Goldman’s top sector specialist, Scott Feiler, offers four thoughts on the consumer ahead of what he calls a “very important week” for the space.

Feiler said that consumer stocks finally showed signs of life last week, helped by a few solid earnings beats, but the improvement was mostly based on market rotation as AI names dumped for three consecutive days.

He said the next round of consumer earnings, from now till Thanksgiving, should look better than the first leg of the earnings season.

Positioning in discretionary sits at 7-year lows, he noted, adding that many traders are reluctant to pre-trade a 2026 “consumer rebound” given that the group still trades in the shadow of daily AI moves and a labor market that feels soft.

Here’s what Feiler is telling clients about consumer stocks before the week kicks off:

1. Consumer Refresh – The consumer group finally acted a little better last week. Why? It helped that the limited consumer EPS reports we got were good and were finally rewarded, as opposed to faded (ONON, REAL, DDS). We should get a run of good results this week and next from a bunch of the bellwethers. It won’t be unanimous, but earnings between now and Thanksgiving should feel much better than the 1st part of the consumer earnings season.

While the better EPS results helped last week, the improved price action really just felt primarily the result of market factors. The sector outperformed the market 3 days in a row (Tuesday to Thursday). Those 3 days just so happened to be the 3 days of the substantial AI underperformance.

2. What Next for Consumer? Hope, but Without Conviction:

It does feel like we can see some better price action in consumer until year-end. It does not feel like it can happen in a straight line though. We highlighted gross exposure last week in discretionary is at 7 year lows (GS PB) and there is still optimism about the tax refund/stimulus trade in 1H26.

3. Bellwether Week Ahead – Better Results Finally?:

Glass Half Full Week?: Some of the biggest consumer companies in the world report this week. It will not be perfect but would expect this week of earnings to be better than the last few in Consumer.

WMT – No Change?: Given some of the recent concerns on the US consumer, there are few more important things this week than WMT. A beat and raise is expected. It is worth noting that our analyst, Kate McShane, spoke with the management 3x during September and October. Their message was always that they had seen no change to the US Consumer, despite industry concerns. COST did release October results a couple weeks after our last conversation with WMT and COST noted some slowdown at the end of October. Bottom-line, expectations are for WMT’s actual results to be quite good still, but there will be a focus as to whether they saw the late October and early November slowing that others alluded to.

Others That Should Beat: There will be plenty of other really important ones also. Beats are expected are TJX, WSM, ROST & GAP. Then next week, beats are expected from BBY, BURL, DKS, URBN & others.

Home Improvement – Price Action is a Must Watch: Sentiment has cooled here very recently. Small top-line downside is expected from both HD and LOW and consensus numbers in 2026 have been moving lower. Despite some expected squishiness here, there does still seem to be investors optimism that pockets of housing are ownable into 2026 (HD especially). That is why price action will be just as telling as actual results, given few names in consumer have traded well on squishy results so far. Our view is the price action out of HD and LOW feels like it will be more important than the actual results, absent a shock out of numbers (other than tiny top-line downside).

4. De-grossing Activity Slowed & Consumer Was Slightly Better to Buy: In last weekend’s note, we highlighted how gross exposure to consumer discretionary on our PB book hit 7 year lows. This past week, the PB noted single stocks saw their largest gross trading activity in over 4 years, and Consumer Discretionary and Staples both participated in that, and were both better to buy. That’s a change vs the recent trend.

The total PB book saw long buys outpacing short sales (3.4 to 1). Consumer was not alone in higher trading activity, as all sectors saw increased gross trading flow, led in $ terms by Info Tech (short sales > long buys), Industrials (long buys > short sales), Health Care (long buys > short sales). Consumer Disc (long buys > short sales), and Staples (long buys > short sales) were close behind though.

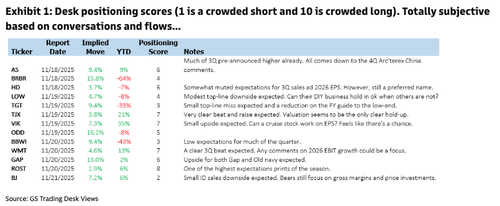

Investor positioning within the consumer stocks that Feiler’s desk tracks.

Related:

With low-income consumers certaintly pressured, the Trump administration has launched:

All eyes are on low-tier consumers. Their sentiments matter.

Loading recommendations…