Let’s keep the budget math nice and simple. Back in March, the Congressional Budget Office (CBO) projected the national debt climbing to 118 percent of GDP by 2035, up from 100 percent this year. Now tack on another 10 percentage points or so thanks to the budget bill just signed by President Trump. A sub-optimal outcome.

Yet amid this continued drift away from solvency, an intriguing theory has emerged: Artificial intelligence might generate enough added economic oomph to stabilize or even reverse America’s dangerous debt trajectory.

It’s a tempting scenario for politicians to latch onto. If AI is the new electricity, as some enthusiasts suggest, then faster productivity growth could generate a revenue windfall, offset deficits and debt, and lessen the need for painful spending cuts or tax hikes.

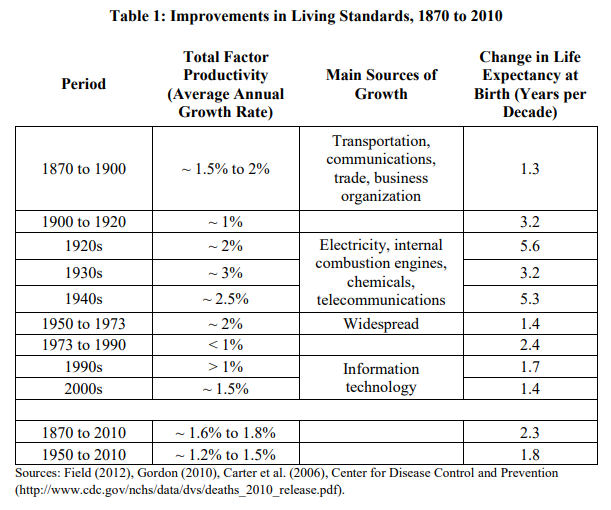

Good news: There’s precedent. According to the CBO’s historical data, total factor productivity (TFP) growth—essentially how much more output we get from the same amount of labor and capital, often driven by technology and innovation—averaged 1.6 percent to 1.8 percent annually from the late 19th century through the 2000s. These gains came in transformative waves tied to economy-altering, general-purpose technologies like electricity and the internet.

That historical backdrop makes a recent paper by Douglas Elmendorf, Glenn Hubbard, and Zachary Liscow (EHL) all the more striking—and revealing in its limits. Drawing on Congressional Budget Office scenarios, the authors show that a sustained 0.5 percentage point annual increase in TFP growth—if somehow achieved—would reduce debt held by the public by 12 percentage points of GDP by placing the US economy back on its historical productivity trajectory. Over 30 years, such a TFP acceleration could shrink the debt-to-GDP ratio by 42 points.

But the EHL paper is clear: None of the plausible policy reforms it examines—covering immigration, housing, permitting, R&D, and business taxes—comes close to producing such a TFP growth surge. They conclude that growth-enhancing reforms may help trim future tax hikes or spending cuts but cannot, on their own, stabilize the debt. That half-point TFP boost remains a hypothetical scenario, not a forecast or expectation grounded in current policy options.

That’s where AI enters the picture—not in the EHL paper, but in today’s broader debate. If AI technologies do generate a historic step-change in productivity akin to past GPTs, the fiscal upside could be transformative. But that’s a speculative bet, not yet an empirically grounded plan.

It would be awesome, however. Joe Davis, investment firm Vanguard’s global chief economist and head of investment strategy, assigns a 45–55 percent probability to a “productivity surge” scenario, one where AI becomes economically transformative by the 2030s. Under this outcome, technology keeps inflation in check while higher tax revenues from stronger growth cause the gusher of red ink to stabilize. So kind of a 1990s replay.

Yet prudent fiscal policymaking shouldn’t bank on technological salvation. Davis also sees a 30–40 percent chance of AI disappointing, leaving productivity sluggish while deficits continue climbing.

Yes, the case for AI optimism is reasonable. But it’s not nearly certain enough to bet the public purse on a best-case outcome or even something a bit short of that. Savvy politicians should pursue a dual strategy: embrace growth-friendly AI policies while maintaining fiscal discipline. This means permitting reform, science investment, R&D incentives, high-skilled immigration … and fixing entitlements sooner rather than later.

The AI productivity boom may materialize, but to wager America’s fiscal future on it would be the ultimate tech gamble. A better play: Hope for exponential growth, but budget for linear reality.

The post Can Artificial Intelligence Rescue America’s Fiscal Future? appeared first on American Enterprise Institute – AEI.