Earlier this week we reported that “Japan Bond Yields Soar To Record, Slamming Door On Stimulus Just As Economy Implodes Amid Escalating China Clash” and while the long end of Japan’s bond curve gaped even higher in the past 48 hours, sending 20Y and 40Y yields to record highs…

… Japan’s pro-stimulus Prime Minister Sanae Takaichi (better known as Abe 2.0) is set to unveil the country’s largest stimulus plan since the pandemic era any second, in a move that adds to her reputation for expansive fiscal policy while putting bond vigilantes on notice, and could start the endgame for Japan’s capital markets and economy.

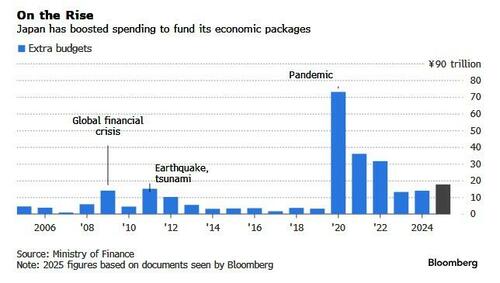

Takaichi’s stimulus package set to be unveiled on Friday, will include ¥17.7 trillion ($112 billion) of spending through what will essentially be the extra budget. That marks a jump from the ¥13.9 trillion former Prime Minister Shigeru Ishiba unveiled last year. And given the larger size, additional bond issuance will also be bigger than last year, putting more pressure on the country’s finances.

In fact, Japan is just the first of many countries set to unveil massive fiscal and monetary stimulus as global economic growth slows down dramatically, and as panicking politicians scramble to hand out stimulus checks to their angry voters, long-term consequences and inflation be damned (which is why the current meltdown in bitcoin is especially funny).

The total value of the package including some items that are already budgeted will be worth ¥21.3 trillion, Bloomberg reported citing leaked documents. By comparison, a proportionate stimulus plan in the US would be just over $1 trillion (and it’s just a matter of time before it arrives).

Together with private sector spending, the impact of the package overall is expected to balloon to around ¥42.8 trillion, as the government seeks to tackle a host of challenges that includes “combating the impact of inflation”, spending on strategic areas, and strengthening foreign policy and defense.

That’s right, the Japanese government is now in now beyond the Minsky Moment, where it has to issue massive stimulus just to offset the inflation effect of the previous massive stimulus, each one bigger than the previous, until everything finally collapses.

At the weekend there were local media reports suggesting that the extra budget will be around ¥14 trillion, signaling there has been last minute negotiations to add to outlays. In recent days fresh reports have emerged saying the Takaichi administration is planning additional cash handouts of ¥20,000 per child.

“As a traditional economist, I’d say the size of the package raises concerns that it could overheat the economy,” said Kohei Okazaki, chief market economist at Nomura Securities. “But according to Takaichi’s close advisors, the economy should be running very hot in the first place. So according to their intentions, numbers like these aren’t surprising.”

Japan’s bonds and currency may disagree, but we’ll get to that in a moment.

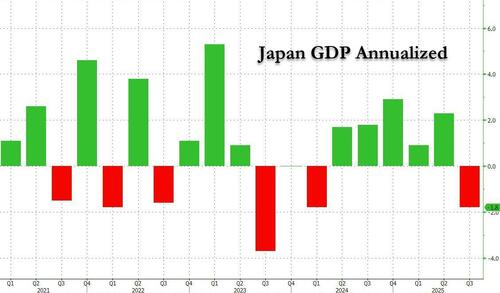

What is certain is that Japan really may not have an option: earlier in the week, data showed that the nation’s real GDP shrank by 1.8% on an annualized basis in the three months through September, the biggest decline in six quarters, and one which has almost certainly sent the economy into recession, giving the Takaichi administration more reasons to spend even as Japan’s inflation is running red hot.

Meanwhile, the looming increase in outlays is set to add to the largest debt burden among advanced economies. Japan’s general government debt is expected to be equivalent to 230% of its GDP, according to the International Monetary Fund. With the BOJ having raised rates three times since March 2024, debt-servicing costs are expected to rise, putting further pressure on Japan’s finances, and assuring that the BOJ will very soon be back to monetizing every yen the government needs to keep the country running.

Economists have questioned whether Japan needs spending on such a large scale, given the current state of the economy. While the country’s GDP contracted in the third quarter, both private consumption and corporate investment held up from the previous three months, suggesting somewhat solid domestic demand despite the hit from US tariffs.

The best part: this is just the start. “The current economic package is merely an early roll out of key measures,” said Nomura’s Okazaki. “The broader growth strategy covering 17 targeted sectors is still set to come, so this may not be the end of her spending spree.”

But while much more Japanese stimulus is coming, the question now become is this the ballgame for Japan, long the world’s “experiment” economy, which was doomed regardless due to its catastrophic demographics, and now both its bond and currency markets are in daily freefall.

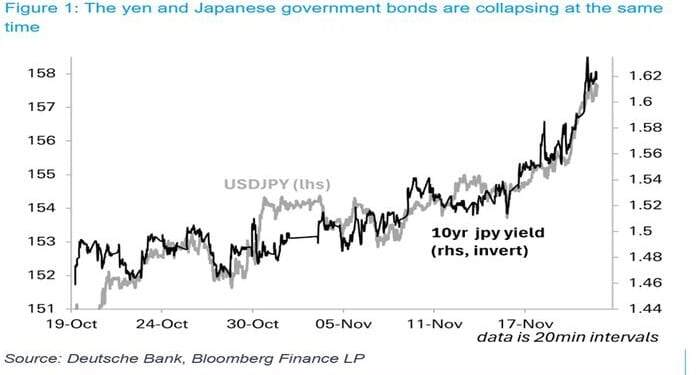

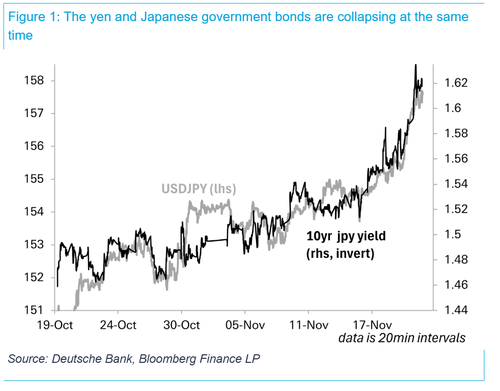

That’s the view of Deutsche Bank FX strategist George Saravelos who today published a note titled “a bit worrying” (available to pro subs), in which he writes that while most commentators have been focused on the recent bout of volatility in US equity markets something far more worrying is happening elsewhere in our view: the Japanese yen and bond market are collapsing together, with the dynamic sharply accelerating in recent days.

As Saravelos shows in the chart below, the yen and 30-yr government bond have dropped by more than 5% in recent weeks, all the more remarkable given that global fixed income markets have been rallying elsewhere.

To be sure, the price action is by now all too familiar given the gilt/sterling episode of 2022 and the combined USD/UST sell-off this April (when every economist rushed to declare the Age of US exceptionalism over… and pushed their clients into the same yen which is now about to disintegrate).

The signalling back then was clear: a loss of faith in the domestic asset base. To some extent, higher inflation expectations and a weaker yen should not be a surprise given the new government’s stated objective of a high-pressure economy via fresh fiscal stimulus and the continued dovish lean from the BoJ.

What is more concerning to Saravelos, is that both the JPY and the long end of the JGB nominal market are starting to decouple from any measure of fair value and that intra-day correlations are accelerating.

This is a problem because Japan’s government bond market is the largest in the world as a share of GDP. At the same time Japanese households are one of the wealthiest. It is this combination of high public debt and high private saving that has historically kept the domestic capital market stable.

But it is stability in inflation expectations that ultimately keeps the whole system together, according to the DB strategist.

If domestic confidence in the government’s and Bank of Japan’s commitment to low inflation is lost, the reasons to buy JGBs disappear, and more disruptive capital flight ensues.

Saravelos will be watching for signs of broader capital flight in Japan’s markets closely in coming weeks – a tell-tale sign would be a spillover of the current price action to a weaker equity market – and bitcoin, at least initially, before all the domestic savings are converted in non-fiat assets – and an ongoing decoupling of JGBs from global fixed income trends.

As Saravelos concludes, the BoJ governor and the government have so far adopted a policy of accepting the recent moves in the Japanese currency and government bond markets. But they will hardly be able to stay as quiet if the current price action continues…

Loading recommendations…