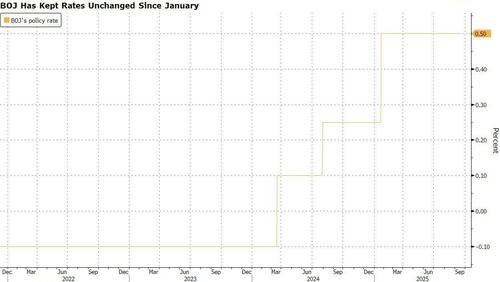

With nobody expecting a rate hike by the BOJ today (although many were looking for hints of an October move), the Japanese central bank did not surprise markets and it held rates unchanged at 50bps (although in a notable twist, 2 BOJ members dissented hawkishly, seeking a rate hike). Where there was a notable surprise however, was in the BOJ’s decision to take another step toward policy normalization, announcing it would start to offload its massive ETF holdings while keeping the door open to further hikes this year including in October.

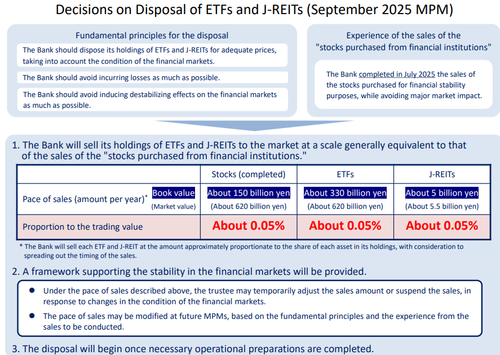

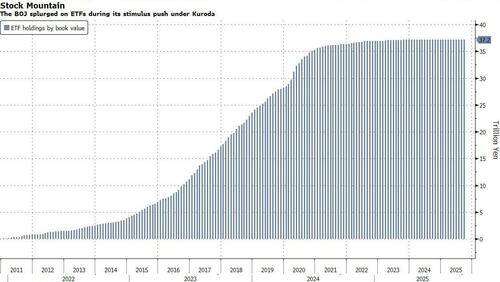

The central bank announced early on Friday it will start selling its well over ¥75 trillion ($508 billion) stockpile of ETFs by market value at a pace of about ¥330 billion in book value per year (and about double that in market value). Indicatively, the pace was smaller than what Goldman economists had projected: ¥600 billion per year (book value; about ¥1.1 trillion at market value), or twice that pace at ¥1.2 trillion per year (about ¥2.3 trillion at market value) over roughly 30 years.

While at the BOJ’s proposed rate it would take more than a century to sell, stocks fell as it marked the first time the BOJ has laid out a plan for offloading the assets accumulated over years of ultra-easy monetary policy.

Sales could begin early next year, Bloomberg reported citing a person familiar with the matter. In any case, the glacial pace of selling will take a loooooong time because the BOJ is terrified markets can frontrun its liquidations and send the local stock market crashing.

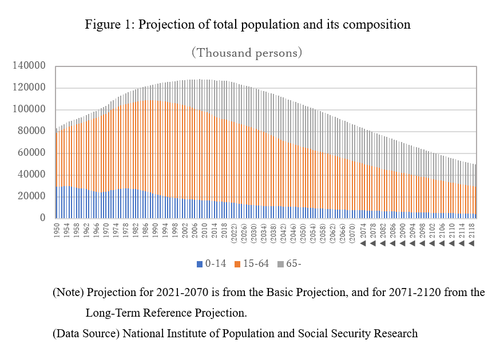

“We won’t be here in 100 years’ time,” Governor Kazuo Ueda said at a post-decision news conference. “But our intention is to keep selling for more than 100 years.” Of course, by then Japan – whose demographic collapse is truly staggering – will be some 60% smaller…

… while its ETF pile will be at best a few percent less.

The 7-2 vote to keep its policy rate at 0.5% also marked the first time there were two dissenters (Takata and Tamura) against a hold decision since Ueda took office in 2023 voting to raise rates instead, showing that pressure is building for Japan to raise interest rates. While the outcome on rates was expected by all 50 economists surveyed by Bloomberg, anticipation for a move is set to build ahead of the next policy meeting on Oct. 29–30. Ueda’s comments during his news conference didn’t obviously rule out an October hike, instead noting that the BOJ still needed to parse various data before making a decision.

After three consecutive rate hikes since the start of 2024, the second of which sparked the biggest crash in Japanese stocks since Lehman, the BOJ has gotten cold feet and kept rates on hold since January.

Following the announcement, BOJ Governor Ueda did not provide much clarity during his press conference, saying Japan’s economy is recovering moderately, albeit with some weakness; will continue to raise policy rate if economy and prices move in line with forecast.

- On the economy: Downside risks to economy still present.

- On policy: Not considering changing pace of ETF sales to adjust monetary policy. Not thinking now of repurchasing ETFs as monetary policy tool. Decision on timing of next rate hike would depend on the risk of US tariff impact materialising and the course of food inflation.

- On trade/tariffs: The domestic economy is withstanding tariff impact. Tariff costs likely to be passed down to consumers in the US from November. Not seeing negative impact in Japan’s economy from US tariffs.

Overall, it seems that an October move is on the cards assuming that data, October 1st Tankan in focus, presents no surprises and the October 4th LDP leadership contest occurs without a major curveball; helpfully, Ueda is scheduled to speak on October 8th.

“Ueda’s press conference didn’t provide any clear direction. In other words, he didn’t rule out an October rate hike either,” said Hideo Kumano, economist at Dai-Ichi Life Research Institute. “I believe December is the next timing for a rate hike, but I think it’s entirely possible it could happen in October.”

Taken together, Bloomberg writes that “the central bank’s moves Friday highlighted further progress in Ueda’s normalization campaign.” Since taking over the reins at the BOJ in spring 2023, the governor has taken multiple steps to unwind the massive easing program conducted under his predecessor Haruhiko Kuroda, and the fate of ETFs was the last major question still remaining.

To put the announcement in context, The BOJ’s ETF holdings are worth around ¥37 trillion by book value and was about ¥70 trillion at market value at the end of March. It became the single biggest holder of Japanese stocks around 2020 during its massive monetary easing program, which ended last year.

While the bank stopped its regular buying of ETFs some time ago, the value of its holdings has continued to rise as the stock market hit record highs earlier this week. The Nikkei 225 has gained around 26% since the start of this fiscal year.

The lack of rate action on Friday was widely expected after Prime Minister Shigeru Ishiba’s resignation declaration kicked off a race for his successor, roughly a year after the last leadership election. From an economic perspective, BOJ officials are still assessing the impact of US tariffs both at home and abroad even after Japan managed to solidify its US trade deal, people familiar with the matter told Bloomberg earlier. It may be possible to raise rates again this year regardless of domestic political uncertainty given current economic conditions.

Friday’s policy statement reiterated the BOJ’s projection that inflation is likely to be in line with its goal in the second half of its three-year projection period, in another signal of the bank’s continued progress toward another rate hike. Board members Hajime Takata and Naoki Tamura proposed raising rates to 0.75%, each citing a different reason to do with inflation.

“We don’t necessarily have to see all of the data through to the end,” Ueda said on judging the impact of tariffs on the US economy for example. “We probably have no choice but to move based on what we forecast based on data that keep coming in.”

The BOJ’s ETF surprise hit Japanese stocks, which erased earlier gains, with the Nikkei-225 gauge closing down 0.6%. Bonds fell, sending yields on two-year and 10-year government bonds higher as expectations increased for a future rate hike from the BOJ. In the swaps market, the chance of a hike by the BOJ at the next meeting at the end of October increased to more than 50%, and the yen made gains against the dollar which were later mostly erased.

d

Loading recommendations…