PayPal shares in New York premarket trading plunged 17%. If the losses hold through the cash session, this would mark the largest decline in four years. The selloff was sparked after the payments company reported adjusted profit and revenue that fell short of Bloomberg Consensus estimates, along with news that CEO Alex Chriss will be replaced.

CFO Jamie Miller will serve as interim CEO until HP CEO Enrique Lores replaces Chriss. Newly appointed board chair David Dorman said that execution under the current CEO has failed to meet board expectations (translation: share price is too low), despite some progress.

“While some progress has been made in a number of areas over the last two years, the pace of change and execution was not in line with the Board’s expectations,” Dorman told investors.

Fourth-quarter earnings missed the average analyst estimates tracked by Bloomberg, with the payments company highlighting weakness from US retail spending and headwinds abroad.

Important to note that fourth-quarter EPS of $1.23 and revenue of $8.68 billion both missed expectations, while full-year EPS of $5.31 fell below prior guidance of $5.35 to $5.39. Adding to investor concern, signs of softening consumer spending emerged as growth in PayPal-branded online checkouts slowed sharply to 1%, down from 6% a year earlier.

CFO Miller warned in October that worsening macroeconomic headwinds (a K-shaped economy) would affect the firm’s ability to achieve its longer-term targets. She and other executives have struggled to monetize the company’s payment services.

Here’s a snapshot of fourth quarter earnings (courtesy of Bloomberg):

Adjusted EPS $1.23 vs. $1.19 y/y, estimate $1.28 (Bloomberg Consensus)

Net revenue $8.68 billion, +3.7% y/y, estimate $8.79 billionTransaction revenue $7.82 billion, +3% y/y, estimate $7.95 billion

Other value added services revenue $857 million, +10% y/y, estimate $838.8 million

Transaction margin dollars $4.03 billion, +2.5% y/y, estimate $4.07 billion

Total payment volume $475.14 billion, +8.5% y/y, estimate $471.51 billion

- Venmo total payment volume $85.79 billion, +13% y/y, estimate $84.05 billion

Payment transactions 6.75 billion, +2% y/y, estimate 6.72 billion

Active customer accounts 439 million, +1.2% y/y, estimate 439.04 million

Adjusted operating income $1.55 billion, +3.2% y/y, estimate $1.59 billion

Adjusted operating margin 17.9% vs. 18% y/y, estimate 18.1%

Adjusted free cash flow $2.10 billion, -0.1% y/y, estimate $2.03 billion

US revenue y/y growth 4%

International revenue y/y growth 1%

Total operating expenses $7.17 billion, +3.5% y/y, estimate $7.26 billion

As for the outlook, PayPal is guiding to muted growth and margin pressure in the near term

First Quarter Forecast

Year Forecast

-

Sees low-single digit decline to slightly positive in adjusted EPS growth y/y

-

Sees roughly flat transaction margin dollars

-

Sees adjusted free cash flow above $6 billion

-

Sees capital expenditure about $1 billion, estimate $997.8 million

The combination of the fourth quarter miss and the CEO being replaced sent shares tumbling in premarket trading, down about 17% around 0800 ET – the largest decline since the 25% crash on Feb. 2, 2022.

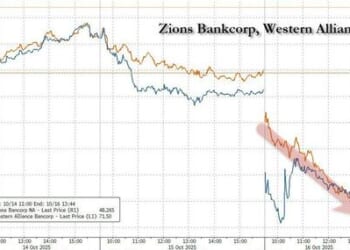

What is this stock pattern called?

What happens to PayPal shares when X Payments goes live?

Loading recommendations…