Deutsche Bank’s latest note argues that Tesla Inc. is no longer mainly a car company, but a long-term bet on artificial intelligence, robotics, and autonomy. In the report, Edison Yu and his team of analysts at Deutsche say that after Tesla’s latest earnings, any doubt about its direction is gone, describing the company as now “all in on Physical AI.”

The clearest sign of that shift is spending. Tesla plans to more than double capital expenditures, potentially topping $20 billion, with most of the money going toward AI training systems, data centers, custom chips, robotics factories, and new platforms. The analysts estimate that billions will be poured into computing alone, as Tesla builds the infrastructure needed to train self-driving and robot systems at scale. Management, they note, is aiming to “structurally disrupt labor intensive services” through vertical integration.

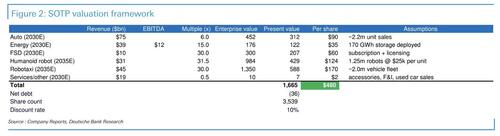

Autonomy and robotics now sit at the center of Deutsche’s long-term outlook. The firm highlights Tesla’s 1.1 million Full Self-Driving subscribers and sees FSD eventually generating up to $10 billion in annual revenue. It also expects the robotaxi network to grow to hundreds of thousands of vehicles by the end of the decade, producing more than $15 billion a year.

On Optimus, Tesla’s humanoid robot, the analysts are optimistic but realistic, warning that complex engineering, new supply chains, and slow early production will limit volumes in the near term.

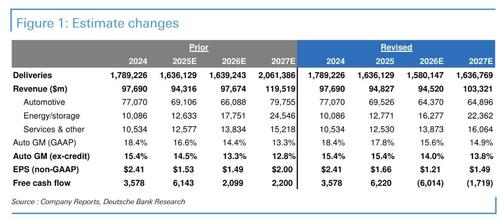

Despite its bullish view on AI, Deutsche slightly trimmed its numbers. It cut earnings and revenue forecasts and lowered its price target from $500 to $480, while keeping a Buy rating. The reduction reflects more conservative assumptions on vehicle sales and slower model rollouts, along with a revised valuation that separates FSD, robotaxis, and robotics into distinct businesses.

Most of Tesla’s long-term value, in their model, now comes from software, autonomy, and robots rather than car sales.

The note also flags risks, including weaker EV demand, intense competition, high execution hurdles in AI and robotics, regulatory scrutiny, and Tesla’s dependence on Elon Musk. Still, Deutsche argues that Tesla’s scale, data advantage, and vertical integration give it a strong chance to win if its strategy works.

Overall, the report frames Tesla as a company in the middle of a major transformation. Short-term forecasts have been trimmed, but Deutsche believes the real story is Tesla’s push to become a leader in AI-powered mobility and automation, with the potential to reshape multiple industries over the next decade.

Loading recommendations…