When White House press secretary Karoline Leavitt ended a press briefing in early January, traders on the prediction market Kalshi noticed something curious: She had wrapped up just seconds before the session crossed a 65-minute threshold that would have triggered payouts on the prediction market. There is no evidence Leavitt was aware of the bet, let alone trying to manipulate it—the market’s volume and largest bet were far too small to draw legitimate suspicion. But the incident raised an uncomfortable question: What happens when people can bet on events they have insider knowledge of or even the power to influence?

Several high-profile insider trading scandals have already emerged from the world’s novel obsession with prediction markets. In October, bets on Polymarket that Venezuelan opposition leader Maria Corina Machado would win the Nobel Peace Prize spiked shortly before she was announced as the recipient, leading to investigations by the prize’s committee into whether its confidential decision was leaked. In early January, another Polymarket trader earned more than $400,000 after predicting that Nicolás Maduro would be removed from office shortly before U.S. forces seized the Venezuelan dictator in Caracas.

Prediction markets, which allow users to buy and sell contracts that pay out based on the outcome of future events, are not an entirely new phenomenon. The Iowa Electronic Markets, for example, has allowed users to bet on the outcome of elections since the 1980s, and numerous corporations and government agencies have experimented with internal prediction markets for years. These markets are generally quite accurate at predicting the likelihood of real-life outcomes.

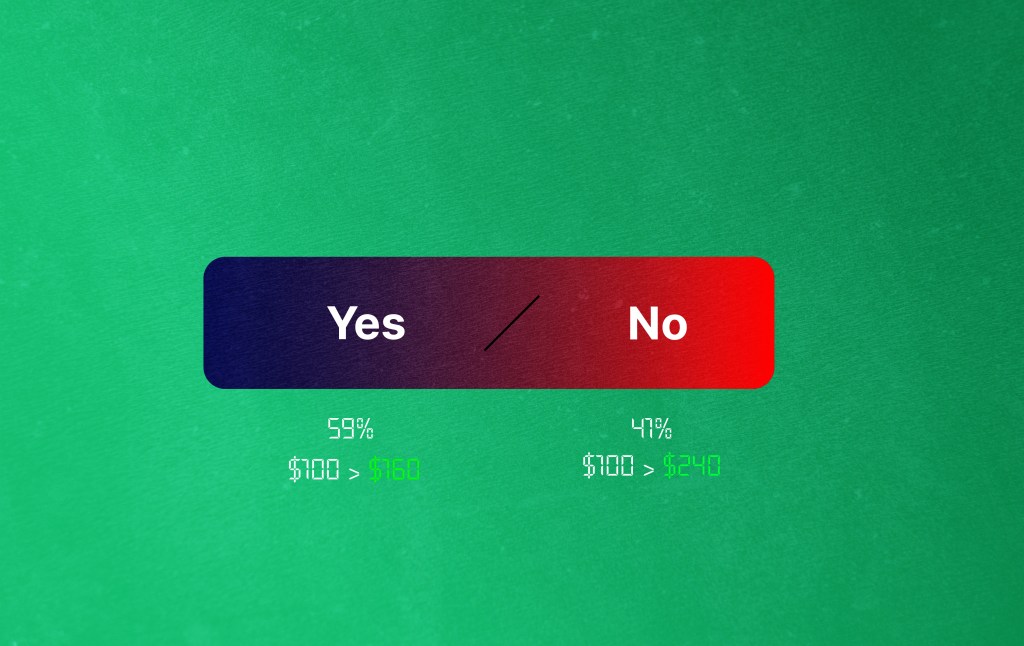

However, the rapid growth of prediction market providers like Kalshi, Polymarket, Robinhood, and Crypto.com has brought what was once a niche playground for financial economists into the mainstream and set up a legal battle with states that argue the platforms are no different than traditional gambling. Prediction market platforms, however, maintain that they are legitimate financial products—no different from derivatives contracts that are traded across the country via platforms like the Chicago Mercantile Exchange every day.

The Commodities Futures Trading Commission (CFTC)—one half of the country’s bifurcated securities and derivatives regulatory regime—traditionally relied on a test to determine whether a financial derivative served a legitimate economic purpose. Derivatives like futures contracts, for example, are essential tools for businesses looking to hedge against future price uncertainty. But the elimination of this economic purpose standard in the 2000 Commodity Futures Modernization Act, which was intended to encourage financial innovation, left a legal void, according to Cantrell Dumas, a senior researcher for financial regulation and policy at the Joint Center for Political and Economic Studies and a former CFTC regulator. “It eliminated a foundational principle that helped distinguish legitimate financial instruments from wagers,” Dumas told The Dispatch.

This legal gray area did not go entirely unnoticed, and in 2010, Congress introduced a public interest review that allowed the CFTC to prohibit event contracts that involved activities like terrorism, assassinations, war, and most notably, gaming. “[Congress] foresaw it,” Dumas said. “They didn’t want derivative markets to be used for gambling.” But after the U.S. District Court for the District of Columbia denied the CFTC’s attempt to block event contracts offered by Kalshi on the outcome of congressional elections in 2024, the landscape for legal event contracts on everything from presidential races to the Super Bowl opened. “If you look at the sort of debates that were happening when this [public interest review] legislation was in the works, people were clearly trying to prevent the exact situation that we have here,” Karl Lockhart, a professor of law at DePaul University, told The Dispatch.

Although they are regulated by the CFTC, the primary legal issue still facing prediction markets now is the extent to which they are—or aren’t—considered the same as traditional gambling, said Melinda Roth, a law professor at Washington and Lee University. “The fundamental legal question is, are event contracts offered by prediction market platforms financial derivative products, or are they simply gambling or betting?” Roth told The Dispatch. “That’s the big-picture question, and it’s not answered yet, and depending upon which way it gets answered, there’s lots of consequences and fallout.”

That legal debate has thus far been focused almost entirely on event contracts related to sports. Prediction markets, despite operating in a very different way than traditional sportsbooks, allow users to essentially place the same kinds of bets that they would otherwise have to place using a state-regulated gambling company. When a company like Kalshi offers a prediction market on who will win this year’s Super Bowl, for example, states have argued that Kalshi is, in essence, offering the same kind of betting opportunity as a traditional sportsbook, meaning that those contracts should be subject to state gambling regulators instead of to the CFTC. “This argument is bigger than just event contracts,” Dumas said. “This is dealing with who has the authority to regulate gambling.”

Under federal commodities law, event contracts like those offered in prediction markets are regulated by the CFTC. Sportsbooks and other traditional gambling companies, however, have been regulated by individual states since a 2018 Supreme Court decision struck down the Professional and Amateur Sports Protection Act, which had previously banned most states from authorizing sports gambling.

Under CFTC regulation, firms that want to offer event contracts must register and be approved as designated contract markets (DCMs), after which they can add new event contracts through a fairly quick self-certification process. Sportsbooks, on the other hand, must adhere to state-specific gambling regulations and generally gain pre-approval before offering new products. This difference in regulatory authority has allowed prediction markets like Kalshi to offer almost identical betting opportunities as traditional sportsbooks while avoiding the state regulations that typically govern sports gambling. “If you are a DCM registered with the CFTC, then you can offer whatever derivatives contracts you want,” Lockhart said.

Those regulatory differences have been particularly evident in states that have not yet passed laws to legalize gambling—like Texas and California—and states where online gambling is legal only for users 21 years or older. While an 18-year-old resident of California could not legally place an online bet on the Super Bowl through a sportsbook, he could place a nearly identical bet using an online prediction market.

Some states, like Nevada, New Jersey, and Maryland, have pushed back on prediction markets offering de facto gambling services. All three states sent cease-and-desist letters to Kalshi last year, after which Kalshi sued each for injunctive relief. In April, Kalshi, arguing that the CFTC’s regulatory authority over event contracts preempted state gambling laws, won preliminary injunctions against both Nevada and New Jersey. But in August, Kalshi lost its request for injunctive relief against Maryland, and in September, Massachusetts won a preliminary injunction to prevent Kalshi from offering sports contracts in the state. Kalshi is also involved in ongoing lawsuits against both Ohio and New York.

Roth believes the Supreme Court may eventually step in. “The conventional wisdom is that [the lawsuits] are going to lead to different outcomes in different states, and that’s going to lead to a circuit split, and that’s going to lead to a potential fast track to the Supreme Court reviewing this issue,” she said.

While the state cases are the most prominent—and most likely to have a long-term effect on the legality of prediction contracts on sports—they are not the only lawsuits against prediction market providers. In July, three Native American tribes in California sued Kalshi and Robinhood, alleging that the companies were in violation of the Indian Gaming Regulatory Act and several other laws. Wisconsin’s Ho-Chunk Nation filed a similar lawsuit in August, which was joined in a legal brief by 16 other tribes early this year. A litigation finance firm is also getting in on the action using an obscure 18th-century law called the Statute of Anne that contains a provision that allows bettors—or third parties—to recover gambling losses from illegal gambling.

While interesting to legal nerds, Roth doesn’t believe these Statute of Anne cases, nor the cases brought by Native American tribes, will have a sizable effect on the prediction market landscape. Instead, she thinks the regulatory future of sports prediction contracts will be shaped mostly by the lawsuits brought by states. “I think that the first bucket is the one that has the potential, depending upon what happens, to either curtail sports event contracts or explicitly make them legal,” she said. But a Supreme Court case isn’t the only outcome that could change the landscape. Congressional action could also clarify whether sports contracts are subject to the CFTC or state gambling regulators, and the CFTC itself can further clarify its rules on event contracts. In a joint CFTC and SEC event yesterday, CFTC Chairman Michael Selig said he would withdraw a 2024 rule proposal that would have prohibited sports and politics-related event contracts and direct CFTC staff to “move forward with drafting an event contracts rulemaking.”

Another pertinent legal question is how insider trading should be treated in prediction markets. There is no evidence that a U.S. official was behind trades related to Venezuela, or that Karoline Leavitt timed the length of a press conference based on an event contract. But even if they were, it’s unclear whether their actions would have actually been illegal.

Even as applied to more traditional markets, insider trading laws in the U.S. are actually quite murky—there is no single statute that explicitly outlaws the practice. “This is a confusing area, because insider trading law, unlike speeding ticket law, is really just a mess of different things,” Andrew Verstein, a professor of law at the University of California, Los Angeles, and expert on insider trading, told The Dispatch. Instead, insider trading prohibitions are based on various statutes and decades of case law.

That case law is fairly clear when it comes to the Securities and Exchange Commission’s authority over the trading of securities: Individuals cannot use material, nonpublic information to make trades. For the CFTC and trading derivatives, that standard is less evident. Insider trading in securities markets, where corporate insiders have a fiduciary obligation to their shareholders, is traditionally viewed as more harmful than insider trading in commodities markets, where traders routinely compete with unequal information. That, combined with the CFTC’s authority over insider trading being newer than the SEC’s, has resulted in far fewer insider trading cases being brought against commodity trading than for traditional securities. “There really aren’t cases for commodity law,” Verstein said. “We have a pretty big open space where the law on the books may be the same [for commodities and securities], but it really does make a difference if you don’t have prosecutors bringing cases and you don’t have case law developing and holding.”

As a result, even though there are laws that could potentially be used to prosecute a government official who uses insider knowledge to profit from prediction markets, it is unlikely that the CFTC would be inclined to do so. “They can use a lot of things in their toolbox,” Dumas said of the CFTC’s enforcement authority. “But the issue is they choose not to.” Verstein believes that legal uncertainty would also hold for a case in which a government official changed their behavior in order to cause a particular event contract to pay out. “I wish that many forms of that were illegal, but I think the case that it’s illegal in securities or commodities is pretty weak,” Verstein said. “In general, we do not have a clear law against adjusting your behavior so that somebody’s bet pays off.”

It would likely require an act of Congress—similar to the STOCK Act, which banned congressional stock trading based on information obtained through their official duties—to ensure that government officials do not use their positions to profit from prediction markets. “That would fully clarify that government officials shouldn’t be trading or sharing this information for trade, and that would be a really good step to actually realistically make a reduction happen,” Verstein said. “And it could happen, we’re one scandal away from a law like that being attractive to people.”

Earlier this month, Democratic Rep. Ritchie Torres of New York introduced a bill—co-sponsored by 30 other House Democrats—that would prohibit federal elected officials, congressional staff, political appointees, and executive branch employees from trading prediction contracts tied to government policy or political outcomes. As of now, it is unclear whether the bill will receive bipartisan support or advance out of the House. But if Kalshi’s congressional contract offerings are any guide, bettors may eventually be able to wager on whether the bill passes—on Kalshi itself.