Boeing is back to its old ways:

Shares of the aerospace giant slumped after Boeing announced a $4.9 billion accounting charge and another delay for its 777X jetliner, now expected to enter service in 2027, a reminder of the long recovery ahead for the troubled planemaker even as rising aircraft deliveries bolster its cash, with the company announcing that 737 production was now at a rate of 42 jets per month.

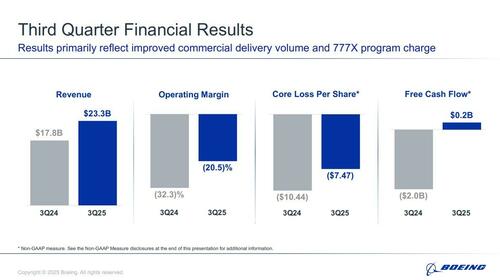

The non-cash writedown overshadowed third-quarter earnings, with a $7.47 loss per share that was wider than the $4.44 deficit predicted by analysts. Revenue was $23.27 billion, compared with the $22.3 billion average estimate.

The company also generated free cash flow of $238 million during the quarter, a feat it last accomplished in the final months of 2023. Boeing was forced to raise cash last year, following a near-catastrophic accident in the first days of 2024 that threw its production into disarray and led to a change in senior management. Analysts had expected the planemaker to burn through $884.1 million in cash before attaining positive cash flow during the fourth quarter.

Here is a snapshot of what the company reported for Q3:

- Core loss per share $7.47 vs. loss/shr $10.44 y/y, far worse than the estimated loss/shr $4.44

- Revenue $23.27 billion, beating estimate $22.29 billion

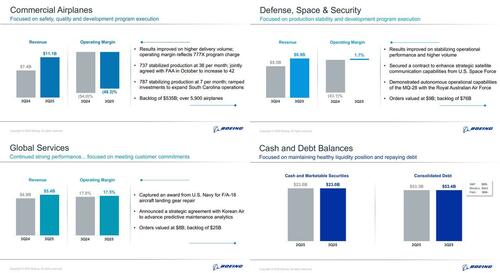

- Commercial Airplanes revenue $11.09 billion, +49% y/y, beating estimate $10.56 billion

- Defense, Space & Security revenue $6.90 billion, beating estimate $6.2 billion

- Global Services revenue $5.37 billion, beating estimate $5.2 billion

- Commercial airplanes operating loss $5.35 billion, missing estimate loss $655.4 million

- Defense, Space & Security operating earnings $114 million, missing estimate $130.4 million

- Global services oper earnings $938 million, beating estimate $929.9 million

- Adjusted free cash flow $238 million, beating est. negative $884.1 million (Bloomberg Consensus)

- Operating cash flow $1.12 billion vs. negative $1.35 billion y/y, beating est. negative $197 million

- Backlog rises to $635.69 billion

And visually:

The US planemaker delivered 160 aircraft during the quarter, the most since 2018, and the pace should continue rising as Boeing boosts 737 production by 10% to the higher rate recently approved by US regulators. The step-up in the factory pace hasn’t yet fully been implemented, Ortberg told employees.

According to Bloomberg, Boeing has now recorded almost $16 billion in total charges for the 777X, a strategically important aircraft that is running seven years behind schedule amid tough regulatory scrutiny and is now scheduled to enter service in 2027. The latest charge shows how CEO Kelly Ortberg still faces multiple challenges to stabilize the company, even as Boeing benefits from surging aircraft orders with support from the Trump administration.

Ortberg alerted investors during a September address that the 777X program faced delays and complex paperwork in the final flight-testing phase as engineers and US regulators work through a new certification processes. The program is in a so-called reach forward-loss position under Boeing’s arcane accounting methodology because costs have ballooned past the point where they’ll be recovered on the first 500 airplanes built.

As a result, the company must immediately book any new abnormal costs and overruns as a charge to earnings. Prior to the third quarter results, Boeing had already recorded almost $11 billion in charges related to the jet.

“With a sustained focus on safety and quality, we achieved important milestones in our recovery as we generated positive free cash flow in the quarter and jointly agreed with the FAA in October to increase 737 production to 42 per month,” said Boeing CEO Kelly Ortberg. “While we are disappointed in the 777X schedule delay, the airplane continues to perform well in flight testing, and we remain focused on the work ahead to complete our development programs and stabilize our operations in order to fully recover our company’s performance and restore trust with all of our stakeholders”

“We are now moving forward with a higher confidence plan and taking steps to improve our performance,” Ortberg, who has been in the job for little over a year, said in a memo to employees.

The 777X is an updated version of Boeing’s popular 777 model, the company’s largest civil aircraft in production. Airbus SE, which also reports earnings later on Wednesday, competes with its A350 plane. Airlines including Emirates, the biggest buyer of the 777X, and Deutsche Lufthansa AG, the launch customer for the plane, have had to revise their fleet modernization plans as Boeing kept pushing back introduction of the giant jet.

Despite the latest 777x sertback, the better-than-expected revenue and free cash flow in the quarter underscores the improvement to the 737 and 787 Dreamliner production this year. That’s a break from the costly delays and quality lapses on the two models that have frustrated customers and weighed on its finances for a half-decade.

Boeing’s general recovery remains “intact and the supply-chain backdrop is probably improving — although you always worry when you say that about Boeing,” said George Ferguson, an analyst with Bloomberg Intelligence.

When Ortberg and Jay Malave, Boeing’s new chief financial officer, host an earnings call later today, analysts will be looking for more detail around the impact to Boeing’s defense division from a strike by St. Louis-area factory workers, which is approaching its 90th day. Also of interest: the status of efforts to certify the final two 737 Max models, and guidance on how the 777X delay will affect cash over the next two years.

Boeing shares fell 0.7% in premarket trading in New York. The stock had jumped 26% this year through Tuesday’s close.

The company’s Q3 investor presentation is below (pdf link).

Loading recommendations…