The Trump administration is preparing to launch a major initiative aimed at protecting US manufacturers from disruptions in the supply of critical minerals, committing about $12 billion in initial funding to build a strategic stockpile of essential materials, according to Bloomberg. The project, known as Project Vault, is designed to reduce America’s dependence on China for rare earths and other strategically important metals. By creating a centralized reserve for civilian industries, officials hope to cushion companies against sudden shortages and sharp price swings that can disrupt production and strain finances.

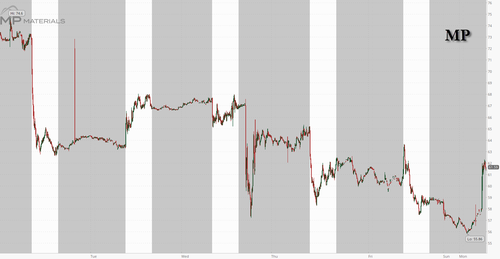

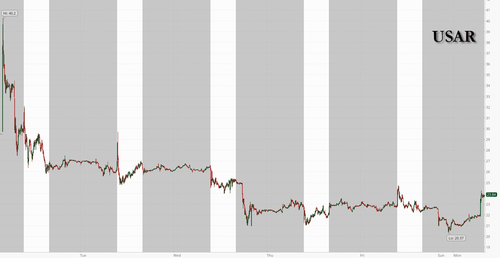

Shares of MP Materials, USA Rare Earth, Critical Metals and other rare earth associated names are higher between 5% and 10% heading into the cash open on Monday on the news.

At this point it’s safe to say last week’s Reuters rare earth hit piece (authored most likely at the behest of a disgruntled short), which sent the sector tumbling on disputed claims the Trump administration was seeking to distance itself from the rare earth space by moving away from a price floor on critical metals and suggesting MP’s deal with the government may be in question, has been thoroughly debunked. Even the MP Materials X account was mocking the grotesque misreporting:

Pathetic

— MP Materials (@MPMaterials) January 29, 2026

Project Vault will be financed through a mix of private and public funding: $1.67 billion is expected to come from private investors, while the US Export-Import Bank is set to provide a $10 billion loan with a 15-year term. The bank’s board is scheduled to vote on the deal, which would be the largest in its history.

More than a dozen major companies have joined Project Vault, including General Motors, Stellantis, Boeing, Corning, GE Vernova, and Google. Three large trading firms – Hartree Partners, Traxys North America, and Mercuria Energy – will handle sourcing and purchasing materials for the stockpile.

Some details about Project Vault’s structure were not immediately known, including the institutional investors providing the $1.67 billion (although JPMorgan will likely be among them). The senior administration officials said the project had been oversubscribed because investors are attracted by a credit-worthy group of manufacturers, their long-term commitments and the involvement of the US export-credit agency.

The specific carrying costs that would be charged to those manufacturers, as well as the fees for the trading firms participating as procurement officers, weren’t disclosed. Under the arrangement, companies that make an initial commitment to purchase materials at a specified inventory price later — and pay some up-front fees — will be able to present Project Vault with a shopping list of preferred materials they need.

The project, in turn, will seek to procure and store the materials, with the manufacturers charged a carrying cost for the expenses associated with interest on the loan and holding the elements. Manufacturers will be allowed to draw down their material stash as long as the firms replenish them. In the case of a major supply disruption, they will be able to access all of it, the officials said.

Project Vault represents the first major public-private partnership under the Trump admin seeking reshoring of a critical supply chain, and blends government-backed financing with private investment and corporate participation. While the plan aims to strengthen domestic supply chains, it comes at a time when rare earth mining stocks such as MP Materials and USA Rare Earth are trading well below their recent highs.

Bloomberg writes that rather than focusing on oil, which naturally is at the basis of the nation’s emergency petroleum reserve, this new effort will concentrate on minerals such as gallium and cobalt.

These materials are used in a wide range of products, including smartphones, electric vehicle batteries, and aircraft engines. The stockpile is expected to cover both rare earth elements and other critical minerals whose prices tend to be unstable.

According to senior administration officials, the initiative would represent the first large-scale mineral reserve designed specifically for private-sector use.

Investor interest has reportedly been strong, with officials saying the project is oversubscribed. They attribute this to the participation of major manufacturers, long-term purchasing commitments, and the backing of a federal credit agency. However, the identities of the main institutional investors and the exact cost structure have not yet been disclosed.

The program is part of a broader push to cut US reliance on China, which dominates much of the critical minerals supply chain. While the US maintains a reserve for defense needs, it has never created a similar system for civilian industries. The government has also expanded domestic investment and international cooperation with partners such as Australia, Japan, and Malaysia.

Momentum increased after China tightened export controls last year, forcing some US manufacturers to reduce output and exposing supply vulnerabilities. Under the system, companies will commit in advance to buy set quantities at agreed prices, pay upfront fees, and submit lists of needed materials, which Project Vault will acquire and store.

A central feature is price stabilization: firms must agree to repurchase the same volumes at the same prices in the future, a structure meant to limit volatility and protect against sudden cost spikes like the post-Ukraine surge in nickel prices. Trump is expected to discuss the plan with GM chief executive Mary Barra and mining entrepreneur Robert Friedland.

Loading recommendations…