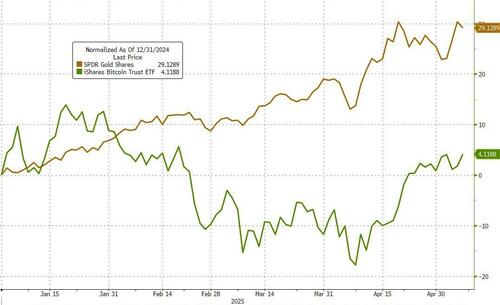

Year-to-date, gold prices have dramatically outperformed those on bitcoin…

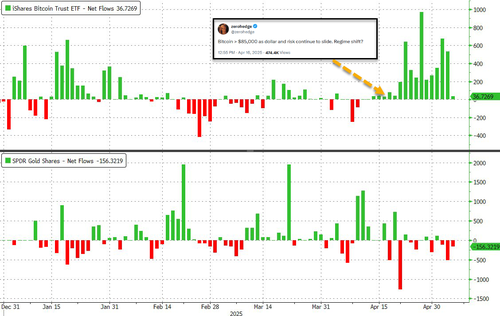

However, despite this dramatic divergence, the performance chasm has failed to deter investors putting new money to work as inflows into IBIT (BlackRock’s spot bitcoin ETF) have surpassed inflows into GLD (SPDR Gold Trust ETF).

Eyeballing the daily net inflows, one can see a pattern where flows seem to swing from one ‘alternative currency’ asset to another…

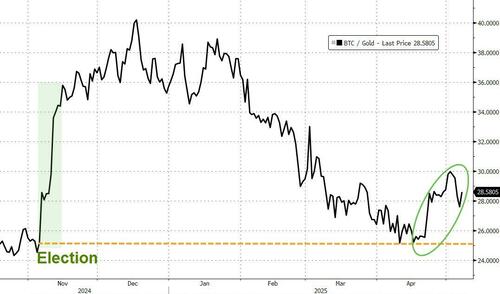

The relationship has been very cyclical since the election when ‘digital gold’ dramatically outperformance the barbarous relic. But from the start of February, gold has outperformed bitcoin.. until erasing all of the outperformance and prompting a relative recovery for crypto…

The majority of recent inflows in bitcoin ETFs has been dominated by IBIT…

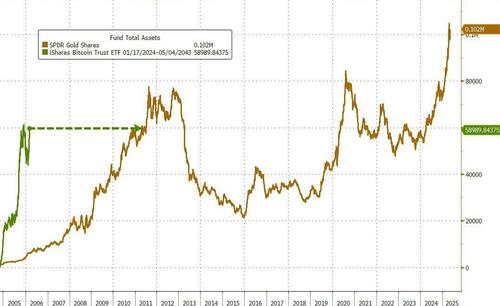

“To take in more cash in that scenario is really good sign for long term, and inspires confidence in our call that BTC ETFs will have triple gold’s aum in 3-5yrs,” Bloomberg’s Eric Balchunas said on X.

Finally, we note that IBIT total AUM (which obviously accounts for not just flows but asset appreciation also) is as high now (after just over a year) as GLD’s total AUM was after 7 years…

And it could be about to accelerate further as Bernstein analysts think companies could put up to $330 billion into Bitcoin over the next five years, with strategies like Michael Saylor’s leading the way, according to a new report. Bitcoin is quickly becoming more than just a speculative asset—it’s starting to look like a serious option for corporate treasuries.

Strategy has employed a unique mix of equity sales, debt issuance, and corporate cashflows to fund its Bitcoin purchases—part of a long-term initiative dubbed the “21/21” capital plan, which it recently doubled to $84 billion in its new 42/42 raising efforts. Now, according to Bernstein’s May 5 report, Strategy could go even further:

“In our bull case, we expect MSTR to hyper scale its capital strategy, utilizing ~ $124 billion for bitcoin acquisition,” the analysts wrote.

This level of investment would not only solidify Strategy’s dominance in the corporate Bitcoin space but also signal to other firms the viability of such an approach.

Loading…