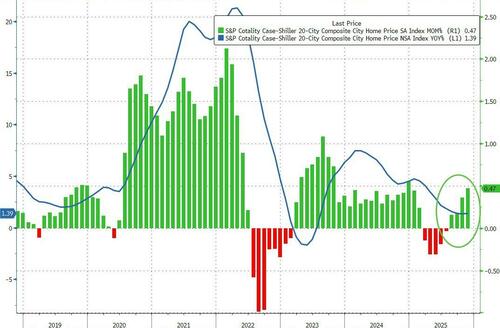

For the fourth straight month, US home prices rose on a MoM basis in November (according to the admittedly lagged and smoothed Case-Shiller data released today). The 0.47% MoM rise is the hottest since Dec 2024

Source: Bloomberg

On a year-over-year basis, there is a very modest inflection higher in the price appreciation (up from +1.32% to +1.39%).

“November’s results confirm that the housing market has entered a period of tepid growth,” said Nicholas Godec, CFA, CAIA, CIPM, Head of Fixed Income Tradables & Commodities at S&P Dow Jones Indices.

Regional patterns continue to illustrate a stark divergence.

Chicago leads all cities for a second consecutive month with a 5.7% year-over-year price increase, followed by New York at 5.0% and Cleveland at 3.4%.

These historically steady Midwestern and Northeastern markets have maintained respectable gains even as overall conditions cool.

By contrast, Tampa home prices are 3.9% lower than a year ago – the steepest decline among the 20 cities, extending that market’s 13-month streak of annual drops.

Other Sun Belt boomtowns remain under pressure as well: Phoenix (-1.4%), Dallas (-1.4%), and Miami (-1.0%) each continue to see year-over-year declines, a dramatic turnaround from their pandemic-era strength.

Declining mortgage rates suggest the rebound in aggregate prices could be about to explode…

Source: Bloomberg

Not exactly what President Trump is looking for from ‘lower rates’ helping his ‘affordability’ message.

Loading recommendations…