Authored by Mark Jeftovic via BombThrower.com,

Excerpt from the July Issue of The Bitcoin Capitalist – ‘The Stablecoin Standard’

Here is the the argument for this section of the Bitcoin Capitalist entitled ‘Bitcoin and Crypto Macro’:

“This sums up everything we’ve been seeing over this past cycle – Bitcoin settling in as the base layer for the next generation of financial instruments, with stablecoins acting as the rails between the legacy dollar system and new fintech-enabled one.”

Here is the whole section.

* * *

I want to reiterate something I used as the opening quote to our Bitcoin Treasuries Playbook, by way of Willy Woo:

“The biggest fintech opportunity in the next decade is not DeFi.

It’s the merger of BTC + TradFi.”

This sums up everything we’ve been seeing over this past cycle – Bitcoin settling in as the base layer for the next generation of financial instruments, with stablecoins acting as the rails between the legacy dollar system and new fintech-enabled one.

Billionaire investor and VC Tim Draper remarked on Bitcoin’s continued dominance, making the argument that what we are witnessing is an example of a “winner-take-all” phenomenon:

Bitcoin recently hit 61% market share, up from 40% after the first boom-bust cycle and 50% after the last one.

There is a gravitational pull toward Bitcoin. All the successful innovations on other platforms are being now ported to Bitcoin.

This matters so much more than people realize.

All the innovation that started in altcoins (smart contracts, blockchain applications, ordinals) is moving to Bitcoin.

I liken this phenomenon to Microsoft in the operating system days.

When Lotus 1-2-3 took off, Microsoft created Excel and brought it into the OS. WordPerfect succeeded, so Microsoft built Word. Then Microsoft bought PowerPoint early. All of these applications became standard with Microsoft, while the early startups were marginalized.

Bitcoin is worth $1.8 trillion. The next largest token, Ethereum is only worth $250 billion. Bitcoin gets most of the programmers now. They are gravitating toward Bitcoin.

The five applications that really matter are being built on Bitcoin—DeFi (Peer to Peer Payments, Trading, Exchanges, financial inclusion etc), Smart Contracts (supply chain transparency and traceability, asset trading and resource tracking), Ordinals, Runes, and Layer 2 solutions like low cost micropayments.

This gravitational pull is accelerating.

Every entrepreneur building on Bitcoin has the entire ecosystem’s momentum behind them.

Smart entrepreneurs are always building on the platform with the strongest gravitational pull.

That platform is Bitcoin.

When people ask what Bitcoin will be worth in 5 years, I say it will be worth one bitcoin. It may be infinite against the dollar as the dollar continues to inflate into nothingness.

Bitcoin’s dominance was 61% when Draper posted that less than a week ago – it’s now 64%:

Meanwhile, Ethereum continues to languish, although there are those who say it’s undervalued and poised for a spectacular comeback – I just don’t see it.7

As noted in the Treasuries Playbook, we’re now starting to see ETH Treasury companies springing up; we mentioned SBET in that report – currently trading even lower than when we first cited it.

Now a Bitcoin miner of all things, BitMine Immersion Tech (NYSE: BMNR) has appointed Tom Lee (not the Motley Crüe drummer) as Chairman – and closed a $250M funding round to build an ETH treasury.

BitMine has the 62nd-largest corporate Bitcoin treasury at 161 BTC – and it’s unclear if they plan to liquidate that for more ETH purchases. I advise against it.

Bit Digital (BTBT) – also eschewing my advice – will be exiting Bitcoin mining entirely to “become an Ethereum pure-play”: they will sell off their Bitcoin (which according to their March investor deck was 742 BTC) in order to acquire ETH – and sell off or wind down their entire Bitcoin mining operation. We’ve never owned BTBT, good luck.

We did hold Sol Strategies, who set out to build a Solana Treasury company about a year ago, and we managed to ride that one near perfectly – exiting our position (for a stellar 2043% return) when I surmised that the memecoin trade was over, and there would be no alt-season as we’d seen in previous cycles.

Sol Strategies also had a BTC treasury – which I had hoped they would keep as an anchor – but they sold it off to buy more SOL, close to the highs – meanwhile Bitcoin has gone on to fresh new highs.

Future MBA and finance students may someday look back on this era and surmise that crypto treasury strategies can only succeed when the asset being stockpiled is the dominant asset, and it probably needs to be over some magical hurdle like 50% market dominance.

It also needs to have a rolling four and ten year CAGR that is higher than anything else, otherwise there’s no point in stockpiling it versus something with a higher RoR (see the “Bitcoin is the new Benchmark” section in the Playbook).

In other words, it has to be Bitcoin and all other treasury plays will stiff. Bank on it.

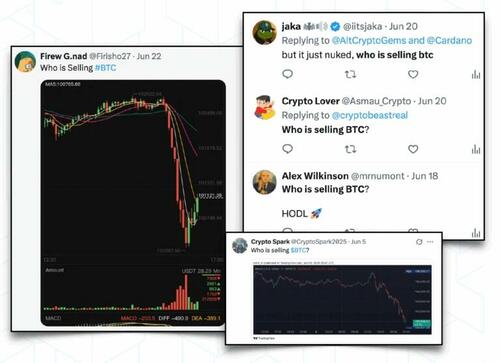

So, if Bitcoin is the only game in town for corporate treasuries and for the base layer of the next-gen financial system, “why isn’t BTC going up?”, is the question we’re seeing a lot of on social media…

Especially after that horrific crash all the way down to (checks notes), $98K on June 22nd – losing the psychologically important $100K level for nearly a whole eight hours.

People were permanently scarred – most likely from the Class of ’24.

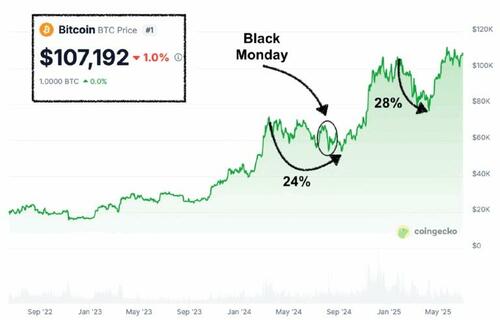

One of the things I’ve been wrong about for this entire cycle was that we should be expecting a couple of 30% to 40% drawdowns, at least.

But there hasn’t been anything over 30% since November 2022, when the crypto winter ended, and Bitcoin bottomed at $16K (yes, really).

The chart below has the two major drawdowns of this cycle: the pull back after the spot ETFs approvals and post-halving hangover look like a single grind down – and that little squiggle in there in August was when the entire financial system shit itself after the Bank of Japan spoiled everything with a surprise rate hike that was a measly 15 basis points over expectations.

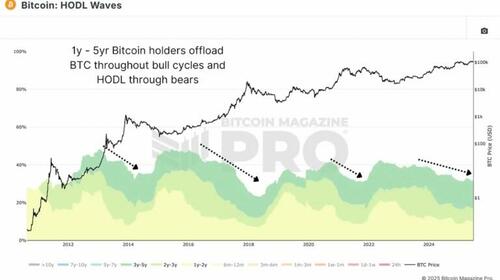

In this look at the very question of why “number not go up”, Bitcoin Magazine examined the HODL waves and concluded that there are just a lot of whales sitting on ultra cheap BTC who are taking their lifetstyle chips off the table, with over 240,000 BTC being sold by wallets that have been holding for one to five years in recent months.

“This selling has largely counterbalanced institutional accumulation. Given that daily miner issuance still adds another ~450 BTC to the market, we see why price has struggled to break higher: the market is in a state of supply-demand equilibrium”

Given the systemic shocks and seemingly existential crises that have been arriving at a steady clip (Japan imploding, bond yields, Middle East war, Ukraine War, etc), “Why isn’t Bitcoin Up?” isn’t the foremost question in my mind.

“Why isn’t it going down more during these periods?”, is what I’ve been wondering.

It is possible, even looking likely, that the market structure has fundamentally changed, possibly to the point where (dare I say it?) the four-year cycle could be a thing of the past.

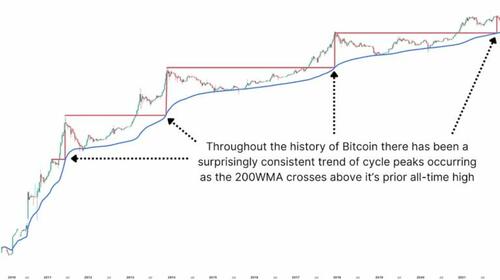

Or maybe elongated, this other Bitcoin Mag piece looks at the 200-week Moving Average compared to prior cycles, noting that:

“a remarkably consistent pattern has emerged when the 200WMA surpasses its prior all-time high level. Across multiple cycles, when this crossover occurs,

Bitcoin has either peaked or come extremely close to peaking in price.”

Should that pattern hold up, we seem to be looking at somewhere around May or June 2026 for this cycle to top out (we would normally expect BTC to hit a cycle-top in Q4 this year or early ’26, if the four-year cycle holds up).

Loading…