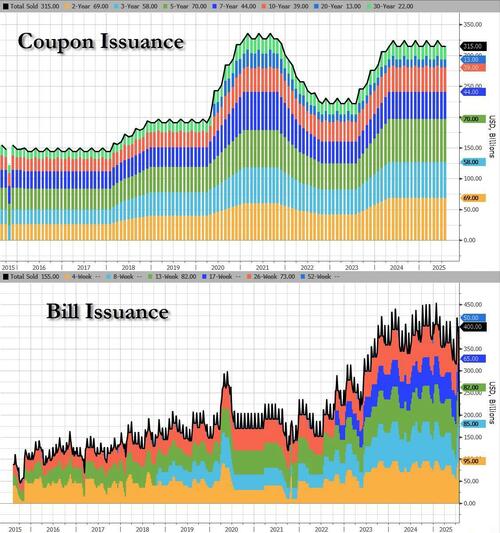

In today’s closely watched Quarterly Refunding Announcement on debt issuance – which to many was more important than the FOMC statement – the Treasury Department said at 8:30am ET that that it anticipates keeping the size of its note and bond auctions unchanged “for at least the next several quarters.” And since that was the same guidance the Treasury has given since the start of last year, it leaves bills, which were the fulcrum security of Janet Yellen’s Activist Treasury Issuance strategy so repeatedly penned by Scott Bessent, once again bearing the brunt of the government’s rising borrowing needs, although as the charts of Bill and Coupon issuance below show, the US is already pretty much at 10…. so these better go to 11.

This means that the Treasury will rely more on the shortest-dated securities to fund the gaping federal deficit at least until 2026, after Treasury Secretary Bessent said last month that yields on longer-dated Treasuries were too high to consider boosting sales of such debt. In doing so he is implicitly endorsing the same strategy that he slammed when it took place under Janet Yellen.

As we noted in our QRA preview, and as Bloomberg notes, Wall Street had varying views on what guidance the Treasury would provide. Wells Fargo expected a reiteration of the previous language. JPMorgan strategists said officials “perhaps” might lop off the “at least” qualification for the coming several quarters, while Stephen Stanley at Santander US Capital Markets said his best guess was the entire removal of the guidance.

In the end this is what the Treasury did say:

“Treasury believes its current auction sizes leave it well positioned to address potential changes to the fiscal outlook and to the pace and duration of future SOMA redemptions. Based on current projected borrowing needs, Treasury anticipates maintaining nominal coupon and FRN auction sizes for at least the next several quarters.”

Which is nothing more than can kicking: “The longer debt managers wait to get started, the more difficult the job becomes” of preparing markets for bigger sales of interest-bearing debt, or coupons, Santander’s Stanley wrote before the Wednesday announcement.

Turning to the actual refunding, as widely expected by dealers, the Treasury maintained the size of next week’s quarterly refunding auctions, which span 3-, 10- and 30-year maturities. Specifically, the Treasury will offer $125 billion of Treasury securities to refund approximately $89.8 billion of privately-held Treasury notes and bonds maturing on August 15, 2025, both in line with estimates, and raising new cash of about $35.2 billion. The composition is as follows:

- 3-year note in the amount of $58 billion, maturing August 15, 2028

- 10-year note in the amount of $42 billion, maturing August 15, 2035

- 30-year bond in the amount of $25 billion, maturing August 15, 2055

The table below presents the actual auction sizes for the May to July 2025 quarter and the anticipated auction sizes for the August to October 2025 quarter. As one can see, the 3, 10 and 30Yr issuance sizes are identical as during the last refunding in May of 2025.

The Treasury also said it was continuing to nudge sales of some Treasury Inflation-Protected Securities, or TIPS, higher in order to keep their share of the overall Treasury market stable. It announced the following adjustments:

- A bump up of the September 10-year TIPS reopening auction to $19 billion

- An increase of the October 5-year new issue TIPS auction to $26 billion

And since there was no surprise in the coupon issuance schedule, it means Bills will once again have to step up and fund the balance. As the Treasury wrote, “since the $5 trillion increase to the debt limit on July 4, Treasury has increased bill issuance to continue to finance the government and to gradually rebuild the cash balance over time to a level more consistent with its cash balance policy.” As previously noted, Treasury anticipates that the cash balance will approach levels consistent with its policy in September. Accordingly, “Treasury anticipates further marginal increases in short-dated Treasury bill auction sizes in the coming days and then maintaining sizes at or near those levels through the end of September. Additional increases to Treasury bill auction sizes are anticipated in October. Treasury will carefully monitor market conditions and adjust its bill issuance plans as appropriate.”

Bessent had been among the most Republicans to criticize former Treasury Secretary Janet Yellen last year for artificially holding down sales of longer-term debt, saying it was an attempt to keep borrowing costs low before the election. And while Bills made up about 20% of the Treasuries market at the end of June, the ratio is now set to climb in the coming months as the Treasury continues to refrain from increasing note and bond issuance. The Treasury Borrowing Advisory Committee, an outside panel made up of dealers, investors and other market participants, last year recommended that bills average about 20% of total outstanding Treasuries over time.

Relying just on bills to fund the deficit would at some point make the ratio of those securities so large that it would introduce sharp volatility in the Treasury’s financing costs. It would also potentially force the department to set aside a bigger stockpile of cash in case of challenges in rolling over maturing bills on any given day.

For now, strategists say there’s ample demand for bills. Money-market funds are expected to keep growing, giving them the capacity to absorb part of the additional bill supply if those securities make up a bigger share of debt, according to Morgan Stanley strategists. The Fed may also emerge as a bigger buyer of bills as policymakers begin to discuss whether to tilt their bond portfolio toward shorter-duration securities. And Bessent has repeatedly pointed to stablecoins as a fresh source of demand. That’s right: very soon Tether will become just as important as the Fed when it comes to funding the US government.

Translation: expect a very, very front-end loaded Treasury curve, one which will be funded by stablecoin issuers and which will be at the whim of the Fed for short-term funding costs. Whatever can possibly go wrong.

But (re)funding schedules aside, which as noted were a snoozer, the most consequential aspect of today’s Quarterly Refunding was how the Treasury’s buyback program will be changed. As readers will recall, ahead of today’s refunding announcement, we said that Goldman was expecting a 50-100% increase in Treasury buybacks and said that “Calling this “shadow QE” is definitely a bridge too far…but it might on a path that leads to that bridge.”

Goldman expects a 50-100% increase in Treasury buybacks announced in today’s QRA. Says “Calling this “shadow QE” is definitely a bridge too far…but it might on a path that leads to that bridge.”

— zerohedge (@zerohedge) July 30, 2025

That’s more or less what happened, because in the biggest news of the day, the department unveiled plans to beef up its program of buying back older securities, bringing that initiative to an annual target in excess of $300 billion.

The Treasury said it would double the frequency of long-end operations, boosting the liquidity support cap from $30 billion to $38 billion per quarter, and opening the door to broader market access through direct offers from a limited set of counterparties starting in 2026.

This change to buybacks is not a marginal tweak — it’s a structural shift aimed at injecting flexibility and smoothing market functioning as Treasury debt issuance ramps higher; and while nobody will ever admit it, it is also a shadow QE meant to prop up the long end in case the Fed refuses to step in similar to what happened in April.

Describing the changes to the buyback program meant “to better achieve its liquidity support and cash management goals”, the Treasury said that based on feedback from a wide range of market participants, including the primary dealers and the Treasury Borrowing Advisory Committee, Treasury believes it is appropriate to:

- Double the frequency of long-end nominal coupon liquidity support buybacks: Changes involved will boost the aggregate size of liquidity-support buybacks to a maximum par amount of $38 billion per quarter from $30 billion

- Increase the size of cash management buybacks: Ramping up the cash-management buybacks to a maximum par amount of $150 billion per year from $120 billion

- Make a technical adjustment to the TIPS buyback buckets: i) There will now be two operations per quarter of up to $750 million of 1- to 10-year TIPS buybacks; ii) There will be one operation per quarter of up to $500 million of 10- to 30-year TIPS

- Allow a limited number of additional counterparties to directly access buyback operations. I.e., spread the “NOT STEALTH QE” wealth.

These changes will be effective August 13, 2025 and are reflected in the tentative buyback schedule for the upcoming refunding quarter.

So what is really going on here? Well, recall that in April, just as yields exploded higher after Liberation Day, Powell appears on BBG TV and said that if the Fed does nothing, the Treasury has a “big toolkit” and could “up the Treasury buybacks” (to prop up Treasuries, in lieu of QE).

Must watch interview: Bessent reveals he has breakfast with Powell every week, and also reveals that if the Fed does nothing, the Treasury has a “big toolkit” and could “up the Treasury buybacks” (to prop up Treasuries, in lieu of QE). https://t.co/XX24GkV9Ru https://t.co/iABbJiYXVG

— zerohedge (@zerohedge) April 15, 2025

Which of course is another way of saying that the Fed and Treasury are once again planning on “merging” and that Yield Curve Control – which requires a consolidated Fed/Treasury – is coming.

Loading recommendations…