. 2yr JGBs are around +3bps higher with 10yr and 30yr yields -1bps and flat respectively while the Nikkei is -1.90% due to the strong Yen since Friday.

With all that in mind, let’s take a look at the coming week.

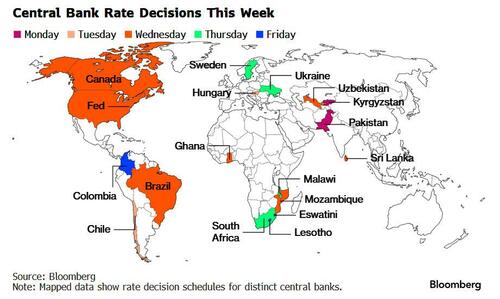

The main event this week will be the Fed’s decision on Wednesday with the main focus not on the likely unchanged Fed Funds rate but on what Powell says about a variety of things in the presser (more below). The Bank of Canada meet the same day with Sweden’s Riksbank meeting on Thursday, with both also expected to be on hold. Finally, the ECB will publish its monthly consumer expectations survey on Friday.

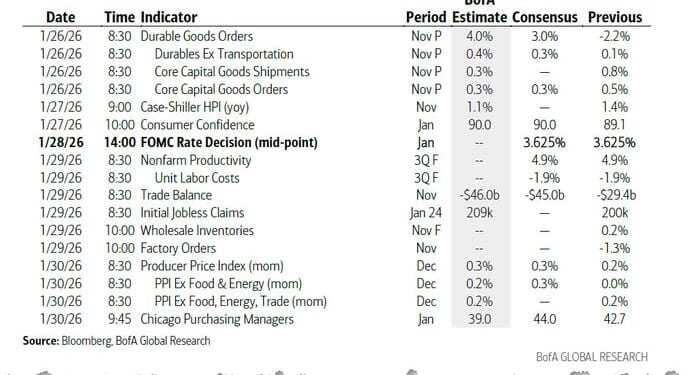

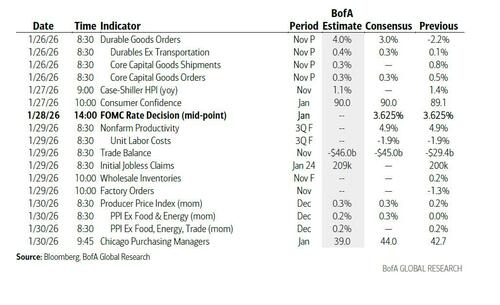

In terms of data, the US sees durable goods (today), consumer confidence (tomorrow) and PPI (Friday).

In Europe preliminary January CPI for countries including German and Spain are released, alongside Q4 GDP for the main economies all on Friday. The German Ifo is out today.

Over in Asia, a likely busy week of news flow for Japan is bookended with a big data dump on Friday featuring the Tokyo CPI, consumer confidence, retail sales and industrial production. The Lower House election campaign begins tomorrow ahead of the 8 February vote. Other notable indicators due in the region include December industrial profits in China tomorrow and Q4 CPI in Australia on Wednesday.

Rounding out with corporate earnings, an important week is ahead featuring results from four Magnificent 7 stocks – Microsoft, Meta and Tesla on Wednesday and Apple on Thursday. The four make up 16% of the S&P 500 by market cap, with the overall list of firms reporting this week totaling 32% of aggregate capitalization. Other tech highlights include ASML, Samsung, IBM and SAP. The focus will also be on defense firms RTX, Northrop Grumman and Lockheed Martin. On Friday, big oil firms Exxon and Chevron will also report. In Europe, highlights also include LVMH, Roche and Sanofi.

Previewing Wednesday’s FOMC meeting, DB economists expect the Federal Reserve to leave policy unchanged while striking a slightly firmer tone on the underlying economic backdrop. Although the usual focus would be on the policy outlook, circumstances this time mean that Chair Powell’s press conference is likely to dwell heavily on non-economic matters. Questions will inevitably surface around the recent DoJ subpoena, the situation involving Governor Cook, and the broader issue of future Fed leadership. Powell will probably lean on the themes of his recorded statement from 11 January, emphasizing the importance of institutional independence and resisting political pressure — a message he is unlikely to dilute given the current environment.

On the policy statement itself, expect the Fed to upgrade its description of growth from the previous “moderate pace” to something closer to a “solid pace,” consistent with Vice Chair Jefferson’s comments on 16 January. They also expect the Committee to acknowledge a somewhat steadier labor market, reflecting the more recent data flow available since the November meeting. Inflation is trickier: with core PCE still running at 2.8% year on year into November, progress has been limited, and the Committee may simply reiterate that inflation remains “somewhat elevated,” echoing Jefferson’s framing of recent developments.

Where the statement may shift most meaningfully is the second paragraph. Over the past several meetings, the Fed has justified its easing bias by pointing to rising labor market risks. Given the more balanced labor picture and the lack of discernible improvement on inflation, DB economists believe the Committee may drop its explicit reference to labor market deterioration and revert to the more neutral line that it remains attentive to risks on both sides of the mandate — while stopping short of last year’s language that risks were “roughly balanced.”

Taken together, Wednesday’s decision and press conference should reinforce the idea that policy is now within the Fed’s estimated range of neutral and that the Committee is well placed to respond in either direction if incoming data justify a move. Nearly all voters are likely to endorse that message, though Governor Miran will likely dissent in favour of additional easing.

Day-by-day calendar of events:

Monday January 26

- Data: US November and October Chicago Fed national activity index, November durable goods orders, January Dallas Fed manufacturing activity, Japan December PPI services, Germany January Ifo survey

- Central banks: ECB’s Nagel and Kocher speak

- Earnings: FANUC, Ryanair, Epiroc

- Auctions: US 2-yr Notes ($69bn)

Tuesday January 27

- Data: US January Conference Board consumer confidence index, Dallas Fed services activity, Richmond Fed manufacturing index, business conditions, November FHFA house price index, China December industrial profits, France January consumer confidence, EU27 December new car registrations

- Central banks: ECB’s Nagel speaks

- Earnings: LVMH, UnitedHealth, RTX, Boeing, Texas Instruments, NextEra Energy, Union Pacific, HCA Healthcare, Atlas Copco, Northrop Grumman, UPS, General Motors, Sandvik AB, Kimberly-Clark

- Auctions: US 5-yr Notes ($70bn)

- Other: the EU-India summit

Wednesday January 28

- Data: Germany February GfK consumer confidence, Italy January economic sentiment, Australia Q4 CPI

- Central banks: Fed’s decision, BoC’s decision, BoJ’s minutes of the December monetary policy meeting, ECB’s Elderson and Schnabel speak

- Earnings: Microsoft, Meta, Tesla, ASML, Lam Research, IBM, Amphenol, GE Vernova, Danaher, AT&T, ServiceNow, Starbucks, Advantest, General Dynamics, Corning, Volvo AB , Lonza, Kia, MSCI

- Auctions: US 2-yr FRN ($30bn)

Thursday January 29

- Data: US November trade balance, factory orders, wholesale trade sales, initial jobless claims, Japan January consumer confidence index, France Q4 total jobseekers, Italy November industrial sales, December hourly wages, Eurozone January economic confidence, December M3, Canada November international merchandise trade, Sweden Q4 GDP indicator

- Central banks: Riksbank decision, ECB’s Cipollone speaks

- Earnings: Apple, Visa, Samsung Electronics, Mastercard, SK hynix, Roche, Caterpillar, SAP, Thermo Fisher Scientific, KLA, Blackstone, Hitachi, Honeywell, ABB Ltd, Stryker, Lockheed Martin, Parker-Hannifin, Sanofi, Comcast, Altria, Keyence, ING, Lloyds Banking, Hyundai Motor, Sandisk, L3Harris Technologies, Norfolk Southern, Swedbank, Nokia, Givaudan

- Auctions: US 7-yr Notes ($44bn)

Friday January 30

- Data: Tokyo CPI, December jobless rate, job-to-applicant ratio, retail sales, industrial production, US December PPI, January MNI Chicago PMI, UK January Lloyds Business Barometer, December net consumer credit, M4, Japan December housing starts, Germany January CPI, unemployment claims rate, Q4 GDP, December import price index, France Q4 GDP, private sector payrolls, December consumer spending, PPI, Italy Q4 GDP, December unemployment rate, PPI, Eurozone Q4 GDP, December unemployment rate, Canada November GDP

- Central banks: Fed’s Musalem speaks, ECB December consumer expectations survey

- Earnings: Exxon Mobil, Chevron, American Express, Verizon, Sumitomo Mitsui, Regeneron, Colgate-Palmolive

Finally, looking at just the US, the key economic data releases this week are the durable goods report on Monday and the producer price index on Friday. The January FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM.

Monday, January 26

- 08:30 AM Durable goods orders, November preliminary (GS +5.0%, consensus +4.0%, last -2.2%); Durable goods orders ex-transportation, November preliminary (GS +0.3%, consensus +0.3%, last +0.1%); Core capital goods orders, November preliminary (GS +0.3%, consensus +0.3%, last +0.5%); Core capital goods shipments, November preliminary (GS +0.4%, consensus +0.2%, last +0.8%): We estimate that durable goods orders rebounded 5% in the preliminary November report (month-over-month, seasonally adjusted), reflecting an increase in commercial aircraft orders. We forecast a 0.3% increase in core capital goods orders and a 0.4% increase in core capital goods shipments—the latter reflecting the increase in orders in the prior month.

Tuesday, January 27

- 09:00 AM S&P Case-Shiller home price index, November (GS +0.2%, consensus +0.2%, last +0.3%)

- 10:00 AM Conference Board consumer confidence, January (GS 90.5, consensus 90.0, last 89.1)

Wednesday, January 28

- There are no major data releases scheduled.

- 02:00 PM FOMC statement, January 27-28 meeting: As discussed in our FOMC preview, this January meeting is likely to be uneventful, with no change to the fed funds rate, only minor changes to the statement, and few hints about the future policy path. Chair Powell is likely to emphasize that the FOMC has just delivered three cuts that should help to stabilize the labor market and is well positioned for now while it assesses their impact.

Thursday, January 29

- 08:30 AM Nonfarm productivity, Q3 final (GS +4.9%, consensus +4.9%, last +4.9%); Unit labor costs, Q3 final (GS -1.9%, consensus -1.9%, last -1.9%)

- 08:30 AM Initial jobless claims, week ended January 24 (GS 200k, consensus 205k, last 200k); Continuing jobless claims, week ended January 17 (consensus 1,850k, last 1,849k)

- 08:30 AM Trade balance, November (GS -$37.0bn, consensus -$44.2bn, last -$29.4bn); We forecast that the US trade deficit widened by $7.6bn to $37.0bn in November, reflecting a decline in gold exports and an increase in imports of computers and electronic products from Taiwan.

- 10:00 AM Factory orders, November (GS +2.4%, consensus +1.6%, last -1.3%)

Friday, January 30

- 08:30 AM PPI final demand, December (GS +0.2%, consensus +0.2%, last +0.2%); PPI ex-food and energy, December (GS +0.2%, consensus +0.3%, last flat); PPI ex-food, energy, and trade, December (GS +0.3%, consensus +0.2%, last +0.2%)

Source: DB, Goldman

Loading recommendations…