By Charles Kennedy of OilPrice.com

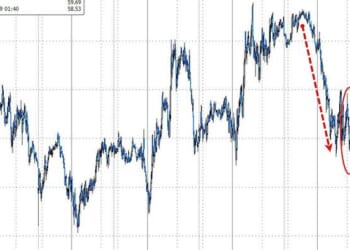

Brent Crude prices topped $70 per barrel – and $71 shortly after – early on Thursday for the first time since September, as U.S. President Donald Trump warned Iran that a “massive armada” of U.S. Navy ships is headed to the Persian Gulf.

At the time of writing, Brent Crude prices had jumped by 3.38% at $70.71. This was the highest in more than five months and the first time the international benchmark has topped $70 per barrel since early August. The U.S. benchmark, WTI Crude, was also trading higher, up by 3.51% to $65.43. WTI topped $65 per barrel for the first time since September.

After a week or so of relative calmness in the U.S. rhetoric toward Iran, which continued to brutally suppress mass protests, President Trump warned the Islamic Republic of a Venezuela-style “mission,” at least this is what the President suggested in a post on his Truth Social platform.

“A massive Armada is heading to Iran. It is moving quickly, with great power, enthusiasm, and purpose,” President Trump posted.

“It is a larger fleet, headed by the great Aircraft Carrier Abraham Lincoln, than that sent to Venezuela. Like with Venezuela, it is, ready, willing, and able to rapidly fulfill its mission, with speed and violence, if necessary,” the President continued.

He urged Iran “to make a deal” pledging “NO NUCLEAR WEAPONS,” otherwise, President Trump said, “The next attack will be far worse! Don’t make that happen again.”

Markets reacted to the renewed tension in the world’s most important oil-producing and exporting region, and oil and gold soared.

Iran, for its part, said that its army is ready to “immediately and powerfully” respond to any possible attack by the United States.

“Our brave Armed Forces are prepared—with their fingers on the trigger—to immediately and powerfully respond to ANY aggression against our beloved land, air, and sea,” Iran’s Foreign Minister Abbas Araghchi posted on X.

If Trump tries to enforce a blockade, Iran will retaliate using asymmetrical means.

The Houthis caused havoc for global trade by hitting just 30 vessels over two years. Iranian attacks on merchant vessels in the Persian Gulf will have far greater impact.https://t.co/oLKvUzFrVd

— Esfandyar Batmanghelidj (@yarbatman) January 28, 2026

Commenting on the latest flare-up in the Middle East, ING commodities strategists Warren Patterson and Ewa Manthey said on Thursday, “Clearly, this more aggressive rhetoric has left the oil market nervous about the potential for supply disruptions.”

Loading recommendations…