Coty shares crashed in premarket trading after the beauty giant warned of a deeper sales slump this quarter and posted a steeper-than-expected loss for the fourth quarter.

The beauty company, which develops, manufactures, markets, and distributes cosmetics, fragrances, and skincare products, warned that like-for-like sales, which measure revenue from existing business units, will fall between 6% and 8% this current quarter, exceeding the Bloomberg consensus estimate of a 2.6% decline.

For quarter four, Coty beat on revenue but missed on earnings, pressured by margin compression and weaker U.S. consumer beauty sales.

Here’s an earnings snapshot of the previous quarter:

Earnings: Adjusted loss per share 5c, wider than last year’s 3c loss and well below the 1.4c profit expected (Bloomberg consensus).

Revenue: Net revenue $1.25B, down 8.1% y/y but slightly above the $1.21B estimate.

Americas: $511.2M (-12% y/y, vs. $515M est.)

EMEA: $574.2M (-4% y/y, vs. $569M est.)

APAC: $167M (-8.4% y/y, but well ahead of $134.6M est.)

Prestige: $760.6M (-5.3% y/y, above $717.8M est.)

Consumer Beauty: $491.8M (-12% y/y, in line with $496M est.)

Margins & Profitability: Gross margin 62.3% (vs. 64.2% y/y, 63.1% est.); Adjusted EBITDA $126.7M (-23% y/y, vs. $130.8M est.).

Sales Trends: Like-for-like sales fell 9%, the sharpest drop in over four years.

Coty’s latest comes amid a five-year turnaround effort. There are reports that the company may unload assets – potentially selling its luxury portfolio to Interparfums and ending mass-market names like Covergirl, Rimmel, Adidas, and Nautica in a separate deal, according to Women’s Wear Daily.

Softness is expected to continue into the second quarter ending in December, with Coty forecasting sales declines of around 5%, versus the Bloomberg Consensus estimate of flat performance.

“A return to sales and profit growth at Coty is delayed until fiscal 2H26 at best,” Bloomberg Intelligence analyst Deborah Aitken wrote in a note, adding that the beauty maker’s “forecast of a sales drop in 1H26 “is not without risk to a recovery in 2H, though is aided by new launches, price hikes to offset tariffs and an easier year-ago comparison partially.”

JPMorgan analyst Andrea Teixeira wrote in a note, “Investors will continue to treat COTY shares as a ‘show me the money’ story given the lack of visibility and more discretionary nature of fragrances amid a more challenging consumer demand backdrop.” Teixeira has a “Neutral” rating on the stock.

Even though the bar was very low for Coty following the year-to-date underperformance, “results were worse than expected,” Citi analyst Filippo Falorni said. He cut the stock from “Buy” to “Neutral” and downshifted his 12-month price target to $4.25 from $6.50.

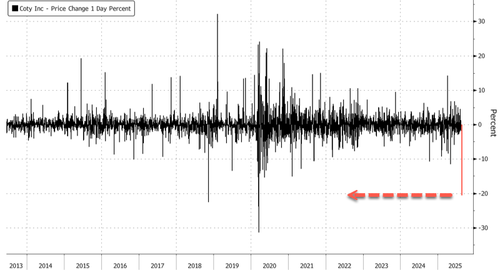

Shares are down 21% in premarket trading. If losses hold into the cash session, it would mark the steepest daily decline since the early Covid period.

Rollercoaster ride.

. . .

Loading recommendations…