Ahead of Apple’s earnings report this afternoon, which concludes the results from big 4 group of the Mag 7 (including MSFT, META and AMZN) UBS said that sentiment was a 5/10, with the bank’s analyst expecting some pull-forward offsetting soft demand, while creating tougher 2H compares with the consensus too optimistic. UBS, which has a $210 price target, reiterated its $210 price target (Neutral) warnings that although the rich valuation remains a perennial overhang, sentiment is more cautious given the ongoing tariff and market share headwinds. The bottom line: with the mild short bias ahead of the print, there was a decent chance for a tactical bounce due to pull-ins, but probably not enough to alleviate the ongoing concerns.

And sure enough, 30 minutes after AMZN disappointed with lackluster AWS profit margins and a soft operating profit forecast, it would be 2 for 2 for the bears, with AAPL stock sliding on disappointing China sales even as tariff fears sent iPhone purchases across the world into overdrive. Here are the details:

- Adjusted EPS $1.65 vs. $1.53 y/y, beating estimate $1.62

- Total revenue $95.36 billion, +5.1% y/y, beating estimate $94.59 billion

- Products revenue $68.71 billion, +2.7% y/y, beating estimate $67.84 billion

- IPhone revenue $46.84 billion, +1.9% y/y, beating estimate $45.94 billion

- Mac revenue $7.95 billion, +6.7% y/y, beating estimate $7.75 billion

- IPad revenue $6.40 billion, +15% y/y, beating estimate $6.12 billion

- Wearables, home and accessories $7.52 billion, -4.9% y/y, missing estimate $8.05 billion

- Service revenue $26.65 billion, +12% y/y, missing estimates if $26.72 billion – this was the first red flag.

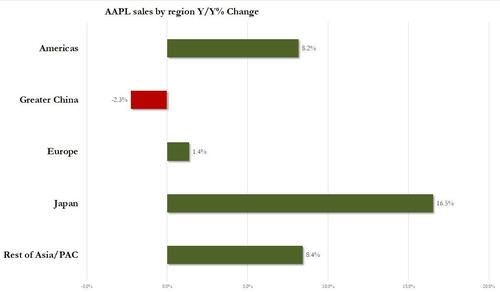

The second, and even bigger, red flag was the usual suspect: China, where revenues unexpectedly slumped, sliding 2.3%, while Wall Street was expecting a mid-single digit growth

- Greater China rev. $16.00 billion, -2.3% y/y, missing estimates of $16.83 billion

Going down the line:

- Total operating expenses $15.28 billion, +6.3% y/y, higher than estimate $15.17 billion

- Gross margin $44.87 billion, +6.1% y/y, higher than estimate $44.58 billion

- Cash and cash equivalents $28.16 billion, -14% y/y, missing estimates of $32.73 billion

- Cost of sales $50.49 billion, +4.1% y/y, higher than estimate $50.23 billion

And so on:

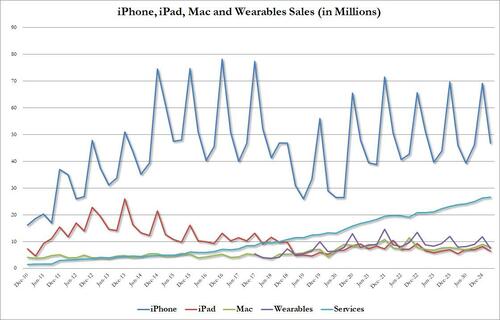

Looking at a breakdown of sales by product category it was a generally solid report, although that was to be expected as a result of pulled forward demand for iPhones ahead of tariffs which would likely push prices sharply higher. Here are the details: .

- IPhone revenue $46.84 billion, +1.9% y/y, beating estimates $45.94 billion but much of this was due to pulled forward sales ahead of tariffs

- Mac revenue $7.95 billion, +6.7% y/y, beating estimates of $7.75 billion, same logic here

- IPad revenue $6.40 billion, +15% y/y, beating estimates of $6.12 billion

- Wearables, home and accessories $7.52 billion, -4.9% y/y, big miss to estimate $8.05 billion

Bottom line, while most segments came in stronger than expected, much of this will likely reverse in Q3 when tariffs push prices higher (because tariffs are inflationary right), meanwhile, Apple’s wearables segment (where one can find the Vision Pro disaster) remains a big disappointment, and the new low-end AirPods and hearing features for the AirPods Pro apparently did not draw much interest.

Here is the full revenue breakdown by product:

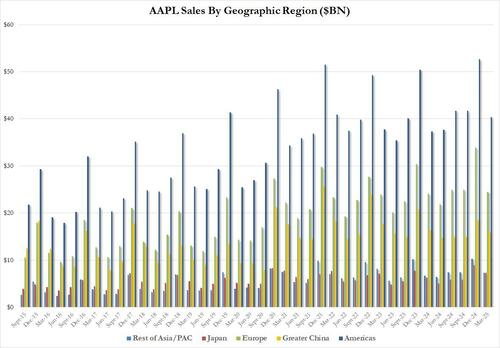

But if iPhone sales was solid (if transitory) the devastation that is China sales was catastrophic: contrary to expectations for a modest rebound, as China sales declined for a seventh consecutive quarter, down 2.3%, and printing at only $16BN, below the $16.9BN estimate.The rest of the world saw growth, modest in the Americas at 8.2%, and stronger in Japan and APAC, while Europe barely grew.

And in dollar terms:

Needless to say, China continues to be a very weak spot for Apple and the company hasn’t done much to push new products, pricing and initiatives in that market — or other emerging areas — to offset the issues. The weakness there, which Apple will try to explain away in its conference call, is because of a combination of nationalism and interest in local products, whose designs are getting better. The local players are also trying new things like foldables while Apple continues to use the same design it rolled out five years ago. Oh, and Trump’s trade war which is getting worse by the day, isn’t helping.

The result: revenues declining now for an unprecedented 7 quarters!

There was more: Service revenue, which for many years was the only golden goose left in AAPL’s roster, is starting to sputter, and even though it rose to a new record $26.65 billion, this missed estimates of $26.72 billion and the growth rate was the lowest in two years.

The company has been contending with multiple challenges, beyond just the looming tariffs. Apple is playing catch-up in artificial intelligence, forcing it to shuffle management in recent weeks. It’s also under mounting regulatory pressure in the EU and its home country. On Wednesday, a federal judge demanded that the company open up its App Store to third-party payment options and stop charging commissions on outside purchases.

But tariffs remain one of the biggest question marks. Though Apple is likely to sidestep the 145% China levy that the administration originally proposed, new tariffs on electronics are still coming. The turmoil threatens to upend the company’s supply chain and potentially force it to raise prices. Already, Apple is looking to make more of its US-bound iPhones in India rather than China. Ironically, it was tariffs that helped the company revenues beat estimates as customers flooded Apple retail stores to buy new iPhones and other products out of fear that price hikes were coming.

In the press release, CEO Tim Cook tried hard to stay positive, but failed.

“Today Apple is reporting strong quarterly results, including double-digit growth in Services,” said Tim Cook, Apple’s CEO. “We were happy to welcome iPhone 16e to our lineup, and to introduce powerful new Macs and iPads that take advantage of the extraordinary capabilities of Apple silicon. And we were proud to announce that we’ve cut our carbon emissions by 60 percent over the past decade.”

The bigger problem is what he said on the conference call, where it said that he hadn’t seen excess pull forward demand in Q1 (it did)…

- COOK: DIDN’T SEE EXTRA DEMAND IN MARCH QUARTER ON TARIFFS

… and pretended not to know what the tariff impact will be:

- COOK: NOT SURE WHAT TARIFF IMPACT WILL BE AFTER JUNE QUARTER

Trump’s tariff policy may be unclear to Cook, but what is clear to everyone, is that growth for AAPL is slowing fast:

- *APPLE CFO: Q3 REVENUE TO GROW LOW TO MID-SINGLE DIGITS YOY

Which was the same guidance as the current quarter, and the market is starting to realize Cook isn’t sandbagging… instead the debate what is the right multiple on a company that has now officially flatlined. To be sure the kneejerk reaction was not happy, with AAPL stocks sliding about 3% after hours, the second consecutive quarter in which the market punished AAPL earnings, to just above $206 after closing today at the highest price since Trump’s Liberation Day.

Not even the news that the iPhone maker authorized a new $100 billion stock buyback and boosted its quarterly dividend 4% to 26 cents a share, was enough to prop up the stock.

Loading…