Ahead of Apple’s earnings report this afternoon, which concludes the results from big 4 group of the Mag 7 (including MSFT, META and AMZN) Goldman notes the tech giant is a very clear outlier from a sentiment, flow, and positioning perspective relative to its Mega-Cap Tech peers. As the largest Mutual Fund Underweight in the market and a popular HF relative short, AAPL has represented a significant source of “performance Alpha” for most this year (stock -17% vs. NDX +9%) and Goldman has it as a 4 on 1-10 positioning scale.

As a reminder, Apple declined to give any form of guidance for services revenue in the June quarter, citing uncertainty. The services segment is under fire from regulators globally, who are upending App Store policies in a way that could dramatically reduce revenue from apps and subscriptions.

While a beat was expected in the quarter (and most were ‘respectful’ of that dynamic), but long term uncertainties around AAPL’s competitive positioning feel like they remain as high as ever heading into tonight’s results.

Just 30 minutes after AMZN disappointed with lackluster AWS growth and a soft operating income outlook, AAPL flipped the script with a big top- and bottom-line beat:

-

*APPLE 3Q REV. $94.04B, EST. $89.3B

-

*APPLE 3Q EPS $1.57, EST. $1.43

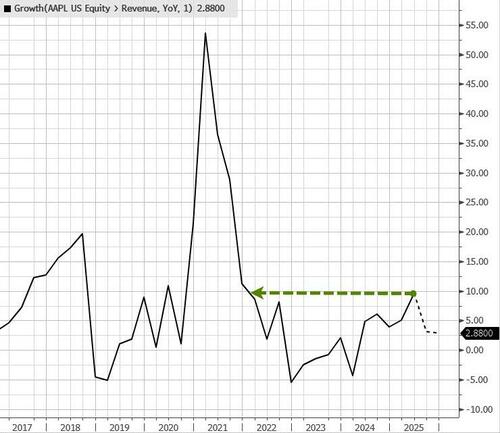

The best YoY revenue growth since Q4 2021:

Under the hood, it was mixed with products beating expectations led by iPhone and Mac revenue, while iPad and Wearables disappointed…

Bloomberg points out that the iPad’s decline of 8% can probably be explained by the mediocre updates this year. There was no new iPad Pro, and the iPad Air and low-end iPad refreshes were both minor.

China is back to growth, up 4.35%

CEO Tim Cook on the quarter:

“Today Apple is proud to report a June quarter revenue record with double-digit growth in iPhone, Mac and Services and growth around the world, in every geographic segment.”

AAPL rallied back to unchanged on the day ahead of earnings and extended gains modestly after the results…

CEO Tim Cook has been reluctant to offer guidance in recent calls, but we note that the iPhone beat is likely driven by shoppers flooding Apple stores earlier in the quarter when they feared immediate price hikes. That could create some pull-forward, though, for the fourth quarter

Loading recommendations…