Authored by Autumn Spredemann via The Epoch Times,

Americans of all ages increasingly view a comfortable retirement as a challenge, according to recent studies.

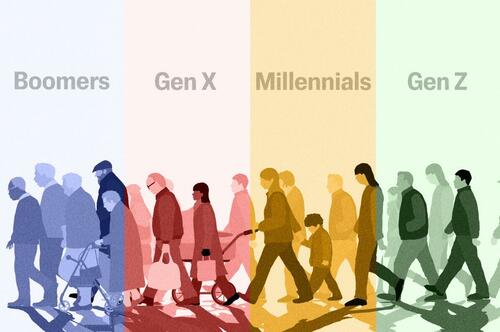

From baby boomers nearing their final paycheck, Gen X being late to the savings game, and millennials with employment-sponsored plans to Gen Z grappling with artificial intelligence (AI) on the first rungs of the career ladder, the challenges and outlook for each generation are very different.

Wealth management experts told The Epoch Times that the reality will likely mean lifestyle changes for many before and during their golden years. Laying out the pitfalls and opportunities for each, they also warn that some of the current expectations about certain generations might not hold true.

With more than 30 million Americans estimated to reach the age of 65 by 2030, according to Nasdaq, the road after retirement will be rocky for those who aren’t financially prepared.

In December, investment company Vanguard released a report that found that 58 percent of Americans will be unable to maintain their current lifestyles in retirement.

“The study primarily focused on an important metric: maintenance of their lifestyle in retirement. As a fiduciary retirement planner, I believe this is the most important metric to consider,” said Paul Murray, president of PTM Wealth Management.

“No one really wants to live on a tight budget after a lifetime of work.”

The Vanguard report also suggests that younger age groups and millennials may be better prepared for retirement than baby boomers because of wider access to defined contribution plans and better employer-sponsored options.

Murray disagrees, saying that the report is an “optimistic snapshot in time that is bound to be revised downward into the future.”

He said he believes that younger generations, including Gen Z and millennials, are more likely to struggle to define an acceptable living standard as the employment landscape changes, especially because of advances in technology.

He said most of the baby boomers he has worked with have maintained a “strong commitment” to saving in employer-sponsored plans.

“I consider baby boomers to have been fortunate to have accumulated wealth in a comparatively less complicated world, benefiting from the conservative values their parents passed on to them,” Murray told The Epoch Times.

“Vicinte,” who had been waiting in line overnight, prepares to enter Fresno Mission for food in Fresno, Calif., on Oct. 1, 2025. A December Vanguard report found 58 percent of Americans will not be able to maintain their current lifestyle in retirement. John Fredricks/The Epoch Times

The ‘Steady Savers’

Esmeralda Quintero, wealth management adviser at Iarann Wealth, said that younger generations tend to “look more prepared on paper.”

“Many of them started saving earlier through auto-enrollment and easy access to Roth accounts,” she told The Epoch Times.

“They grew up hearing about market crashes and shaky pensions, so they’re more aware than older generations were at the same age.”

However, awareness isn’t the same as action, according to Quintero.

“Gen Z spends a lot on lifestyle, travel, and convenience. If they don’t start building habits in their 20s—into 401k, Roth IRA, regular investing—they could fall behind quickly,” she said.

“From what I see with clients, millennials are the most steady savers. They’ve built discipline because they’ve lived through multiple economic shocks. Gen X is trying the hardest to catch up because retirement is getting close. The least prepared tend to be late boomers who didn’t have strong retirement plans early in their careers,” Quintero said.

Chris Heerlein, CEO of retirement planning firm REAP Financial, had a similar take, noting that millennials and Gen Z are better savers than some would expect.

Students walk on the University of North Carolina at Chapel Hill campus in Chapel Hill, N.C., on Sept. 20, 2024. Paul Murray, who leads a wealth management firm, says younger generations may struggle to define an acceptable living standard as the employment landscape changes, especially because of advances in technology. Madalina Vasiliu/The Epoch Times

“Young generations are more financially prepared because they separate their identities from their incomes,” Heerlein told The Epoch Times.

He said he believes that the large debt held by older generations stemmed from associating self-worth with earnings, climbing a ladder, and upgrading their lifestyles at each stage of the journey.

“Younger workers these days, for all the criticism they get, tend to cap their lifestyles at an earlier stage and begin redirecting income into long-term savings earlier,” Heerlein said.

Manulife John Hancock Retirement’s financial resilience and longevity survey found that 56 percent of Gen X feel as if they’re behind in their retirement savings, while 70 percent of Gen Z said they’re focused on day-to-day expenses.

While financial planners may be bullish about younger workers saving money, these age groups don’t appear to harbor the same level of confidence.

The Manulife analysis noted that 52 percent of Gen Z and 53 percent of millennials rate their finances as either fair or poor. By contrast, 49 percent of Gen X and 34 percent of baby boomers felt the same.

Longer Life, Bigger Nest Egg?

Part of this gloomy outlook comes from how many years people expect to spend outside the workforce. Last year, a Corebridge Financial survey highlighted that many Americans expect to live longer, shifting the perspective on how much is needed to survive their golden years.

Half of U.S. residents think it’s possible to live for 100 years. However, Corebridge Financial stated that there’s a “clear disconnect” between longevity optimism and retirement planning. Half of the non-retired respondents are only planning for 20 years or less of retirement, but most don’t intend to work beyond their early 60s.

The reality of retirement savings takes on a different focus for Gen X and baby boomers. According to a 2024 AARP survey, one in every five Americans older than 50 years of age has nothing saved for retirement, while 61 percent are worried that they won’t have enough money to support themselves outside their working years.

Customers use ATMs at a Bank of America office in Daly City, Calif., on July 18, 2023. According to a 2024 AARP survey, one in every five Americans over 50 years had nothing saved for retirement. Justin Sullivan/Getty Images

“Every adult in America deserves to retire with dignity and financial security. Yet far too many people lack access to retirement savings options and this, coupled with higher prices, is making it increasingly hard for people to choose when to retire,” Indira Venkateswaran, AARP senior vice president of research, stated on the organization’s website.

“Everyday expenses continue to be the top barrier to saving more for retirement, and some older Americans say that they never expect to retire,” she said.

Optimism improved this year for younger generations, according to AARP’s Financial Security Trends Survey.

Among adults older than the age of 30, 26 percent reported their financial situation in January was better than 12 months earlier—the largest segment that expressed this since the survey began in 2022.

That said, one in four U.S. residents in the same age group said their financial situation got worse during the same period.

Different Generations, Different Pressures

Vanguard’s own researchers called their analysis “pessimistic” in comparison to other recent retirement reports because of growing levels of personal debt across the age spectrum.

Vanguard predicted the median-income individual will suffer an annual spending shortfall of $5,000 after retirement. If this is true, then many will be forced to fall back on other assets, Social Security, or even return to the workforce to maintain the same lifestyle.

Murray, Quintero, and Heerlein all said a $5,000 spending shortfall is realistic based on the savings trends they’ve seen and inflated living costs.

“For some households, it may be more, especially with health care and rising living costs. Many people will need to work longer, spend differently, or use home equity. The biggest barriers to retirement are housing costs, debt, inconsistent access to employer plans, and rising medical expenses,” Quintero said.

Students arrive at Nora Sterry Elementary School with a parent in Los Angeles on Jan. 15, 2025. The biggest barriers to retirement are housing costs, debt, inconsistent access to employer plans, and rising medical expenses, one expert said. Chris Delmas/AFP via Getty Images

“Each generation deals with a different version of that. Gen Z faces expensive housing and a shaky job market. Millennials are juggling debt and delayed homeownership. Gen X is squeezed between raising kids and supporting aging parents. Boomers are dealing with longevity and health care shocks.”

Heerlein said lifestyle adjustments on paper are more than just numbers.

“I think what people underestimate is the emotional stress that it causes. I’ve seen retired people avoid seeing their grandkids or skip little trips because they don’t know if their budget allows it,” he said.

Some of this shortfall stems from what Heerlein called “decision overload.”

“The typical family has a bunch of different accounts thrown here and there. More often than not, people are embarrassed to admit they don’t know what’s going on with all of them,” he said.

In his work, Heerlein said baby boomers often look at all these separate parts and feel overwhelmed trying to figure out how to turn them into a paycheck-like income.

U.S. dollar bills in Washington on Nov. 13, 2025. With record demand on Social Security and Medicare and record national debt, Paul Murray expects taxes to rise across the board. Madalina Kilroy/The Epoch Times

His Gen X clients say they feel like they’re being crushed from all sides because many are taking care of their own finances along with that of their parents.

Are Taxes the Biggest Threat?

Murray said he believes that the most impactful lifestyle adjustment for Americans won’t come from a lack of fiscal belt-tightening before retirement but higher taxes.

“The biggest and most profound reason why future generations are threatened is taxes,” he said.

With the national debt surpassing a record $38 trillion in 2025, alongside record-high demands on Social Security and Medicare, Murray said he expects taxes will likely increase across the board.

“The reason why this is so critical … is because Gen Z and millennials are still largely saving in tax-deferred accounts, and every dollar they remove in retirement to maintain their standard of living will be subject to income tax. As taxes increase to mitigate our country’s fiscal decline, there will be less after-tax spending power,” he said.

Ultimately, Quintero said addressing retirement plans on the front end is the best strategy.

“Every group has a hurdle, but the earlier someone starts addressing theirs, the better their retirement looks,” she said.

Loading recommendations…