Authored by Jill McLaughlin via The Epoch Times,

Low incentives and complicated state regulations, combined with high housing and business costs, have rendered California unable to keep Hollywood from moving production to other states and countries, according to an entertainment industry report released on May 27 by the Milken Institute, a California-based think tank.

Hollywood’s in-state production has dropped in the past two years as other states and international destinations continue to increase industry incentives, according to the report’s authors, Kevin Klowden, executive director for the Milken Institute Finance, and Madeleine Waddoups, a graduate teaching assistant in the Luskin School of Public Affairs at the University of California–Los Angeles.

The industry has contributed for more than a century to the state’s cultural and physical exports, has a huge impact on tourism, and has also boosted the fields of design, technology, and innovative manufacturing, according to the report, adding that numerous other industries depend on the movie and television business and its contribution to the state’s identity, jobs, and exports.

The industry has seen many highs and lows in California over the past 100 years or more, but has never faced the “wide ranging” threat now posed to production after television reached its peak in 2021, the authors said.

“The consequences for California have been significant,” the institute said.

The Golden State lost $4.14 billion in industry output and more than 17,200 jobs from 2019 to 2023.

“While most states other than New York cannot compete with California’s combination of skilled workers and filming infrastructure, California’s base 20 percent incentives, combined with dramatically higher housing and business costs, have left the state uncompetitive,” the institute found.

A “base 20 percent incentive” means the tax credit in California starts at 20 percent of a film producer’s in-state spending, up to a specified amount.

Previous disruptions to the entertainment industry in California have involved the advent of television in the late 1940s, a strong dollar in the 1990s, and competitive film incentives in the early 2010s, the report said.

But Hollywood has never faced several issues at the same time, as it has recently, according to Milken.

“Combined with high levels of financial strain facing the studios in the wake of the 2023 strikes, driven by stagnating streaming growth and the loss of prior revenue streams in DVDs and broadcast television, the need to find less expensive locations has never been stronger,” the institute reported.

The consequent impact on the state’s workers and businesses—inside the industry and supporting it—“has never been felt more quickly and more severely,” according to the study.

The Hollywood sign in Los Angeles on Dec. 29, 2022. Stefani Reynolds/AFP via Getty Images

Streaming growth has slowed nationally. From 2019 to 2023, revenue from streaming content increased by 150 percent.

That growth is expected to slow significantly, however.

Pricewaterhouse Coopers (PwC), which provides professional services to the global entertainment and media industry, projects only 30 percent growth in streaming revenue from 2023 to 2028, according to the Milken Institute.

“This growth has not been enough to offset the decline in revenue and demand from movies, broadcast, television, and cable,” the report authors wrote in the executive summary.

National entertainment jobs also decreased by nearly 14 percent from 2019 to 2023. The number of productions peaked around 2016, the institute reported.

From the spring of 2019 to the spring of 2024, entertainment jobs dropped by 15 percent in California, the institute reported. Adding to the pain, working hours and wages in California’s entertainment industry did not bounce back after the 2023 writers and actors strikes during the union-driven national “summer of strikes.”

The five-month writers strike was declared over in September 2023 after they reached an agreement with major studios that included significant multi-year pay raises, more health insurance contributions, regulations on the use of artificial intelligence (AI), and other production guarantees.

The actors settled their contract with studios two months later. The $1 billion contract also includes pay increases, AI regulations, and the introduction of streaming participation bonuses.

According to the Milken study, the entertainment industry had 28.5 average weekly hours and $30.84 average hourly earnings in 2023. In 2024, from January to November, that number dropped to 27.3 average weekly hours and $27.38 average hourly earnings.

“The problem is particularly noteworthy in filming activity within Los Angeles County,” the institute reported.

Since 2019, the number of on-location filming days has dropped by nearly 36 percent in Los Angeles, and soundstage filming days dropped by nearly 30 percent, according to FilmLA, a film office for the city and county of Los Angeles and other local jurisdictions.

Outside competition for production has strengthened since 2014. Other states are increasing incentives to attract productions. New York has grown its annual incentives funding from 2022 to 2025, raising the budget to $700 million per year and increasing the base credit rate to 30 percent.

Texas is also expected to increase its biannual incentives to nearly $500 million per year by the end of 2025, according to the report.

California allocates $330 million.

The Milken Institute recommended several actions to address the lack of work before the loss of talented workers, prop houses, costume shops, catering firms, camera rentals, and other businesses “becomes irrecoverable.”

The institute recommended increasing the state’s film incentive rates to a base of 30 percent and offering at least $700 million in production incentives per year. The changes would generate nearly $3 billion in more entertainment spending in California, and nearly $6 billion in total output to the state’s economy, according to the report.

Another idea was to address gaps in productions, include shorter-form shows under 40 minutes, and increase coverage for independent films and mid-budget productions that provide consistent streams of regular local work.

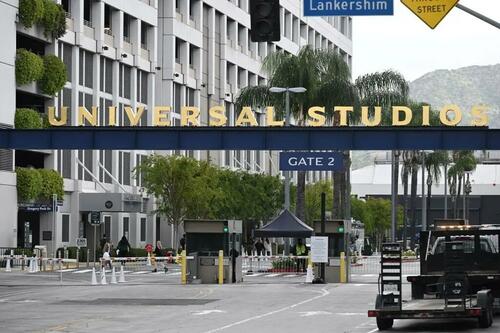

An entrance to Universal Studios in Los Angeles County on May 2, 2023. Robyn Beck/AFP via Getty Images

The institute also suggested moving to a year-round schedule for allocating tax incentives and improving the state’s regulatory processes for applying for the credits.

The report also mentioned streamlining and improving local filmmaking permits and easing restrictions on the use of local buildings.

Local, state, and federal officials have responded to the entertainment industry crisis in California in the past few months.

In May, Los Angeles Mayor Karen Bass issued an executive directive to support local production and boost jobs. The order aims to lower costs, streamline city processes, and increase access to iconic city locations.

In October, Gov. Gavin Newsom proposed a plan to expand the tax credit program for the film and television industry to $750 million—more than double the current $330 million allocation.

And President Donald Trump also announced on May 4 that he authorized his administration to impose a 100 percent tariff on movies produced outside the United States as a way to protect the industry.

Loading…