Authored by Lance Roberts via RealInvestmentAdvice.com,

Assessing a bear market rally proves challenging when you experience it firsthand. It is only in hindsight that the complete picture reveals itself to investors. Of course, after a bear market rally, investors tend to review their investments and speculate on what they should have done differently.

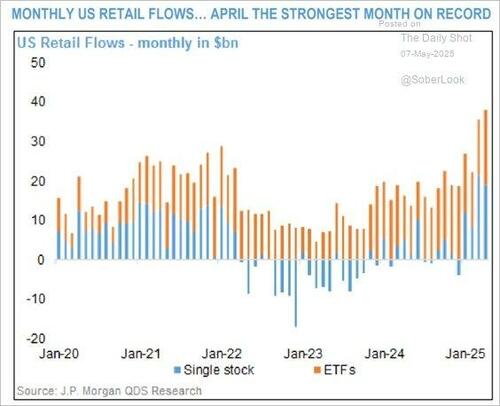

Retail investors seem to view the recent sharp correction as possibly finished. As I noted last week on X, despite the near 20% correction in the markets, retail investors piled into US equities at a record pace. Of course, historically, retail investors were considered a contrarian indicator, but in recent years, particularly post-pandemic, they have been aggressive buyers of any dip in the market. Of course, after 15 years of monetary and fiscal interventions to stave off deeper bear markets, their “buy the dip” mentality is unsurprising.

Before we go further, we should discuss what a “bear market rally” is to frame better our discussion about what the possibilities and probabilities of what happens next.

Bear Market Rally Or Just A Correction?

A bear market rally represents a short-term increase in stock prices that emerges while the market is in a downward trend. Such price rallies bring forth positive expectations because markets experience significant upward movements throughout several weeks or months. These rallies do not indicate any actual market recovery. They serve as brief interruptions before the dominant downward trend continues. The general drivers of these bear market rallies generally result from investors buying back their short positions, market participants feeling increasingly optimistic, and technical indicators showing oversold conditions. As such, they increase risk assets.

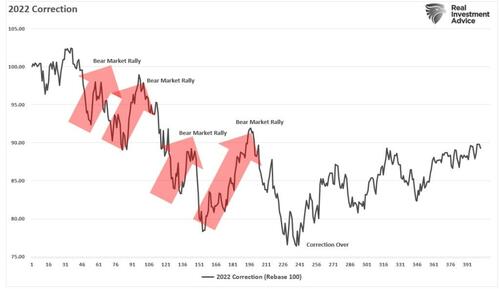

However, the fundamental problems that initiated the previous corrective phase are still present. Such factors generally range from declining earnings to monetary condition changes, rising recession risk, economic policy uncertainty, or a combination that persists despite temporary price increases. Reality eventually returns to market fundamentals, which makes the rally disappear before the bearish trend reemerges. A good example was 2022, where investors experienced several bear market rallies amid the Federal Reserve increasing interest rates while Russia invaded Ukraine. Each time the bear market rally occurred, it sucked bullish investors back into the market and left them stranded.

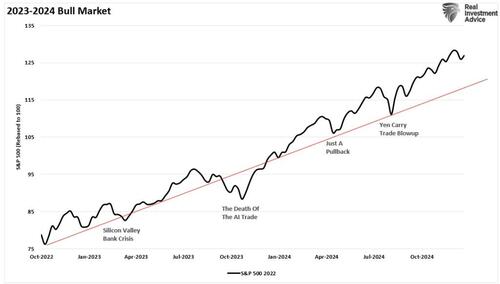

Conversely, a correction, which occurs during an upward market trend and represents a decline of 10% or more, differs from a bear market rally. Generally, a correction is a short, singular down cycle within a rising trend. These events typically stem from short-term market anxieties, including overbought positions, geopolitical disturbances, and policy modifications. Yet, they do not shift the future direction of the market. The market stabilizes after a correction because positive economic trends and favorable earnings support its upward movement. The fundamental distinction rests in the environment and period of the market situation. The basic trend stays solid during a bull market correction, and investors will eventually experience positive outcomes from new price peaks. A good example of corrections within a bullish trend is evident in the 2023-2024 market. Despite a bank crisis, concerns of AI, or leveraged blowups, the market recovered quickly and moved to new highs.

The risk for investors is the real-time determination of what type of corrective action we are in. Investors who reenter risk assets during a bear market rally face additional market declines since the primary downward trend continues after the brief recovery. Investors who buy the dip during a corrective phase in a bull market benefit.

One grievance I often receive from readers is that I don’t tell you the answer. The reason is that neither I nor anyone else can predict the future. All I can do for you is address the possibilities and probabilities of what can happen so you can manage your investment risk accordingly.

With that said, let’s dig into both cases.

The Bull Case For “Just A Correction“

The bulls can certainly make a case for continuing the bull market that began in October 2022.

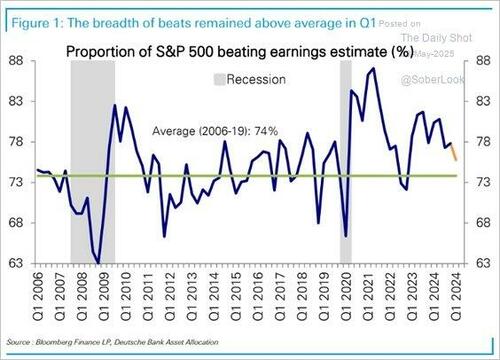

First, Q1 earnings delivered above-average results overall but were primarily driven by major technology companies and the AI-powered “Magnificent 7.” That cohort continues to provide the cornerstone for investor optimism. However, even though the largest capitalization-weighted companies delivered the bulk of earnings, the proportion of companies beating estimates remained well above the long-term average of 74%.

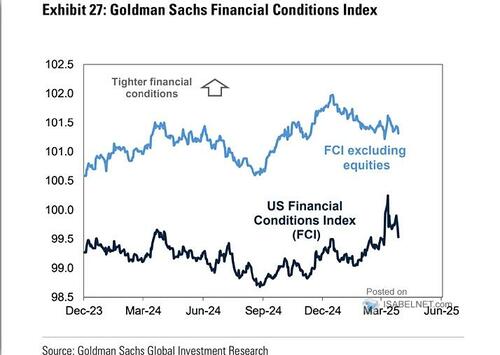

Secondly, financial conditions refer to current conditions across financial markets that can affect the dynamics of the economy. Those factors include improved interest rate levels, U.S. Treasury yields, credit risk spreads, equity valuations, and currency strength, which are supportive of the financial markets.

Furthermore, sentiment among both professional and retail investors has rebounded from its profoundly negative state, which is bringing buyers back into the market. Notably, that sentiment remains far from optimistic, providing further support for asset prices. The chart below shows the Z-score (standard deviation) of the net bullish sentiment of both retail and professional investors. Profoundly negative readings are often coincident with market lows.

Overall, investors maintain a favorable position toward the market because the current conditions provide sufficient space for constructive improvements without leading to excessive speculation. The recent market decline resulting from tariff concerns has proven more significant than expected. However, it is worth noting that spikes in policy uncertainty tend to mark the bottom of market corrections rather than the beginning. Given that policy uncertainty around tariffs and other political statements about trade barriers has reduced in intensity lately, this could become supportive for the market.

Are these factors a guarantee that the recent market correction is over? No. But historically, depressed sentiment, high levels of policy uncertainty, and easing financial conditions have often been the contrarian setup that investors should be looking for.

But let’s review the case for a bear market rally.

Why This Could Still Be A Bear Market Rally

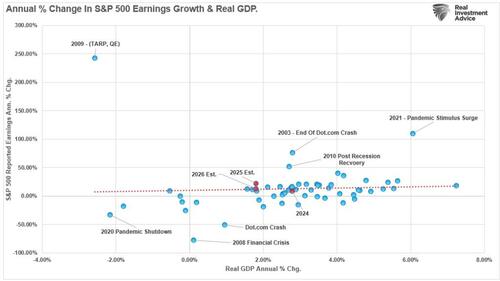

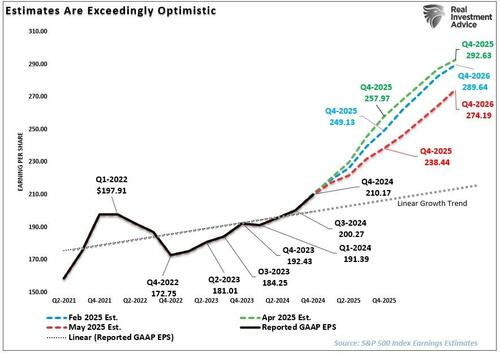

Multiple indicators indicate this could be a bear market rally. Since markets are forward-looking, investors focus on future earnings growth to justify paying higher valuation multiples today. The problem for the market currently is that economic data, particularly the key ingredient of employment, which drives consumption, is softening. As we discussed in this past weekend’s #BullBearReport such is critical given that employment and consumption drive earnings growth.

“Since 1947, earnings per share have grown at 7.7% annually, while the economy expanded by 6.40% annually. That close relationship in growth rates should be logical, particularly given the significant role that consumer spending has in the GDP equation.” – Market Forecasts Are Very Bullish

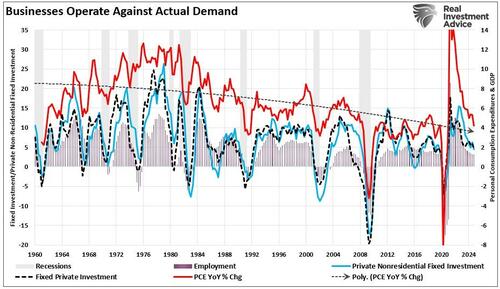

“Since, consumer spending comprises nearly 70% of the GDP calculation, everything else, from business investment to imports and exports, is a function of the consumer’s “demand.” In other words, if the consumer is slowing down or contracting spending, businesses will not ‘invest’ in expansion projects, increasing employment, or buying more products for resale. That relationship is shown in the chart below, which compares PCE to jobs and private investment.”

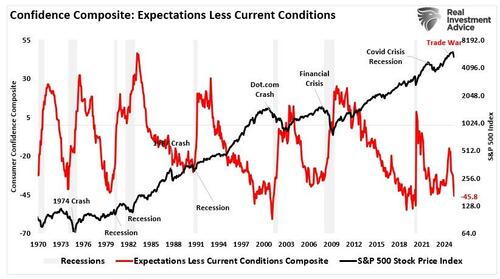

Economic data is softening as post-COVID monetary supports fade. As such, consumer confidence indicators show a downward trend, especially regarding expectations about the future. The chart below shows the difference between current and future expectations. Historically, very low readings are consistent with more protracted bear markets and deeper corrections.

Lastly, the market’s technical backdrop remains a near-term concern. While momentum and relative strength have improved, those factors are beginning to wane, suggesting buyers may be reaching near-term exhaustion. Secondly, volume has been weak during this corrective process. If this were just a short-term correction, we would have liked to see much stronger buying coming into the market. Finally, support is just below current market levels, which may limit near-term declines. However, there is formidable overhead resistance just above. The 100 and 200-DMA and the January lows will likely prove challenging for the markets to crack without a pullback to support first.

As noted, numerous investors failed to predict how quickly or dramatically the market decline would be. As such, these “trapped longs” will likely become sellers as soon as this rally falters. While our 2022 example of bear market rallies set new lows, this does not mean we will repeat that process. A pullback to support could hold if economic data stabilizes, trade deals progress, or the Federal Reserve cuts rates.

Conclusion

So, what does this mean for investors? With no clear indication of the market’s next move, investors will likely benefit from managing risk exposures. Moreover, investors must avoid making absolute decisions because both sides present compelling evidence. More often than not, markets resolve themselves in a more bullish fashion. Therefore, adopting a more bearish view has a risk associated with it. The current market rally does not necessarily negate the risk of this being a bear market rally. Nor does it signify the end of the correction.

The essential question is whether market risks are appropriately incorporated into prices and if upcoming returns justify additional market participation. For now, caution is prudent. The current macroeconomic environment shows gradual improvement without being strong. While Q1 earnings reports showed strength, the most notable risk to investors is the drastic cuts to forward earnings. Such certainly does not portray economic optimism.

Investors can do a few things to navigate the market’s next move.

-

Focus on maintaining portfolio equilibrium instead of following recent market gains.

-

Review your current exposure positions for alignment with current risk patterns.

-

Reassess position sizes, tighten stops, and avoid concentration in crowded trades.

-

Risk management can be achieved by combining cash reserves with portfolio hedging strategies.

The trick to navigating markets is not to try to “time” the market. That is impossible. Successful long-term management is understanding when “enough is enough” and being willing to take profits and protect your gains. That is our situation for many stocks after the robust rally from the recent lows.

With markets in a corrective process and trading below long-term moving averages, there is an opportunity to rebalance risk and reduce portfolio volatility.

Unfortunately, many investors will opt to “hope” for further gains, but will sell at lower levels if the correction continues.

Trade accordingly.

Loading…