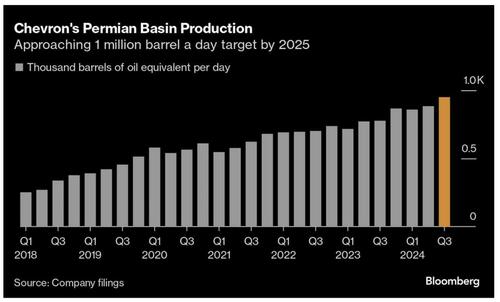

Chevron is approaching a production plateau in the Permian Basin—America’s top oil field—and expects this shift to generate billions in free cash flow, according to Bloomberg.

The company is cutting back on drill rigs and frack crews as it nears its long-term target of 1 million barrels of oil equivalent per day, which it expects to sustain through 2040.

“We’re going from growth to cash generation,” said Bruce Niemeyer, president of Chevron’s shale business. “We’re already in the earliest phases of that. We’re making adjustments to rigs and the frack spreads which will reduce the amount of capital we’re spending on an annual basis.”

Chevron has reduced its rigs from 13 to 9 and frack crews from four to three this year. These cutbacks are expected to boost free cash flow from the Permian by $2 billion over this year and next, reaching $5 billion annually by 2027, assuming Brent crude averages $60 a barrel.

“A million barrels is the right plateau for us to carry out into the next decade,” Niemeyer said. “It’s the natural next phase. You want to create something at scale that ultimately supports our dividend objectives.”

Bloomberg writes that unlike conventional oil production, shale wells decline quickly and require constant reinvestment. But Chevron believes it’s cracked the code: after 65% production growth over five years, the company now operates at a scale and efficiency that allows it to maintain output with lower capital spending.

“Chevron shifting from growth to flat-lining is coming at the right time because the market doesn’t need them to meaningfully grow,” said Neil Mehta, an analyst at Goldman Sachs. “Now that they’ve gotten to scale, the right thing to do is to shift this business into a free cashflow orientation.”

Chevron’s position is strengthened by a rare asset: mineral rights inherited from a 19th-century railroad bankruptcy. Originally acquired by Texaco in the 1960s, these rights—now part of Chevron—mean the company produces about 15% of its Permian oil with zero capital costs.

“It’s a meaningful competitive advantage for them as an organization,” said Mehta. “Chevron has that embedded in its portfolio and doesn’t necessarily always get full cost recognition for it.”

While other oil majors exited the Permian during downturns, Chevron stayed. That decision paid off when shale boomed.

“The decision to stay in the Permian was very deliberate,” Niemeyer said. “We tend to enter basins and stay for a very long period of time, and that isn’t true of everybody.”

Loading…