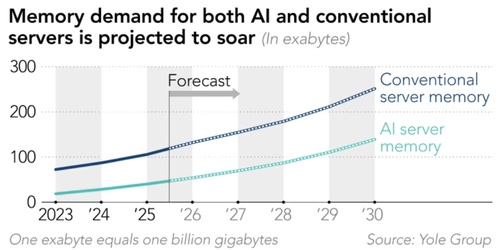

A global shortage of high-bandwidth memory (HBM) has emerged in recent months, and some of the first casualties of the “great memory crunch” were flagged by Goldman in December, starting with consumer electronics companies such as Nintendo.

The list of victims has continued to expand. Last week, we noted that smartphones, PCs, and other consumer electronics dependent on HBM were set to come under pressure. Goldman then followed with another note, warning that it had slashed global PC shipment forecasts due to soaring memory prices. Now the list of victims is expanding yet again, and we suspect this memory price shock will persist through the year.

Bloomberg Opinion’s US technology columnist Dave Lee opined that, “One frustrating characteristic of the AI boom seems to be that everyone must pay for it, regardless of any interest in using it. For some, it will be through rising utility bills as data centers strain the grid.”

Lee pointed out, “For even more of us, it will be increasing costs of just about every electronic product you can think of: laptops, smartphones, televisions — perhaps even cars.”

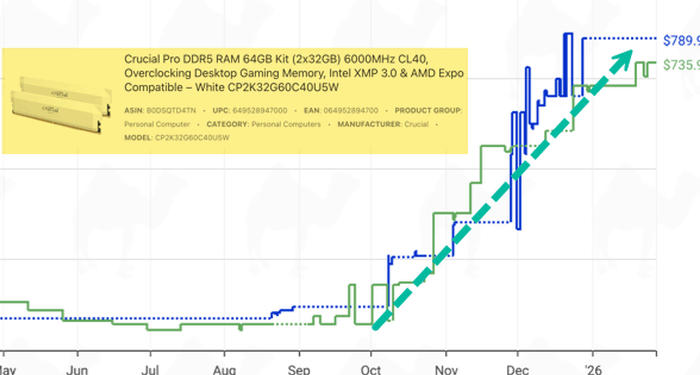

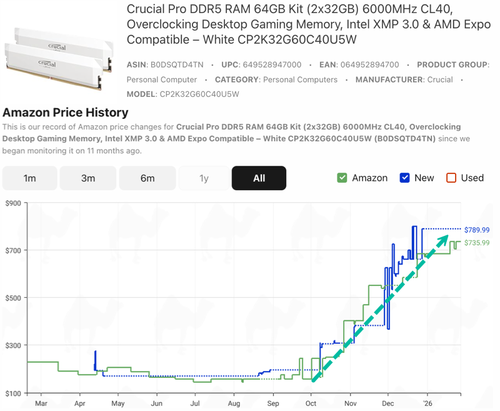

The columnist is correct about exploding prices tied to the AI-driven supercycle, as massive data center buildouts are soaking up the world’s HBM supply. A look at the Amazon price-tracking site CamelCamelCamel shows a parabolic surge in the price of Crucial Pro DDR5 64GB RAM, which has jumped from $145 to $790 in just six months.

Expanding the list of victims of the great memory crunch of our time is a new report this week from Nikkei Asia, which warns that entry-level consumer electronics devices, such as smart TVs, set-top boxes, home routers, budget tablets, smartphones, and PCs, will be among the hardest-hit segments. Automobiles are also expected to be heavily affected, as they require longer verification cycles. The analysis is based on commentary from numerous industry executives deeply embedded in the memory supply chain.

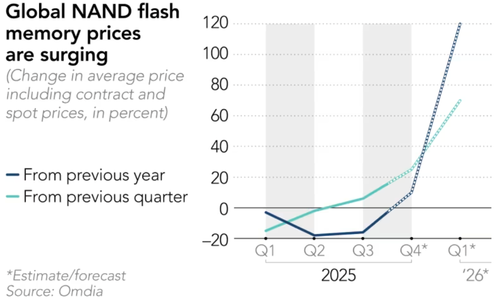

Those same industry executives warned that the memory shortage will persist through this year and into 2027. So if you are planning to build a gaming PC for a new trading desk or just for gaming, or if you are thinking about upgrading to a new AI-equipped PC, be warned: prices are expected to soar further. That is why Goldman’s Allen Chang revised down his global PC shipment forecasts for 2026 to 2028, citing a sharp spike in memory prices as data centers worldwide soak up the supply of HBM.

“Demand from servers and AI is extremely strong, and we expect NAND flash prices to continue rising sharply through 2026,” P.S. Pua, CEO of Phison Electronics, a major developer of NAND flash memory controller chips, told Nikkei Asia.

Pua said, “But many consumer electronics makers may not be able to absorb that kind of price increase. TVs will be seriously affected, and products like set-top boxes will be hit very hard as well. The total shipment volume will definitely go down. Many of them simply can’t afford those prices.”

For those who are wondering whether it’s time to upgrade the PC before memory prices soars even more, an executive at one Japanese component supplier summed it up perfectly: “If you want to buy any consumer goods, PCs, or smartphones … do it now, as it is for sure all the prices will be increased. Take an average PC, for example. The ratio of memory chips in the BoM [bill of materials] cost has increased from some 15% to almost 40%.”

The surge in memory prices prompted Synopsys CEO Sassine Ghazi to note that the world’s top memory suppliers are now fully absorbed by AI infrastructure demand, crowding out other end markets.

“Now it’s a golden time for the memory companies,” Ghazi said. Meanwhile, memory suppliers such as SK Hynix, Samsung Electronics, and Micron Technology are imposing stricter customer checks to prevent panic hoarding, even as they see record profit margins.

Loading recommendations…