The strong bank earnings continued for a second day, when after solid results from JPM yesterday (if rather mediocre from Wells) this morning we got top and bottom line beats from Goldman, Morgan Stanley and Bank of America. Taking a closer look at the latter, the bank’s traders posted a record second quarter – yet one which missed revenue estimates – as the company reaped the benefits of volatile markets and net interest income topped analysts’ estimates.

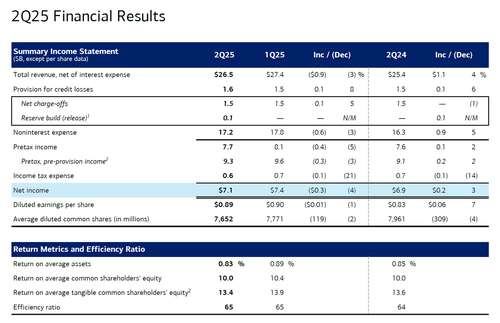

While BofA reported an EPS beat (Q2 came at $0.89, vs est of $0.85), total Q2 revenue of $26.5 billion was down 3% YoY from $27.4 billion a year ago, and missed estimates of $26.75 billion. Overall, Bank of America’s second-quarter profit rose, with net income up 3.2% to $7.12 billion, more than the $6.56 billion analysts had predicted.

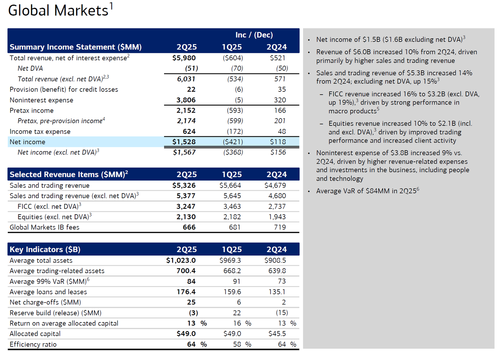

Still, revenue from fixed income, currencies and commodities trading jumped 19% to $3.25 billion “driven by strong performance in macro products”, which helped Bank of America top analysts’ estimates for per-share earnings. Equity trading rose 9.6% to $2.13 billion, also topping expectations,” driven by improved trading

performance and increased client activity.”

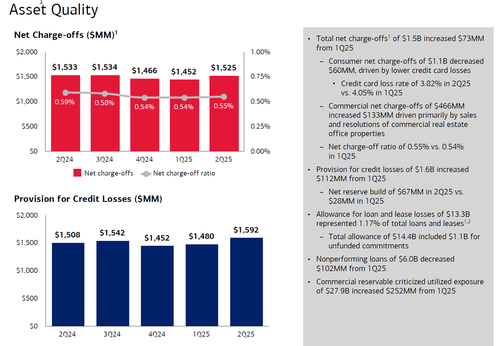

Unlike JPM, where the provision for credit losses unexpectedly tumbled, Bank of America saw its loss provisions rise to $1.6 billion from $1.5 billion a year ago, and in Q1 2025. The net reserve build was $67MM in 2Q25 vs.$28MM in 1Q25. Some more details:

- Total net charge-offs of $1.5B increased $73MM from 1Q25

- Consumer net charge-offs of $1.1B decreased $60MM, driven by lower credit card losses: Credit card loss rate of 3.82% in 2Q25 vs. 4.05% in 1Q25

- Commercial net charge-offs of $466MM increased $133MM driven primarily by sales and resolutions of commercial real estate office properties

- Net charge-off ratio of 0.55% vs. 0.54% in 1Q25

- Allowance for loan and lease losses of $13.3B represented 1.17% of total loans and leases

- Total allowance of $14.4B included $1.1B for unfunded commitments

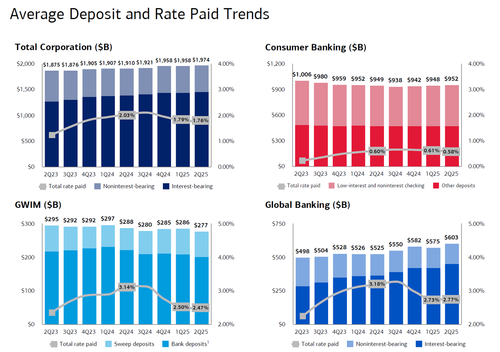

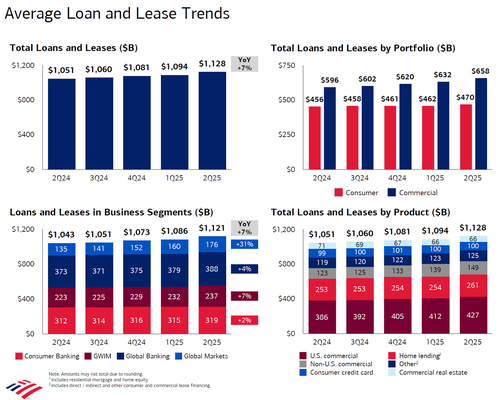

Taking a closer look at the balance sheet, both total deposits and loans increased across the franchise:

- Average deposits of $1.97T increased $64B, or 3%

- Average loans and leases of $1.13T increased $77B, or 7%

- Average Global Liquidity Sources of $938B

- CET1 capital of $201B was flat to 1Q25

- CET1 ratio of 11.5%4 vs. 11.8% in 1Q25; well above regulatory minimum

- Paid $2.0B in common dividends and announced plans to increase quarterly common dividend 8%5

- Repurchased $5.3B of common stock

Banks benefited from the market volatility which whipsawed global markets after Trump announced tariffs on trading partners around the world in April. Indeed, what was bad news for markets (at least initially) was great news for businesses at Bank of America and its rivals across Wall Street as they’ve benefited from a surge in client activity while also thwarting expectations for a strong rebound in mergers and acquisitions.

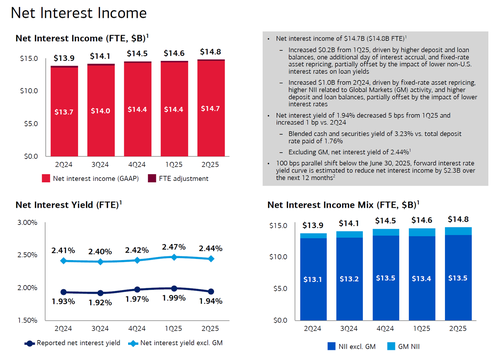

The second-largest US bank also said that net interest income, a key source of revenue for the company, rose 7.1% to $14.7 billion, above the 6.5% analyst estimate for NII, the revenue collected from loan payments minus what depositors are paid. Commenting on the results, BofA said that NII increased $0.2B from 1Q25, “driven by higher deposit and loan balances, one additional day of interest accrual, and fixed-rate asset repricing, partially offset by the impact of lower non-U.S. interest rates on loan yields.” The Q2 NII also “increased $1.0B from 2Q24, driven by fixed-rate asset repricing, higher NII related to Global Markets (GM) activity, and higher deposit and loan balances, partially offset by the impact of lower interest rates.”

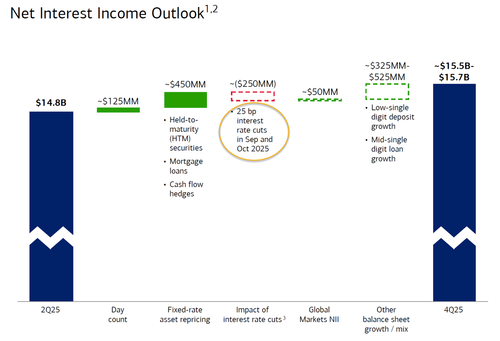

Similar to JPMorgan, BofA’s outlook is for continued growth in NII (to $15.6BN), where fixed-rate asset repricing adds $450MM by year end, offsetting the $250MM in expected rate cuts in Sept and Oct.

“Consumers remained resilient, with healthy spending and asset quality, and commercial borrower utilization rates rose,” Chief Executive Officer Brian Moynihan said in the statement. “In addition, we saw good momentum in our markets businesses.”

As Bloomberg notes, Bank of America’s results offered a further look at how the biggest US banks fared at the beginning of Trump’s second term. Investors are also eager to hear details on the national economy from executives whose firms cater to large swaths of American consumers and businesses.

On Tuesday, JPMorgan and Citigroup reported earnings that beat analysts’ estimates, with trading and investment-banking activity boosting results. Executives at both banks expect the momentum in trading to continue and the investment-banking pipeline to build as corporate clients get more comfortable with geopolitical tensions.

Shares of Charlotte, North Carolina-based Bank of America rose 1.8% at 6:59 a.m. in early New York trading. They gained 4.6% in the 12 months through Tuesday, less than the 19% increase in the S&P 500 Financials Index.

Much more in the full Bank of America earnings presentation below (pdf link).

Loading…