Authored by Peter Tchir via Academy Securities,

AI largely drove the show last week on the risk front. We started poorly, as Blue Owl pulling out of a future Oracle deal triggered some fears. But we finished the week strong as Micron had a solid beat, alleviating many concerns (a nice, soft CPI print helped matters too).

This flip-flopping back and forth on the AI story fits well with last week’s themes – AI Debt Diet vs AI Spend Diet.

Bitcoin seemed to be a decent leading indicator for stocks, but the past few days watching Bitcoin’s intraday moves was about as painful as watching Elaine dance on Seinfeld.

Equity markets are hovering near important levels. I know we’ve been talking a lot more than usual about technical levels, but they often seem to play a more important role during slow, less liquid periods than normal. The Nasdaq 100 bounced, just above the 100-day moving average (like it did in November when the Fed turned dovish). It closed just above the 50-DMA on Friday, which if it holds, should let the Santa rally loose. If it fails, we could be testing the 100-DMA for the 3rd time, and that tends to not work well.

With a holiday shortened week, let’s have some fun with AI.

What If CEOs Were Being Replaced by AI?

With markets being powered by AI, it is one of the main topics of conversation. Literally, every conversation.

In general, I’m on board with the importance of AI. I use it. It is improving rapidly. Having said that, using it “hampers” learning (not searching, reading, and digesting info on my own) and creates “work” around looking for hallucinations. I’d rather do some of the original, interesting work, including going down the wrong path, than searching for ticker symbols that don’t exist, etc. I do worry about the spend versus the results, at today’s costs and usefulness.

What I’ve been wondering lately is how much demand there would be for AI if CEOs thought they were going to be replaced by AI?

First, let’s make it abundantly clear, the CEOs can be guilty of “herd mentality.” Remember when every company had to have a China strategy? When any announcement of investment in China by U.S. companies triggered stock price gains! See Free Money. The rationale was there:

-

The potential to sell into a market of 1 billion people, whose incomes and net worths were growing.

-

Even cheaper supply chains.

Yeah, yeah, there were people who questioned whether a 51% stake for China made sense. Questioned whether China would ever truly open their markets and whether Chinese consumers would ever spend much on “American” goods? Heck, some even questioned the ability to protect IP.

- At the time, naysayers were drowned out and CEOs were rewarded for their skills in driving business to China. It didn’t always work out quite as planned.

I’m not arguing that the investment in AI is anything like the “need” to have a China plan, but I’m not sure that it is completely irrelevant.

But anyways, why not replace CEOs with AI?

At the moment the trend is to try to reduce jobs and hiring at lower levels in the organization.

Virtually everyone in “our industry” is talking about the ability to have fewer analysts, or do more with existing analysts (code for hiring fewer people). While I’m more familiar with what is going on in our industry, I think it is safe to say that most of the AI spend is centered around reducing labor costs at the lower end of the corporate ladder.

But why?

-

At today’s cost, is it really cheaper to spend on AI than to have a few more junior people?

-

Sure, if you can spend $100k and replace 3 junior people, it’s a huge win. But are those the numbers we are currently seeing? If it is $1 million to save 3 jobs, maybe it isn’t the correct trade off?

-

-

Why not empower junior employees? The cynical side of me (which is by far the bigger side) sometimes thinks the management consultant industry exists because CEOs prefer to pay a lot of money to be told by recent grads at the consulting firms what their own recent grads could tell them as part of their daily duties.

-

I will admit that perspective on the consulting industry is a bit over the top, but all too often it seems that it is difficult for people doing a job every single day, to get their own voice heard on what would make their job more effective. Maybe it is easier for AI to cancel the 10am Monday meeting, than to listen to some junior person argue that it is pointless? Maybe management is scared to empower the people who might know best what would make their jobs easier? Certainly, before embarking on AI spend, it would make some sense to see what can be done internally? I highly expect the conclusions wouldn’t be that dissimilar, but you’d have people who will grow with the organization, and the organization will be better for it in the long run.

-

The U.S. military, and my colleagues at Academy who have served (and in some cases are still serving in the reserves) relies heavily on NCOs. The Non-Commissioned Officer class (typically sergeants) is one of the unique features of the U.S. military relative to other militaries. Not that other militaries don’t have that rank, they just don’t empower them. General after General, Admiral after Admiral, all tell me that empowering the NCOs is one of the big advantages the U.S. military has. They carry on the culture. They mold those who serve with them (including sometimes, junior officers at the start of their career). They can take action in the field, of their own volition, in pursuit of goals and targets. Those actions often are the difference between winning and losing, which in the military, really is a matter of life or death.

-

Maybe I’m rambling, but I suspect we could all listen to juniors more, even as part of any AI implementation, and be pleasantly surprised how many good ideas for efficiency and growth are there, just waiting to be tapped?

-

-

The CEO’s job is extremely difficult.

-

No other job requires so much input. In my role at Academy, I have relatively few inputs to take into account while delivering what I deliver. As you move up the management chain, you have to deal with more and more inputs. Almost a mind boggling amount of information for a CEO of a large company. And the consequences of their decisions matter! If you hate this T-Report, you may not open the next one. That is probably the biggest downside from my decision today. Decisions to open or close business lines have far bigger impacts, ones that cannot be changed quickly.

-

So why isn’t AI groomed to be CEO?

-

The job is more difficult and requires more information to be processed, so isn’t AI better suited for that? Aren’t the “real” benefits of AI more relevant to the CEO than to the average employee? If you “fix” junior jobs, you are talking about dollars and cents. If you fix the CEO jobs you are talking about millions, and maybe billions?

-

I did use AI to find that in 2024 the average CEO to worker pay ratio for S&P 500 companies was 285:1. The same AI, also told me that CEOs on average made $21.45 million while employees earn on average about $51,394 – which is 400 times.

-

Yes, there is only 1 CEO and leadership is also a crucial role the CEO plays. Not just the decision making part, but also getting the team focused and working together. AI cannot replace leadership, and it really can’t replace leadership at junior levels, where that leadership is also critical.

-

-

Just like China strategies evolved, I expect that we could see AI strategies evolve, hopefully in a way that we maximize the Human Intelligence (HI?) while trying to be cost effective in our AI deployment.

I do think this section, as offbeat as it might seem, is something people are thinking about and may slow the AI spend, as costs continue to rise.

It will also drive the AI (and data centers) to new solutions and products to feed the evolution of the industry and the use cases.

Back to Yields

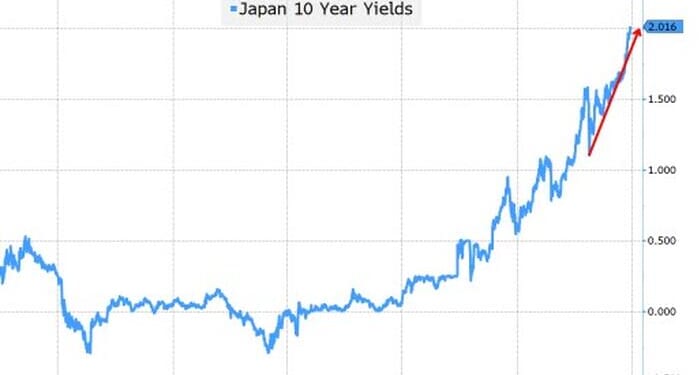

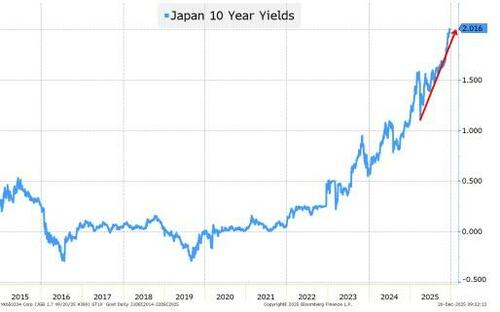

If the “scary” chart of the past couple of weeks has been Oracle CDS, it was Japanese bond yields by the end of this week. For the record, Oracle CDS finished a couple bps tighter on the week – making the end of my interview last Friday seem better than it did early in the week when it was still widening.

The Japanese 10-year bond yield broke 2% for this week. It spent most of the past decade below 0.5%.

So far this rise in Japanese bond yields has been accompanied by a weakening yen. Not exactly what the “textbook” would predict, but markets often follow narratives of their own (in theory as the yield differential decreases, the currency should appreciate, or so I read).

The yen carry trade is either some huge overriding trade that drives global markets, or it is a niche trade, where many overstate the importance of it. I’m in the latter camp, but since it is gaining a lot of attention lately, it is worth revisiting.

In theory many funds borrow in yen to fund positions in other assets. The interest rate on borrowing in yen was so low that you could “outperform” your borrowing costs (even taking FX risk). The corollary or flipside of this, is that many Japanese bond investors would buy U.S. Treasuries and attempt some currency hedges to outperform direct investments in Japanese government bonds.

That trade is less appealing on the interest rate differential. The difference between Japanese and U.S. central bank rates was 5.4% as recently as February 2024. It is down to 3.1%. Still a large differential, but it could impact the so-called “carry” trade.

A return to a strengthening of the yen would put far more pressure on the trade as many don’t hedge the FX risk. Again, this is a bit of a murky trade where some argue it is a huge driver of risk premium across the globe, while I suspect its importance is overstated. But not so overstated that we can completely ignore it.

This may go a long way to explaining why U.S. 10-year yields are still stuck between 4.1% and 4.2%.

The EU Had “One Job”

Periodically, I search the “you had one job” meme on social media. It never fails to deliver a smile.

Today, I’m not smiling.

Our assessment of what the EU can do to support Ukraine, maybe even as part of their commitment to NATO, was to seize Russia’s frozen assets and use them to purchase military equipment.

The EU does not have the military equipment or personnel to contribute, so aside from fully enforcing sanctions (which they have also been loathe to do), they could fund more equipment purchases for Ukraine.

Seizing Russia’s frozen reserves seemed to be the “easiest” way for Europe to do this:

-

It would not only fund the war effort, but it would also hurt Putin.

-

It would avoid Europe dithering for weeks or months, on issuing debt to fund some sort of purchases. Not exactly the sort of business arrangement the President likes (and I cannot blame him – we’ve argued that many of Trump’s comments seem to have laid down the gauntlet around Europe and Russia’s reserves). In any case, this time, despite the sound of it, I’m not being cynical. Sometimes what sounds like cynicism is just reality.

Without this seizure, we are seeing European bond yields rise. The “mitigating” factor is that it is probably safe to bet that Europe won’t really act. That there won’t be a deluge of European debt offerings to fund weapons purchases for Ukraine because weapons purchases won’t happen at scale.

What a “Peaceful” Ukraine/Russia Will Look Like

The consensus of the GIG is that we aren’t headed towards peace any time soon, but that Putin has the capability to outlast Ukraine, and Ukraine will ultimately come to the table.

Without the seizure of Russia’s reserves, I think Ukraine has to come to the table faster than they would otherwise.

They may not like what the U.S. is proposing, but it is “reasonably” concrete. If you were Ukraine, you could try and keep some of the U.S. proposals at bay, while waiting for Europe to come through. Whatever machinations Europe goes through, if I’m Ukraine, I’m more skeptical about any sort of game changing help from Europe. When headlines read Belgium and Putin win, you have to be nervous (the Weakest Link was almost more popular in the U.K. than in the U.S., maybe because it is the politics of the EU – the UK was part of the EU when that show was at peak popularity). Unanimous decisions within the EU are hard to reach, so appeasing every country makes it difficult to do much. And that is ignoring the hard truth that many European nations have their own economic concerns to deal with.

So, time to think a little bit more about what “peace” might look like:

-

Stronger security guarantees by the U.S. for Ukraine.

-

These will be given because Ukraine will give the U.S. (and its corporations) extremely favorable deals for years. The admin will not provide security guarantees so much to protect Ukraine, but to protect the business interests that will be generated.

-

-

The business deals with Russia will be even better for U.S. corporations.

-

Whatever Ukraine may have to give up, as they realize they cannot get enough support from Europe to continue, will be big for the U.S. Russia will give up even more since Europe clearly had no interest in giving them anything and they are being pushed to the brink by the U.S. It will be interesting to see what China and maybe even India have to say about any favorable treatment given to the U.S. and U.S. businesses.

-

-

Look for Poland and even Romania to thrive.

-

Whatever the prognosis is for lasting peace, many companies will want to stage their operations outside of Russia, and even outside of Ukraine. When deciding where to launch your expansion into Russia and/or Ukraine, both Poland and increasingly, Romania make sense. Poland has proven itself to be resilient and extremely competent during the war. Romania, in my understanding, and I’m learning more, has also played a key role and has some advantages in terms of its borders.

-

Much of what the admin is looking for in the region fits our ProSec™ narrative, and I think we are one step further towards seeing the admin achieve those goals.

Bottom Line

Despite signs that inflation is abating, bond yields will be a bit stubborn, because of what is happening across the globe, rather than due to our domestic policy/data. I want to buy the long end, and own flatteners, but it is still a touch early.

Credit was a little weaker than stocks this week. Fear of the calendar seems to be keeping spreads from tightening even when other risk assets do well. That will likely persist, but I think the start of the new issue season will be a sign to load up on credit. A lot of “room” has been made to absorb the supply, and if we are correct on the AI Debt Diet thesis, some fears, currently priced into the market, will dissipate.

Something looks seriously “off” in the crypto market (I cannot unsee Elaine dancing). Even with the support this admin and the regulators have for the business, it seems prudent to remain cautious. It continues to be erratic and stuck at levels that seem to make little sense given the ongoing drumbeat of positive news.

If stocks can open decently on Monday, look for strength into year-end, and then some more choppiness. If stocks cannot hold onto the gains from Friday, we will all have a far more anxious holiday season than we were hoping for, as support and “blindly” buying the dip don’t seem to be there.

The AI Debt Diet and AI Spend Diet will be key factors for the markets early next year.

Any peace with Russia and Ukraine is likely to lower commodity prices (as access is granted), but look for U.S. companies to dominate any rebuilding and look for the admin to focus on refining and processing even more than extraction.

And no, CEOs should not be replaced by AI, but we should all be figuring out the right balance and what the real cost/benefits are. I think that could drive down spend a little bit, and actually drive up productivity.

Hopefully, markets cooperate and let us enjoy the holiday season as we ramp up for what should be a busy 2026!

Loading recommendations…