Authored by Autumn Spredemann via The Epoch Times (emphasis ours),

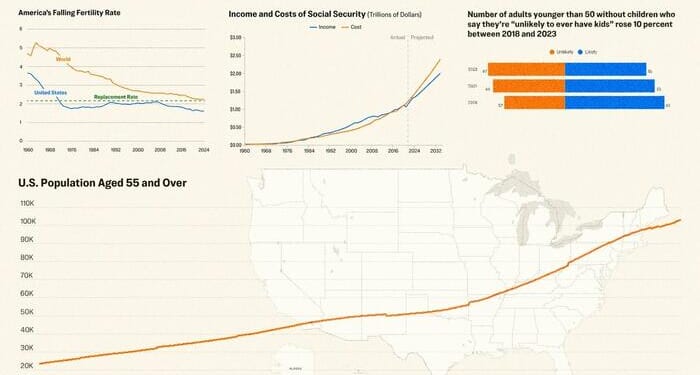

The data are in: The United States is getting older and welcoming fewer babies. This decades-long phenomenon is creating a demographic squeeze that some anticipate will affect nearly every aspect of the nation’s economy and infrastructure over the next couple of decades.

“I see a total reshuffling of our economy and society, brought about by historic demographic turnover,” regenerative medicine specialist Dr. David Ghozland told The Epoch Times.

In a report for the American Enterprise Institute, economist Jesús Fernández-Villaverde called falling U.S. fertility rates “the true economic challenge of [the] time.”

The number of adults aged 65 and older is forecast to hit 82 million by 2050 and will make up 23 percent of the population, according to the Population Reference Bureau. That is a 42 percent increase from 58 million people aged 65 and older in 2022.

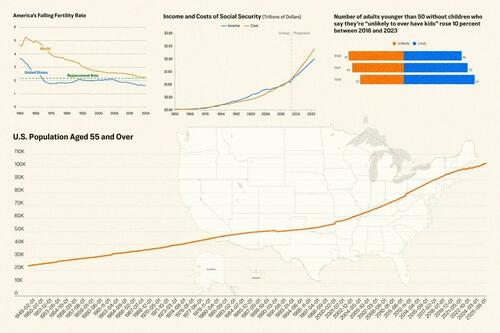

Meanwhile, the general fertility rate—the number of live births per 1,000 women of childbearing age—has dropped to record lows. The North American rate plummeted from 3.1 in 1950 to 1.6 in 2023, according to a McKinsey Global Institute analysis published in January.

Ghozland said he believes that this population inversion will force structural changes at the budget and care level, potentially leading to what he called a “cruel choice” in the next 10 years.

“We will experience a regulated destruction of safety nets such as Medicare,” he said, calling the rapidly aging population the “primary political and economic competition of [the] era.”

Health Care Upheaval

Ghozland said he is already seeing a dramatic change in the health care industry.

“We are currently observing the boom of the longevity business, which is going to become a multibillion-dollar industry exceeding 30 trillion [dollars] that will integrate biotech, wellness, and regenerative medicine,” he said.

Medicine and wellness care focused on supporting longevity is no longer a niche industry, according to Ghozland. However, he said this new economic driver in the health care sector hides a “great threat.”

Ghozland said that population inversion, aside from putting more pressure on existing U.S. health care resources, will lead to the long-term disintegration of the “social contract.”

Aspen Economic Strategy Group Director Melissa S. Kearney wrote in a September 2024 essay for The Dispatch: “We should not blithely declare that falling birth rates are of no real consequence, or even something to be celebrated. An increasingly aging and childless culture poses problems for individuals, families, and nations.”

Staffing shortages within the health care sector are already creating challenges. A recent AAG Health report on staffing statistics stated that the United States is already short 500,000 nurses this year, with a 10 percent shortage projected to last through 2027. Based on current industry trends, the United States could face a dearth of 3.2 million health care workers by 2026.

In a 2024 study published in the journal Aging, researchers said the health care system, as it stands, is “underprepared for the onslaught of demands this aging population will impose.”

In his work in reproductive care, Ghozland has seen the other side of the U.S. population inversion.

“There is a greater social-psychological cause of declining birth rates that I term ‘procreative dissonance,’” he said.

“My patients maintain the optimal levels of health and are biologically young even in their 40s. This creates a robust yet untrue feeling of suspended biological time, which comes into conflict with the fixed timetable of female ovarian aging.”

Ghozland said he believes that this contradiction—between readiness to have children and the biological window of time in which to have them—is “a dividing line” that prevents many couples from starting a family. Data also support his observation.

Between 2023 and 2024, the Centers for Disease Control and Prevention observed a decline in birth rates among females in the 15 to 34 age category, while women in the 40 to 44 age category showed an increase in births. This tracks with the established national trend of declining teenage pregnancies, which fell by 28 percent between 1990 and 2002.

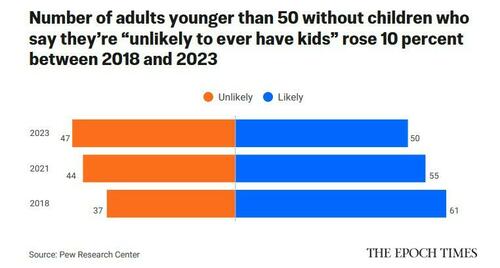

Moreover, some evidence suggests that adults are not simply waiting longer to have children; many are opting out of parenthood entirely. A 2024 Pew study reports that the number of adults younger than 50 without children who say they are “unlikely to ever have kids” rose by 10 percent between 2018 and 2023.

While some researchers say the dangers of this demographic shift are overstated, others believe that it will have a massive effect on the economy.

The McKinsey analysis stated that younger generations will inherit “lower economic growth and shoulder the cost of more retirees, while the traditional flow of wealth between generations erodes.”

At the same time, according to analysts, nations, including the United States, need to raise fertility rates to avoid a passive “depopulation.”

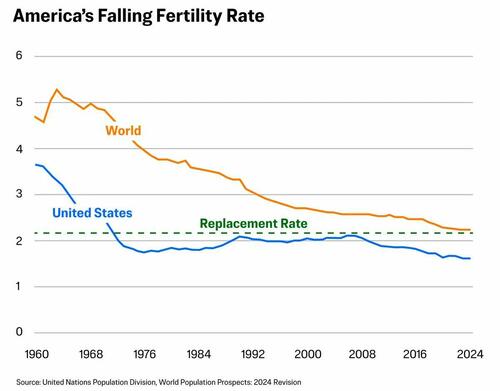

Economists and the Social Security Administration have warned for years that more beneficiaries and fewer people paying into the program will make it insolvent. The Peter G. Peterson Foundation, in a 2022 report, stated that by 2034, Social Security costs will exceed Social Security revenue to the tune of $437 billion.

Labor Market Transformation

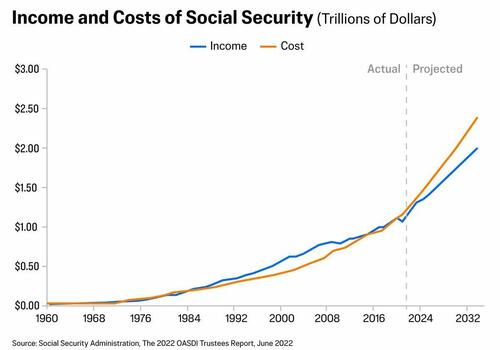

The labor market will also undergo a drastic transformation as fewer people enter the workforce over the next several decades. Meanwhile, adults are choosing to work longer into what traditionally would have been their retirement years. Some are even reentering the job market.

“It’s not so much the average age of the population that will be … important, [but rather] the average age of the workforce,” Scott Siff, CEO of Pivoters, told The Epoch Times. Pivoters helps match job seekers older than 55 with employers seeking talent.

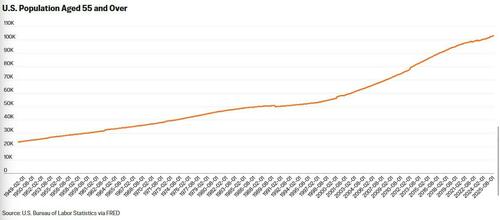

“At the moment, there are around 110 million people in the population over 55, and only about 37 percent are working,” Siff said. “But 74 percent of them want to be working.”

Figures vary, but the number of U.S. adults older than 55 is estimated to be near 103 million, according to the Federal Reserve Bank of St. Louis.

“The biggest change we can look for is that the entire concept of retirement will change dramatically, and perhaps fade away entirely,” Siff said.

Siff said he believes that as overall population growth begins to slow, millions of adults older than 55 will start reentering the workforce en masse—and only partially because of lack of retirement savings.

While they need to work for financial reasons, “increasingly, they also want to work because of the dramatic positive impacts work has on longevity, happiness, health, and sense of purpose,” he said.

“The median savings today for people reaching so-called retirement age is about $50,000, but now that people can live decades past this notional retirement age, estimates are that people need to have $1 million saved for retirement,” Siff said.

Annual retirement costs for more affordable states in the Midwest and South run to about $50,000, according to a Visual Capitalist analysis. Consequently, this puts many in the age range of 55 and older in a financial bind.

Read the rest here…

Loading recommendations…