A bifurcated consumer landscape is one of the top themes (besides everything AI) of the third-quarter earnings season. Even though most consumer companies beat expectations and raised FY25 guidance, notably Dollar General, Five Below, and Ulta, management teams highlighted an unsettling financial squeeze on working-class and lower-income consumers.

Readers have seen in prior notes how the “K-shaped” economy has divided consumers into two groups. Now that earnings season is wrapping up this week, it’s worth drilling deeper into what corporate executives of these companies are saying.

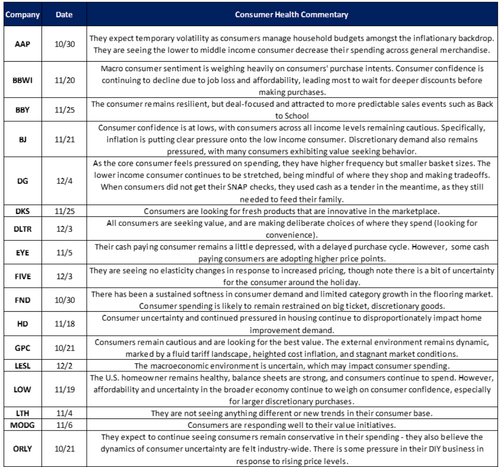

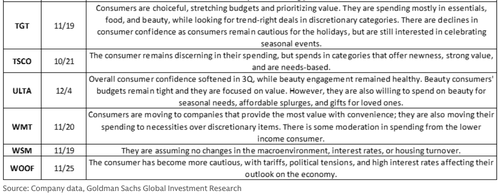

Below, Goldman Sachs Managing Director Kate McShane highlights consumer health commentary from management teams across the stocks in her coverage universe.

“This quarter, many companies emphasized that consumers remain cautious and focused on value,” McShane noted.

All commentary below from retailers reinforced the picture of a bifurcated consumer, with lower- and middle-income households tightening, value retailers benefiting from trade-downs, and discretionary or larger-ticket categories seeing demand slowdowns.

Last month, Treasury Secretary Scott Bessent offered insight into when the light at the end of the tunnel may finally emerge for working-class households. He believes that the inflection point could come as early as the first quarter, driven by a combination of “substantial tax refunds” and “real wage increases,” and even described next year as “fantastic.”

McShane’s full note, available to ZeroHedge Pro subscribers, provides additional color on the consumer environment along with her recommendations and 12-month price targets for the retailers mentioned above.

Loading recommendations…