Economists, long snarked as practitioners of the dismal science, unsurprisingly tend to scoff at Silicon Valley predictions of artificial intelligence generating warp-speed economic growth—10 percent a year! 20 percent! 30 percent!—especially when such fantastic forecasts hinge on advances that have yet to happen. But the chances of human-level AI (or beyond) are high enough, at least in the view of The Economist, that the magazine devotes its new cover story to grappling with economic scenarios that sound science fictional.

No doubt, the bull case is a brain bender for traditional forecasters used to economic growth rates of 2–3 percent in advanced economies. If artificial general intelligence (AGI) can automate not just tasks but the generation of ideas themselves, productivity could rise not incrementally but explosively. A model from Epoch AI, a private think tank focused on forecasting AI’s economic and technological impacts, suggests GDP could compound at rates far beyond anything seen since the Industrial Revolution.

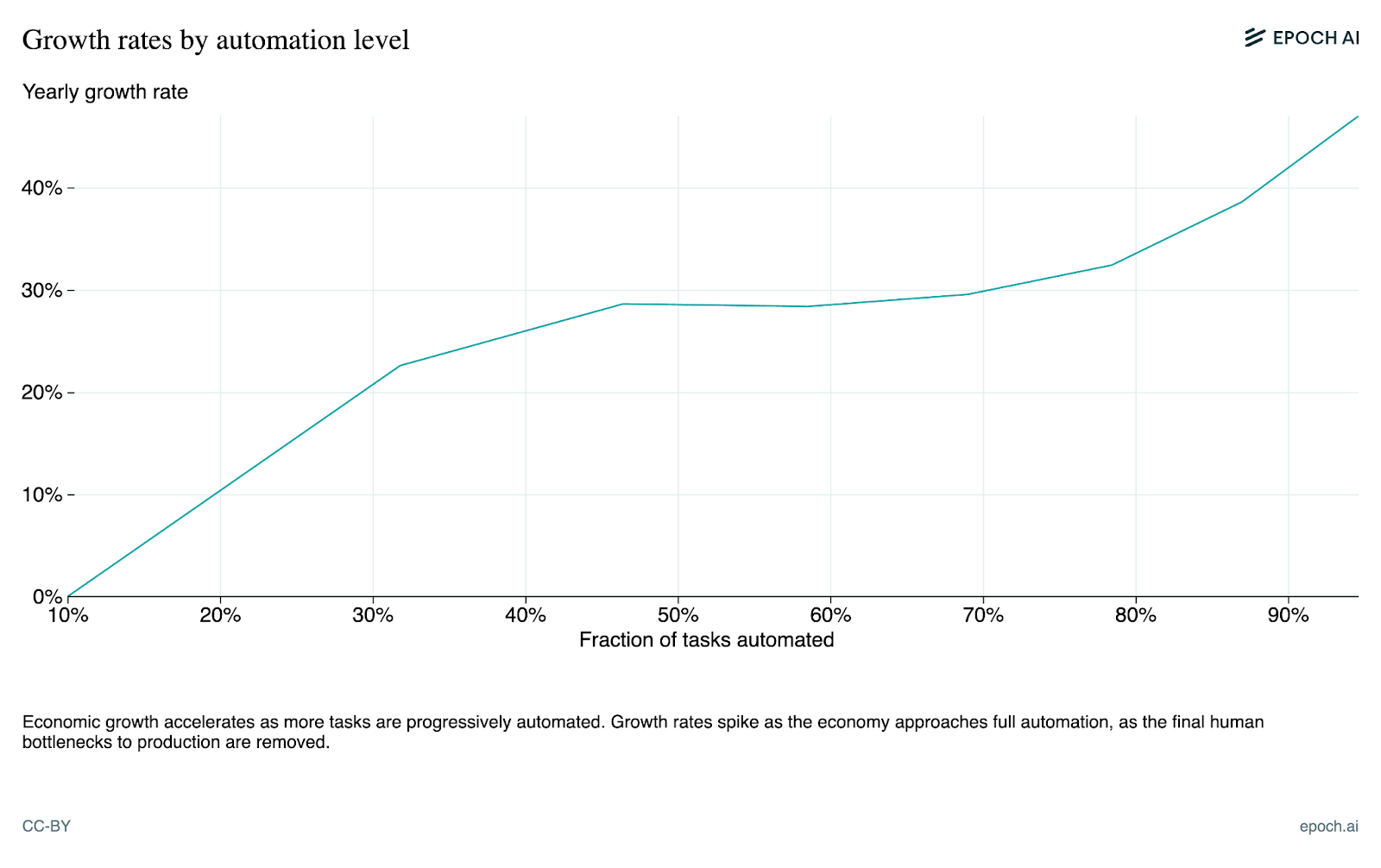

And once AI automates roughly a third of all tasks, Epoch’s projections see annual growth exceeding 20 percent, with early automation gains rapidly reinvested into more powerful hardware and software. This creates a feedback loop of self‑reinforcing innovation, where capital accumulation and idea generation feed off one another, potentially unleashing exponential or “runaway” growth.

Yet The Economist is careful to inject a dose of skepticism. Even if AGI arrives, its effects may be constrained by stubborn real-world bottlenecks, including energy capacity, regulation, institutional sluggishness, and plain human inertia. As economist Tyler Cowen notes in the piece, the stronger AI gets, the more those weak links matter.

Also: The mathematics of hypergrowth are sobering, as I note in my 2023 book The Conservative Futurist: How to Create the Sci-Fi World We Were Promised. A 30 percent growth rate would make society a thousand times richer within 25 years—requiring technological advances 10 times greater than all previous human innovation combined. This breakneck pace would unleash unprecedented “creative destruction,” rendering skills and technologies obsolete at politically unsustainable speeds. Displaced workers and businesses would demand protection on a scale that would overwhelm governments already struggling with ordinary economic churn.

Moreover, extreme prosperity might paradoxically dampen growth itself. As incomes soar, rational actors would likely reduce working hours, retire early, or live off surging investment returns—echoing Keynes’s prediction of 15-hour work weeks. The irony is stark: The very success of hyper-growth could undermine the labor supply needed to sustain it, creating a self-limiting cycle that constrains the economic miracle it promises to deliver.

Markets, for now, aren’t buying the hype. The Economist highlights research from MIT economists Isaiah Andrews and Maryam Farboodi showing that bond yields have often declined following major AI announcements—hardly a vote of confidence in imminent hypergrowth. If investors truly believed AGI would trigger explosive economic growth, they would anticipate a surge in demand for capital to fund massive investment in infrastructure, energy, and computing—pushing real interest rates up, not down.

Nor do you find growing optimism in online prediction markets that we are on the cusp of AGI:

Still, The Economist closes with a reminder that technological change often outpaces consensus. If the economic impact of AGI is being underestimated the way its technical progress has been, the world may be in for a surprise that no model, dismal or otherwise, is fully pricing in.

The post AI Dreams Meets the Real World appeared first on American Enterprise Institute – AEI.