The first half of 2025 was a highly kinetic period, to say the least, according to Goldman Sachs head of hedge fund coverage, Tony Pasquariello.

With a touch of distance from the screens this week, he went back and read a bunch of his recent notes, which served as a reminder of the immense narrative volatility along the path.

For example:

-

US exceptionalism was a bright and shining consensus position at the start of the year…

-

…that gave way to the worst short-cycle selloff in domestic equities since the depths of COVID…

-

…only to see S&P close out H1’25 on the dead highs (and we’ve kept going).

What follows from here is a set of views that Pasquariello took away from the past six months — with an eye towards the next six months…

MARKET DIRECTION:

– given all of the uncertainty and volatility, it’s hard to look back and NOT be a little impressed with how the US economy has performed.

– remember, in the toughest moments of April, many folks believed that a US recession was all but in the bag.

– in practice, the risk management challenge was two-fold: calibrating huge changes to US political orthodoxy — at the exact time as new and disruptive technologies were colliding.

– if you flash forward to today — with NDX nearly 40% off the lows — Mr. Market has added another data point to this analog: periods of exceptionally high policy uncertainty usually give way to strong equity returns.

– the April shakeout also calls to mind this well-worn rule of thumb: within a structural bull market, if you want to be short US equities, your timing needs to be impeccable.

– now, in trying to work out how the market recovered the highs, perhaps it’s simply because governments, corporates and households stayed on the gas.

– don’t take my word for it, simply look at the trajectory of US fiscal spending … or the capex plans of the Magnificent Seven … or US retail demand for stocks.

– looking forward, the bull case is this: the US economy is durable, financial conditions are easy and we’re witnessing a remarkable acceleration of applied innovation.

– set against that, growth is apt to slow during the second half, risk/reward at this multiple isn’t alluring and global bond markets skate on thin ice (witness the UK again this week).

– in the end, it’s still a bull market, yet one that’s delivering less convexity and less consistency than before — I wrote that earlier in the year, and I’m sticking with it.

– core positions that I believe in (and would marry as a composite): US technology / US power … steeper global yield curves … a (somewhat) weaker dollar … and don’t fight the primary trend in gold.

A SHORT SET OF THOUGHTS ON US TECH:

– I’ve long believed that this space offers elements of sword AND shield — while there were some moments when both the sword and the shield had gone missing, NDX finished H1’25 up a very respectable 8%.

– if Q1 was marked by the swing from Stargate euphoria to DeepSeek disruption, Q2 was marked by remarkable earnings news and an unrelenting commitment to capex.

– taken together, both champions and challengers were on the offensive, such that demand for compute was some form of insatiable … I don’t see that changing anytime soon.

– in addition, while the sensation around AI is shifting in the press (namely the risk of impingement on jobs), the capex stories were a clear support for the market (which could only amplify the societal challenges).

– valuation: as Pete Callahan notes, NDX currently trades on a 28x P/E, roughly in line with its 5-year average; while not a tailwind, I don’t regard that as a headwind, either.

– what has clearly changed: in both 2023 and 2024, every stock in the Magnificent Seven rallied; at the halfway point this year, you had three up / three down / one flat.

Conclusion: stay in the pocket, particularly into the seasonal sweet spot that is July.

US VS ROW:

– lest it be said, after a very long (and very powerful) run, the US was NOT the best game in town.

– with a hefty slice of humble pie, I have to give credit to European equites — it was hard to make up a bullish story at the end of last year, but the fact set changed, and specific pockets totally shined (witness the DAX, the banks, the defense names).

– so, whether it was the game change in European defense spending — or the lightning strike that was DeepSeek — there were a few fundamental inflections that played to the strengths of non-dollar markets.

– now the question is whether structural allocators of capital will sell their holdings of US equities and put the chips elsewhere — again, I doubt it, and think the dollar bears the brunt of things for now.

– in the context of that question, Brett Nelson highlighted a recent WSJ article that reminds us of a clear truth: over the past 50 years, Europe has created (from scratch) 14 companies with a market capitalization of more than $10bn; the US has created 241.

– I also found this week’s headline that AstraZeneca is considering a move of their listing from the UK to the US to be notable (when the headline hit, it was the single largest weight in the FTSE).

– in effect, this was the real story of the first half: it was a bull market for GLOBAL equity indices — simply pull up a chart of MXWO — where the US didn’t do all of the heavy lifting.

THE OTHER BIG DYNAMICS IN THE GAME:

– The Fed: our call is now for sequential cuts in September / October / December … then two more moves in March and June of next year … taking the terminal rate down to 3-1/8%.

– on geopolitics, I’d argue that recent months underscore two long standing observations: (1) no one really knows anything; (2) markets have no moral conscience and tend to move on from things.

– the dollar: this was the joker in the pack, from consensus long to start the year to consensus short by the end of Q2; given the Fed is set to out-ease everyone, and given more pressure on USD hedge ratios, again I suspect the path of least resistance is to the downside.

– if there’s a bolt-on to the prior line, it’s that I find it really hard to pick other currencies that I actually want to own — which, of course, leads one back to gold.

– the deficit / debt sustainability: the first half was proof of how this variable comes in and out of market focus on a random cadence, leaving both bulls and bears with more questions than answers; I suspect it will be with us for a long while, and argues for steeper curves / more term premium.

– flows, positioning: it never ceases to amaze me how market technicals can hold so much sway at market inflection points; I can only assume that technical discipline will continue to matter in the second half (the current bias is favorable, thanks to retail and systematic strategies).

– a follow-on from the prior line: I’d keep a close eye on gross exposures — which have been running very high, and saw a significant pressure test this week (e.g. the violent breakdown in the momentum factor).

– breadth: yes, this has been a narrow rally, but such is life in a top heavy index; said another way, I don’t buy the old wisdom that poor breadth means S&P is an unhealthy asset.

– valuation: S&P trades on an objectively elevated multiple, yet that fact alone hasn’t stood in the way of progress, and I suspect the onus is now on earnings to carry the load.

– bitcoin: brick-by-brick, I think it continues to achieve a modicum of respect as a long-term store-of-value (as much of the altcoin universe struggles).

– stablecoins: this theme came on like a wildfire, and I suspect it isn’t going to magically disappear anytime soon;.

– hedge funds: you know my bias, but the fact is both discretionary and systematic managers are performing well.

– the celebration of July 4th, I agree with this wisdom from the great Warren Buffett: “we’re always in the process of change, and we’ll always find all kinds of things to criticize in the country … but the luckiest day in my life is the day I was born, because I was born in the United States.”

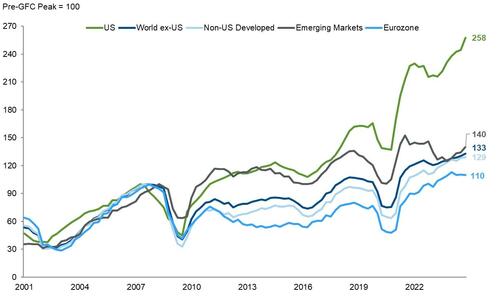

Finally, a chart for the road…

…one that invites as big a question as any right now.

With thanks to Brett Nelson, this plots earnings growth of the US vs various cuts of ROW (12-month trailing EPS, expressed in local FX).

To my eye, it clearly demonstrates why US equities have outperformed so much in the post-GFC era (particularly post-COVID).

Now the debate turns on whether that immense gap is set to converge, or not:

More here from Goldman Sachs Sales & Trading team available to pro subs.

Loading…