With MSFT and META blowing away expectations yesterday and sending the Nasdaq to a new record high, if only to see all those gains disappear during the day, today attention turns to the other two Mag7 giants, AAPL and AMZN, with the latter reporting right after the close, and the former waiting the usual 30 minutes. As we reported in our preview, positioning both companies has been relatively weaker, with Goldman having AMZN at 7 out of 10 (AAPL is even worse at 4 out of 10), so expectations were more modest compared to yesterday’s two juggernauts heading into earnings where the buyside bogeys are as follows: i) AWS growth of ~17% Q2 and ~18% Q3, with perhaps some upside risk to the Q3 number with GOOGL highlighting AI capacity coming online faster (note, management don’t guide that number); ii) Q2 net sales and EBIT high end of respective guides ($159-164B and $13-17.5B); iii) Q3 guidance of net sales $176B & EBIT ~$20B (both high-ends; iv) Post GOOGL, some expectation that AMZN tweak up the 2025 capex outlook from current ~$105BN.

With that in mind, and considering the stock is now trading red after kneejerking green, it appears that the skeptics may have been right.

Here is what Amazon reported moments ago:

- EPS $1.68 vs. $1.59 q/q, beating estimate $1.33

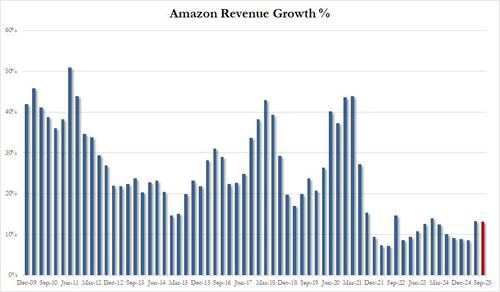

- Net sales $167.70 billion, +13% y/y, beating estimates of $162.15 billion, and above the upper end of the company’s guidance range of $159-$164BN

- Online stores net sales $61.49 billion, +11% y/y, beating estimates $59.13 billion

- Physical Stores net sales $5.60 billion, +7.5% y/y, beating estimates $5.49 billion

- Third-Party Seller Services net sales $40.35 billion, +11% y/y, beating estimate $38.97 billion

- Third-party seller services net sales excluding F/X +10% vs. +13% y/y, estimate +7.49%

- Subscription Services net sales $12.21 billion, beating estimate $11.92 billion

- Subscription services net sales excluding F/X +11%, beating estimate +9.68%

Geographically, the results were strong all around:

- North America net sales $100.07 billion, +11% y/y, beating estimate $97.36 billion

- International net sales $36.76 billion, +16% y/y, beating estimate $34.21 billion

So far so good, with every line time beating. But what the market was especially focused on was the high margin AWS data, and here numbers also beat solidly:

- AWS net sales $30.87 billion, +17% y/y, beating estimate $30.77 billion

- Amazon Web Services net sales excluding F/X +17% vs. +19% y/y, beating estimate +17%

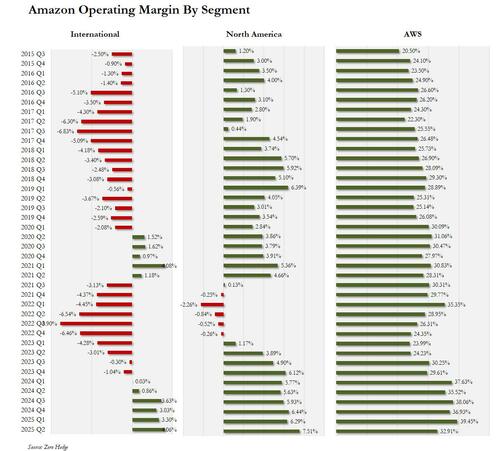

Turning to operating profits, here the results were also uniformly solid:

- Operating income $19.17 billion, +31% y/y, beating estimates $17 billion, and above the upper end of the company’s guided range of $13Bn – $17.5BN

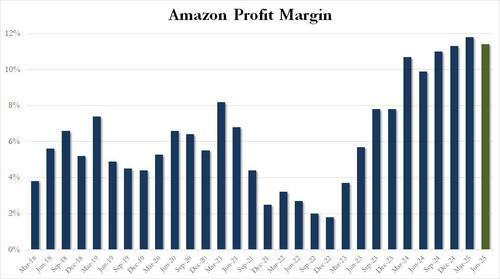

- Operating margin 11.4% vs. 9.9% y/y, beating estimate 10.4%

- North America operating margin +7.5% vs. +5.6% y/y, beating estimate +5.78%

- International operating margin 4.1% vs. 0.9% y/y, beating estimate 1.87%

As for fulfillment expenses, these came in slightly above estimates, while the seller unit mix was slightly worse than expected. These may continue to deteriorate as tariffs rise:

- Fulfillment expense $25.98 billion, +10% y/y, estimate $25.74 billion

- Seller unit mix 62% vs. 61% y/y, estimate 61.5%

Of the above, the most notable highlight – as per our preview – was AWS which grew revenue by 17% to $30.9BN, just above the sellside estimate of $30.77BN. The problem: the growth rate is clearly slowing.

And if revenue growth for AWS just barely beat, what Wall Street may have been growing on is the continued decline in AWS operating margins, which at 32.9% was the lowest since 2023 and a drop both MoM and YoY. Elsewhere, North American profit rose to $7.517 billion, resulting in a profit of 7.51%, beating estimates of 5.6%, while international margins rose to 4.06%, up from 0.9% and also beating estimates of 1.87%

As a result of the drop in AWS profits, Amazon’s consolidated operating margin posted a sequential drop and in Q2 declined from a record high of 11.8% to 11.4%.

However, while the above data was mixed if generally solid, it was the company’s guidance that led to an after hours drop in the stock; that’s because the company projected profit and revenue in the current quarter both of which were seen as coming in soft vs Wall Street expectations:

- Sees net sales $174.0 billion to $179.5 billion, above the estimate of $173.2 billion

- Sees operating income $15.5 billion to $2.05 billion, with the midpoint coming below the estimate of $19.42 billion, vs $14.7 billion in Q2 2024.

This means that revenue growth in Q2 is expected to print 13.1% YoY, or roughly where Q1 came.

In response to the soft guidance and the disappointing AWS profit, the stock initially pumped but then promptly dumped as it now appears that the stellar results from yesterday are unlikely to be repeated…

… as attention now turns to AAPL.

Loading recommendations…