As we wrote in our Mag 7 earnings preview, investor sentiment has soured considerably on META since the Q3 25 print when it became abundantly clear that Zuckerberg’s foot remains firmly pressed down on the OpEx/capex accelerator.

To date, investors have seen little tangible evidence that the Meta Superintelligence Lab is capable of producing a leading edge model, and as JPM sais, “we won’t receive clarity on that issue this print. (But we may get some in the March/April timeframe when Avocado might launch.)” Looking at this quarter specifically, investors’ attention will be focused squarely on the 2026 OpEx guide (can’t be bigger than feared) as well the Q1 26 Revenue guide (needs to show a modest FXN acceleration on an easier comp). All told, investor sentiment on META heading into this print was at best ‘timid’, with many looking for the trade-off between massive capex and returns on investment.

Going into earnings, Goldman’s desk wrote that investor positioning is 7/10, and notes that the stock has been a relative short amongst Mag7 peers for investors since the last earnings print on ROI debates + Product visibility (LLMs? New products? Other?). Into the print, focus on visibility into Meta’s expense profile in 2026 (for context, Goldman sits at $125bn of capex in ’26 and $152bn of total expenses) relative to Revenue trends (Goldman models nearly ~20% ad revs growth in CY26). The options implied move of the stock is 6%.

With that in mind, here is what Meta reported moments ago for Q4.

- Revenue $59.89 billion, +24% y/y, beating estimate $58.42 billion

- Advertising rev. $58.14 billion, +24% y/y, beating estimate $56.79 billion

- Family of Apps revenue $58.94 billion, +25% y/y, beating estimate $57.47 billion

- Reality Labs revenue $955 million, -12% y/y, beating estimate $962.7 million

- Other revenue $801 million, +54% y/y, beating estimate $718.8 million

- Operating income $24.75 billion, +5.9% y/y

- Family of Apps operating income $30.77 billion, +8.6% y/y, estimate $30 billion

- Reality Labs operating loss $6.02 billion vs. loss $4.97 billion y/y, estimate loss $5.8 billion

- Operating margin 41% vs. 48% y/y

- EPS $8.88 vs. $8.02 y/y, beating estimates of $8.19

Some other Q4 details:

- Ad impressions +18% vs. +6% y/y, estimate +12.2%

- Average price per ad +6% vs. +14% y/y, estimate +9.07%

- Average Family service users per day 3.58 billion, +6.9% y/y, estimate 3.56 billion

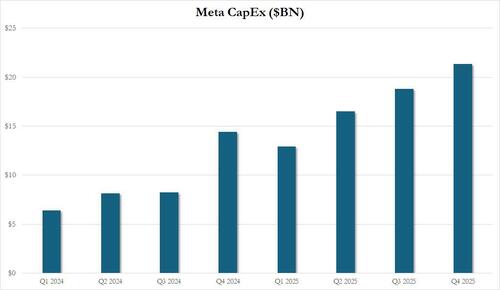

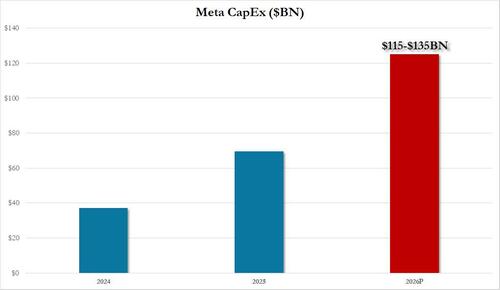

What is probably more important to investors is where did capex end in Q4: the answer, $21.4BN, up more than 50% YoY from $14.4BN a year ago.

Some more comments from management on the quarter:

- “We had strong business performance in 2025,” CEO Mark Zuckerberg said. “I’m looking forward to advancing personal superintelligence for people around the world in 2026”

- “We expect first quarter 2026 total revenue to be in the range of $53.5-56.5 billion.”

- “Despite the meaningful step up in infrastructure investment, in 2026 we expect to deliver operating income that is above 2025 operating income.”

- “Absent any changes to our tax landscape, we expect our full year 2026 tax rate to be 13-16%.”

- “We expect full year 2026 total expenses to be in the range of $162-169 billion.”

- The company will continue monitoring legal and regulatory headwinds in the EU and the US. It continues to see scrutiny on youth-related issues, which may result in material loss

In a nutshell, the historical numbers were solid. What about the future? This is the company’s outlook:

Q1 revenue in the range of $53.5-56.5 billion, higher than the $51.3BN estimate (assumes FX is a ~4% tailwind to year-over-year total revenue growth)

Full year 2026 total expenses to be in the range of $162-169 billion, much higher than the $151BN expected.

- company says the majority of expense growth will be driven by infrastructure costs, which includes third-party cloud spend, higher depreciation, and higher infrastructure operating expenses)

- The second-largest contributor to total expense growth is employee compensation, driven by investments in technical talent. This includes 2026 hires to support our priority areas, particularly AI, as well as a full year of expenses from 2025 hires.

- At a segment level, we expect expense growth to be driven by the Family of Apps, with Reality Labs operating losses remaining similar to 2025 levels.

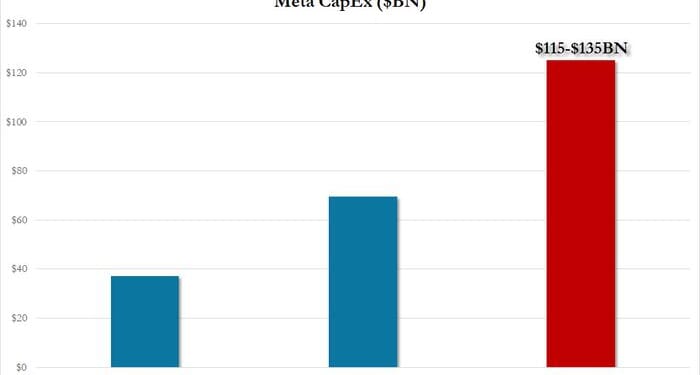

Last but not least, META’s 2026 capex forecast was an absolute stunner: the company said that it anticipates 2026 capital expenditures to be in the range of $115-135 billion, with year-over-year growth driven by increased investment to support our Meta Superintelligence Labs efforts and core business. This is much, much higher than the $110.62BN median estimate, and represents a doubling in capex YoY.

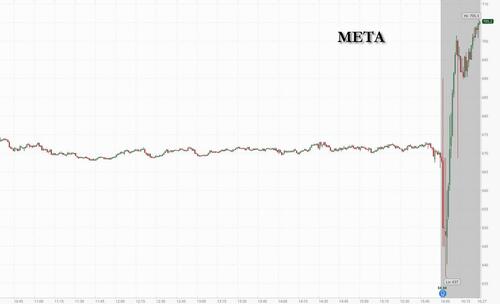

The stock has moved very bizarrely: after initially dumping on the report of the blowout expense/capex surge, it was as if a relentless buyer stepped in and moved the stock from the session low of $640 to what has so far been an after hours high of $705.

Yet we would be very cautious chasing the stock here as the exact same questions that emerged last quarter are bound to resurface, namely just what return is Meta expecting to generate on this mindblowing capex spending.

Loading recommendations…