Is this scenario guaranteed? No, of course not. But that doesn’t mean it’s excluded from the realm of possibility.

We all know the end-game when currencies are inflated as an expedient measure to stave off insolvency: devaluation eventually has consequences as the debauched currency is eventually replaced, a process that wipes out everyone holding or using the devalued currency.

It’s natural to assume this is a linear process and therefore predictable, as that’s what it looks like when looking back at the broad sweep of history. But the process isn’t inherently linear; it’s non-linear as the dynamics around “money” and “risk” are emergent, meaning that the sum of the parts have qualities of their own that are not predictable.

Which brings us to the question: could the much-maligned, guaranteed-it’s-going-to-zero US dollar USD) stage a rip-your-face-off rally that wipes out those shorting the USD by generating a mad rush for scarce–yes, scarce–USD?

The Federal Reserve measures the supply of US dollars via M2: basically cash in various accounts. As you can see on the chart below, M2 Money Supply is about $22 trillion after a $6 trillion rocket-boost in the Covid stimulus phase.

That may sound like a lot, but consider the global bucket of financial assets is worth $480 trillion. Global Asset Monitor: Public (sovereign bonds, etc.) $232.4 trillion, Private (stocks, RE) $246.8 trillion: $479.2 trillion total.

So M2 Money Supply is 4.6% of global financial assets. US dollars in circulation, i.e. Federal Reserve notes/Greenbacks, is around $2.4 trillion.

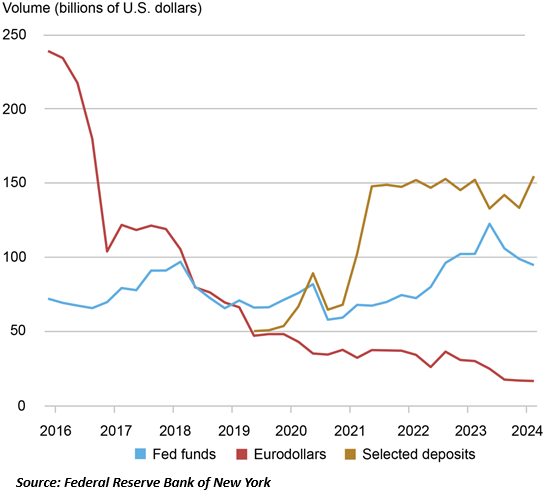

The US dollars held in time deposit accounts in banks outside the US are called Eurodollars. I am not an expert on the eurodollar market, but it appears to have experienced a decline in volume since 2016. As this article from the Federal Reserve Bank of New York explains, changes in banking regulations led to selected deposits on the books of US banks replacing the majority of eurodollars volume.

Who Is Borrowing and Lending in the Eurodollar and Selected Deposit Markets?

“Selected deposits are unsecured U.S. dollar deposits that also tend to have an overnight maturity, similar to Eurodollars. However, unlike Eurodollars, but like fed funds, selected deposits are booked at bank offices in the U.S.”

The conventional view is that eurodollars are advantageous because they are not regulated by US agencies or the Federal Reserve and so much of the activity is opaque, qualifying as “shadow banking.” Eurodollar Secrets: The Hidden Engine of Global Finance (tradingview.com)

“The Eurodollar system is one of the greatest financial innovations–and enigmas–of modern capitalism. Born from geopolitical necessity, it evolved into a vast offshore network that creates and circulates U.S. dollars beyond U.S. borders.

Its power lies in its invisibility: it influences global liquidity, shapes monetary policy, and fuels international trade, all without direct oversight.

However, with great power comes great risk. The Eurodollar market’s opacity and lack of regulation mean it can amplify crises when liquidity dries up.”