IN THIS ISSUE:

- Big Banks No Longer Bound by Federal Climate Accounting Rules

- Democrat-Run States Have Higher Energy Costs

- An Alternative Causal Mechanism for Climate Change Proposed

Big Banks No Longer Bound by Federal Climate Accounting Rules

In another big move against climate alarmism under the Trump administration, quietly on October 16, the Federal Reserve, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency rescinded a set of rules called the “Principles for Climate-Related Financial Risk Management for Large Financial Institutions,” imposed in 2023 under the Biden administration.

The rules required that banks specify and disclose what steps they were taking to account for and manage or mitigate climate-related financial risks to their institutions. The 2023 rules were specifically tailored to force banks with more than $100 billion in assets “to integrate climate considerations into governance, scenario analysis, and risk oversight,” including operations and commercial banking, personal loans, and public bond underwriting. The agencies’ joint statement announcing that the rules were being rescinded said:

The agencies do not believe principles for managing climate-related financial risk are necessary because the agencies’ existing safety and soundness standards require all supervised institutions to have effective risk management commensurate with their size, complexity, and activities. In addition, all supervised institutions are expected to consider and appropriately address all material financial risks and should be resilient to a range of risks, including emerging risks.

The Trump administration, several states, and many Republican lawmakers had objected to the rules arguing that they misdirected banks from focusing on their core functions, such as providing tangible services to people and businesses, and liquidity to the market, at the expense of profitability and reduced returns to shareholder/owners.

“Regulators said the withdrawal reflects a return to long-standing safety and soundness standards that already require banks to manage all material risks—without singling out climate,” wrote The Epoch Times. “Michelle Bowman, the Federal Reserve’s vice chair for supervision, . . . backed the rollback, saying . . . banks should focus on ‘core risks’ such as credit and liquidity rather than speculative long-term climate scenarios, and that the rules could reduce credit supply and raise borrowing costs for American households.

“One likely potential consequence could be to discourage banks from lending and providing financial services to certain industries, forcing them to seek credit outside of the banking system from non-bank lenders,” The Epoch Times reported Bowman saying. “This could result in decreasing or eliminating access to financial services and increasing the cost of credit to these industries. These costs will ultimately be borne by consumers.”

The Epoch Times noted that the action by these agencies was not the first roll back of financial climate regulations by federal agencies. The U.S. Financial Stability Oversight Council, chaired by Treasury Secretary Scott Bessent, disbanded two panels established to analyze climate-related systemic risks for the broader financial sector. Bessent noted that the September action was critical for the agency to redirect its focus to “core financial stability issues,” including bank safety, liquidity risks, and oversight of nonbank financial firms, rather than diverting scarce resources to unknowable and unlikely possible future climate-related harms that financial institutions would be unable to calculate with any degree of accuracy.

Sources: The Epoch Times; U.S. Federal Reserve System

Democrat-Run States Have Higher Energy Costs

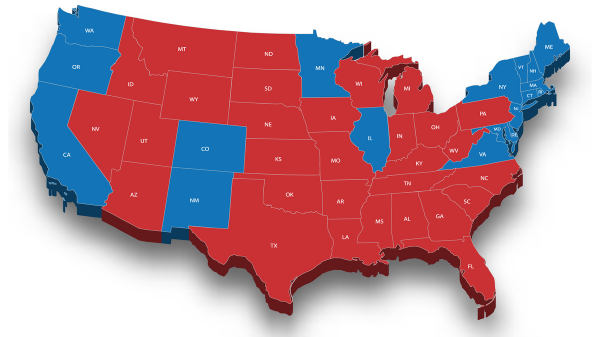

A new study from the Institute for Energy Research finds that states controlled by Democrats and that are reliably blue, having for instance voted for the Democratic nominee for president in both 2020 and 2024, have higher electric power prices than states with Republican leadership.

State level policies have the largest impact on electric power prices because they have the exclusive authority to decide what power generating sources generate electricity within their borders. In general, blue states have implemented more policies to fight climate change or reduce greenhouse gas emissions by limiting fossil fuel use in electric power generation than red states. Those policies have resulted in both higher electric power prices and faster rising prices in those states than the national average.

Specifically, the report finds:

86% of states with electricity prices above the national average in the continental U.S. are reliably blue, having voted for the Democratic nominee for president in the 2020 and 2024 elections. In contrast, 80% of the 10 states with the lowest electricity prices are reliably red, defined as having voted for the Republican candidate in these contests.

According to Lawrence Berkeley National Labs, each of the top five most expensive states for electricity have mandates requiring 100% of their power to come from renewable or carbon-free sources, making their electricity unnecessarily more expensive. These, and other mandates, such as net metering requirements, are driving up prices across America.

In contrast, eight out of 10 states with the lowest electricity prices are reliably red, and seven of these states have no 100% carbon-free mandates. Additionally, 20 of 25 states with the lowest electricity prices are Red states; only four are blue, and one is purple.

In the Northeast and upper mid-Atlantic, where electric power prices are consistently well-above the national average and among the highest in the nation, the states are also parties to the Regional Greenhouse Gas Initiative, which strictly limits greenhouse gas emissions and implements a costly emissions trading scheme.

When it comes to power prices, it seems AI power demand is not the key factor driving higher prices. Rather, state climate policies that discriminate against traditional power sources, primarily leading to the closure of reliable coal and nuclear power and making it harder to use and transport natural gas, are behind ratepayers’ woes. And since energy prices factor into almost every other good and service, it explains why the prices for many products and services are also more expensive in those states.

Sources: Institute for Energy Research; Energy Bad Boys

An Alternative Causal Mechanism for Climate Change Proposed

New research by an international team of public and private sector researchers from Australia and Thailand published in the journal Advances in Oceanography and Marine Biology suggests an alternative explanation for the past half century’s rise in carbon dioxide concentrations: the modest increase in the acidity of the ocean resulting in a release of carbon dioxide.

According to this theory, warming is causing carbon dioxide (CO2) to increase, not the other way around. This hypothesis, which would be consistent with proxy data from the ancient past, suggests past periods of warming have consistently preceded a rise in CO2. Put another way, CO2 is the lagging, not leading, indicator of change.

This hypothesis, as summarized by The Quadrant, goes like this:

The increased concentration of CO2 in the atmosphere since the 1960s has been caused by warming not the reverse.

Warming, perhaps through solar activity, promotes the precipitation of calcium carbonate (limestone) in surface sea water, absorbing CO2 from the atmosphere in the process. In turn, the absorbed CO2, magnified by calcium carbonate precipitation, acidifies surface sea water. The acidification then results in the emission of CO2 into the atmosphere in autumn and winter. This emission of CO2 is greater than the absorption, precisely because of the continuing acidification in the warming water. In the end we see increased atmospheric CO2 and warming. It is easy to draw the wrong conclusion. Indeed, the IPCC has done so.

To be clear, this hypothesis not only bucks the dominant narrative of human greenhouse gas emissions driving recent warming, but also theories put forward by many climate skeptics, which acknowledge the impact of human CO2 emissions, although of diminishing effect, on temperatures.

Although the authors of the study argue their proposition is firmly grounded in physical chemistry, they acknowledge it needs testing and suggest testing regimes. In particular, the researchers suggest field testing (sampling) of calcium-carbonate (CaCO3) deposition rates in sea water, combined with simultaneous measures of seasonal and annual CO2 fluctuations and an isotopic analysis of the chemistry measured in both the Northern and Southern Hemisphere.

This is refreshing since it is almost unheard of in the realm of mainstream climate science for researchers to say their theories or claims need to be tested against reality to prove true. Yet, that is how the scientific method is supposed to work and is the best way to ensure progress in knowledge acquisition about the state of the world.

Describing the importance of this regarding climate research, Peter Smith wrote in The Quadrant,

Whether Kennedy [lead author of the study] is right (or Lindzen and Happer or Clauser) is by the way. Alternative hypotheses are in the skeptical scientific tradition of searching for theories which better explain the facts than does the received theory. That is particularly important in this case. The received theory is upending life as we know it, while being shielded from rival theories by money, politics and pseudo-religiosity.

Sources: Advances in Oceanography and Marine Biology; The Quadrant