After impressive results from AMZN, all eyes were on Apple to see what the iphone maker would report after the close, and if it would help rinse the bad taste from today’s poor market action, or of it would piggyback on the solid results from Amazon. And for a second it was a big touch and go, with the stock first sliding after hours, however after human traders had some time to reverse the kneejerk algo reaction lower, AAPL stock is now also higher after hours.

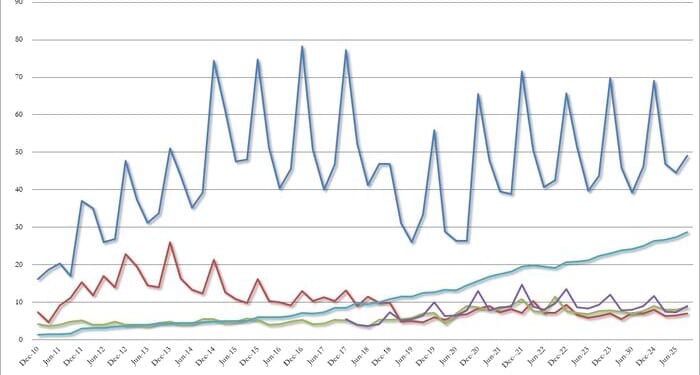

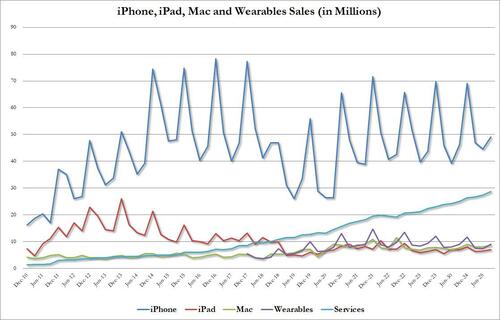

Here is what Apple reported: of note, the company EPS and revenue both beat, despite notable misses for iPhone revenues as well as a drop (and miss) in China revenues

- EPS $1.85 vs. 97c y/y, beating estimate $1.77

- Revenue $102.47 billion, +7.9% y/y, beating estimates of $102.19 billion

- Products revenue $73.72 billion, +5.4% y/y, beating estimate $73.49 billion

- IPhone revenue $49.03 billion, +6.1% y/y, missing estimate of $49.33 billion

- Mac revenue $8.73 billion, +13% y/y, beating estimate $8.55 billion

- IPad revenue $6.95 billion vs. $6.95 billion y/y, missing estimate $6.97 billion

- Wearables, home and accessories $9.01 billion, -0.3% y/y, beating estimate $8.64 billion

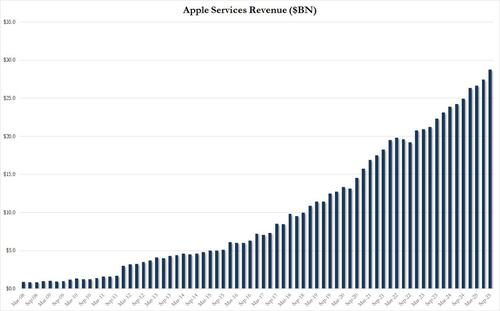

- Services revenue $28.75 billion, +15% y/y, beating estimate $28.18 billion

- Products revenue $73.72 billion, +5.4% y/y, beating estimate $73.49 billion

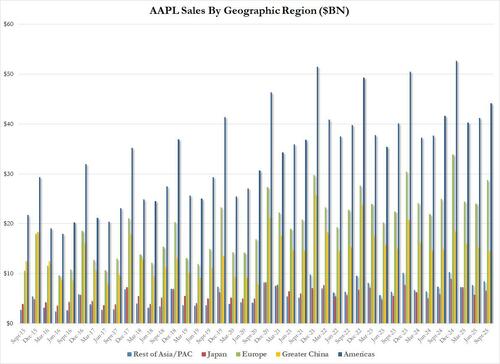

The big highlight of the quarter is that this was the first ever quarter when Apple’s revenue surpassed $100 billion, with results generally strong. The one – very big – fly in the ointment was the usual suspect: China, where revenues unexpectedly dropped to $14.49 billion , down 3.6% YoY, and badly missing estimates of $16.43BN by a whopping 12%.

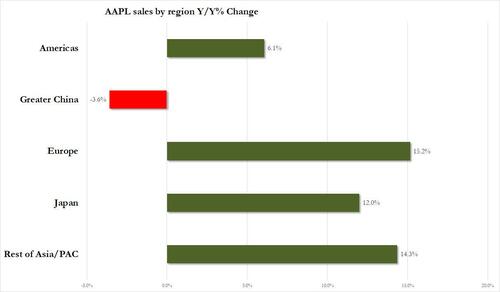

But it wasn’t just China; Americas revenue grew 6.1% YoY, but not enough to beat estimates of $44.45 billion. Other regions performed better:

- Europe revenue $28.70 billion, +15% y/y, estimate $26.36 billion

- Japan revenue $6.64 billion, +12% y/y, estimate $6.41 billion

- Rest of Asia Pacific revenue $8.44 billion, +14% y/y, estimate $8.08 billion

Going down the line:

- Gross margin $48.34 billion, +10% y/y, beating estimates $47.41 billion

- Total operating expenses $15.91 billion, +11% y/y, higher than estimate $15.75 billion

- Cost of sales $54.13 billion, +6% y/y, below estimate $54.47 billion

- Research and development operating expenses $8.87 billion, +14% y/y, higher then estimate $8.8 billion

- SG&A operating expense $7.05 billion, +8% y/y, higher than estimate $6.96 billion

- Cash and cash equivalents $35.93 billion, +20% y/y, estimate $51.67 billion

And so on:

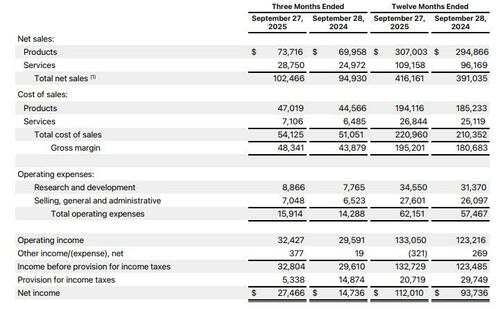

Looking at a breakdown of sales by product category, here the numbers were mixed, with iPhone and iPad missing, while Mac, Wearables and Service revenues beat. The iPhone number especially was a little light, especially for those who put faith in the soft/third party data from the likes of Counterpoint Research.

- IPhone revenue $49.03 billion, +6.1% y/y, missing estimate of $49.33 billion

- IPad revenue $6.95 billion vs. $6.95 billion y/y, missing estimate $6.97 billion

- Mac revenue $8.73 billion, +13% y/y, beating estimate $8.55 billion

- Wearables, home and accessories $9.01 billion, -0.3% y/y, beating estimate $8.64 billion

Here is the full revenue breakdown by product:

Soft iPhone sales aside, it was the surprising drop – and miss – in China sales that prompted the early selling in the stocks: contrary to expectations for a modest rebound, China sales declined down 3.6%, the 7th drop in the past 9 quarters, down a 11.1%, and printing at only $14.493BN, below the $16.43BN estimate. The rest of the world saw growth, with Americas rising 6.1, and double digits growth in both Europe and APAC

Offsetting the China weakness, however, was another solid quarter out of the Services division, which again came in stronger than expected, rising to a new record $28.750 billion, 15% YoY and above the $28.18 billion expected.

Commenting on the quarter, Apple CFO Kevan Parekh said that “our September quarter results capped off a record fiscal year, with revenue reaching $416 billion, as well as double-digit EPS growth.” He added that “thanks to our very high levels of customer satisfaction and loyalty, our installed base of active devices also reached a new all-time high across all product categories and geographic segments.”

And here is Tim Cook: “Today, Apple is very proud to report a September quarter revenue record of $102.5 billion, including a September quarter revenue record for iPhone and an all-time revenue record for Services. In September, we were thrilled to launch our best iPhone lineup ever, including iPhone 17, iPhone 17 Pro and Pro Max, and iPhone Air. In addition, we launched the fantastic AirPods Pro 3 and the all-new Apple Watch lineup. When combined with the recently announced MacBook Pro and iPad Pro with the powerhouse M5 chip, we are excited to be sharing our most extraordinary lineup of products as we head into the holiday season.”

Elsewhere, Apple’s board announced a small dividend update which rose to $0.26 per share of the Company’s common stock. The dividend is payable on November 13, 2025, to shareholders of record as of the close of business on November 10, 2025.

More notably, the company said that it saw $1.1 billion in tariff related costs in Q4, which may explain why the market reversed the after hours selloff, giving AAPL credit for the rather mediocre earnings, which it would blame on Trump.

Seeking to reverse the early selloff, Apple leaked a little guidance, saying it sees a rev. increase of 10% to 12% in the holiday quarter, Cook saying he expects Q1 2026 revenue to be the best ever for the company and iPhone. And if that’s not the case, the company can just blame tariffs.

To be sure, according to Bloomberg Intelligence, the comments from Apple’s CFO about a 10-12% increase in iPhone sales in fiscal 1Q26 vs. consensus of 6% growth, as reported by the Wall Street Journal, overshadows dismal 4Q Greater China sales:

“Remarks about a supply shortage could soothe concerns around market-share loss to local brands in the region. Services-segment growth of 15%, or 230 bps above consensus, was a positive, suggesting App Store fee changes might not be affecting consumer behavior as much as feared.”

And just to make sure the early selloff does not drag the stock lower, Tim Cook was quick to throw out all the key buzzwords, saying Apple is “expanding its investments in AI”, reiterating comments he’s made the last several quarters. Cook also said Apple was making more progress on the new Siri and reiterates it’s coming next year.

For now, the plan is working and AAPL stock managed to sharply reverse its early drop, surging about 3% after hours.

Loading recommendations…