Shares of Chipotle Mexican Grill plunged in premarket trading after the company slashed its full-year sales outlook for the third time this year, now forecasting a low single-digit decline from the previous reporting year instead of flat growth. The downgrade reflects a clear pullback in discretionary dining behavior this fall, as working-class consumers tighten budgets amid mounting economic pressures. None of this should come as a surprise, as we cautioned in our note last week, “Low-Income Consumers Pulling Back on Restaurant Spending May Signal Trouble Ahead.”

Trouble ahead indeed: Shares of Chipotle cratered 18% in premarket trading, adding to a brutal 34% year-to-date decline. It’s been a rotten year for investors as the burrito chain, heavily exposed to younger, cost-sensitive consumers with mounting student loans and insurmountable credit card debt, bears the brunt of an emerging pullback in discretionary spending and waning appetite for eating out.

If premarket losses hold through intraday cash, this would mark Chipotle’s worst down day since July 20, 2012.

“The consumer slowdown is really affecting our business in a meaningful way,” CEO Scott Boatwright told Wall Street analysts on Wednesday evening after an earnings call.

For the third quarter, Chipotle’s comparable-store sales marginally increased but missed Bloomberg Consensus expectations. There were widespread misses on key operational and margin metrics, which only suggest softer sales momentum and elevated cost pressures:

-

Comparable sales: +0.3% (missed Bloomberg Consensus est. +0.99%)

-

Adjusted EPS: $0.29 (in line with est. $0.29)

-

Revenue: $3.00B (slightly below est. $3.02B)

-

Operating margin: 15.9% (vs. est. 16.6%)

-

Restaurant-level margin: 24.5% (vs. est. 25.5%)

-

New restaurants opened: 84 (below est. 90.96)

-

Total restaurants at quarter-end: 3,916 (vs. est. 3,929)

-

Average restaurant sales: $3.13M (in line with est. $3.12M)

The full-year also disappointed investors by cutting the outlook for the third time:

-

Comparable restaurant sales: Now expected to decline in the low single digits (previously forecast about flat)

-

New restaurant openings: Still projected at 315–345 (vs. consensus estimate 333)

Rymer also noted that some consumers are trading down from higher-priced steaks to cheaper chicken options, while continuing to purchase extras like guacamole and drinks. Compounding its troubles, the fast-casual chain also faces operational challenges, including digital order errors, ingredient shortages, and cleanliness issues.

Wall Street commentary on the consumer pullback at Chipotle (courtesy of Bloomberg):

Bloomberg Intelligence analyst Michael Halen

Chipotle’s quarterly same-store sales may drop low- to mid- single digits “as traffic plummets“

“The 4Q restaurant margin may contract meaningfully vs. 4Q24’s 24.8%, based on guidance, due to sales deleveraging and wage and commodity inflation”

Morgan Stanley analyst Brian Harbour (overweight, PT to $50 from $59)

While the 3Q was roughly in line, “4Q stepping down and with slower traffic, more inflation and less price”

“Stock likely under pressure as 4Q remains tough”

Stephens analyst Jim Salera (equal-weight, PT $48)

Chipotle’s lowered FY25 same-store sales guidance to declines of low single-digit % versus flat likely implies a sequential step-down in 4Q25

“Looking to FY26, we believe CMG’s premium multiple could be at risk if the company cannot show signs of accelerating comps back towards the MSD% [mid single-digit] range”

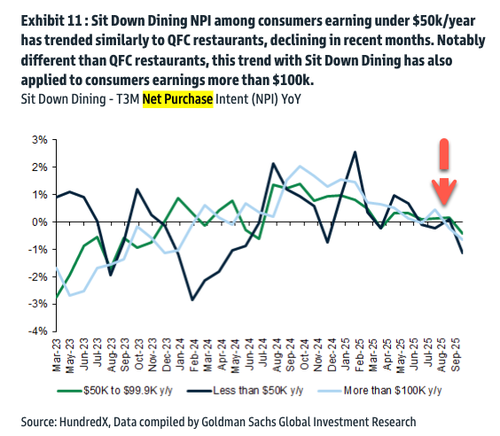

Chipotle’s mounting consumer woes come as no surprise to ZeroHedge Premium and Pro subs. Early last week, we shared a Goldman Sachs survey that found low-income consumers were pulling back on spending. Here’s the chart we were focused on:

Read the report here.

Loading recommendations…