While oil prices keep rising on mounting geopolitical tensions in Iran, the production glut refuses to go away, and as today’s DOE report showed, there was a material increase across almost all products, with the exception of Distillates which were flat. Of note, amid expectations for a modest crude draw, we saw a 3.4MM barrel increase, the largest since the start of November.

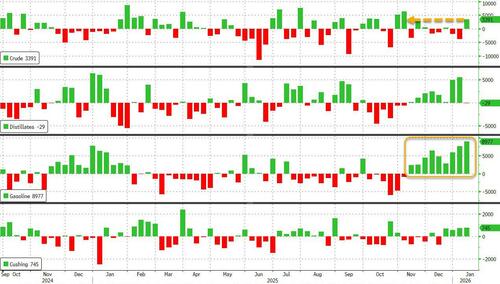

Here is what the EIA reported in its weekly inventory report

- Crude +3.391MM, Exp.-1.682MM

- Gasoline +8.977MM, Exp. +2.0MM

- Distillates -29K, Exp. -662K

- Cushing +745K

Of note here is that while we saw a sizable build in most products, with Crude rising the most in two months, it was gasoline where the stocking was most notable: the nearly 9 million barrels added were the most since December 29, 2023.

While Cushing draws reversed for a 4th consecutive week, stocks remain not too far from tank bottoms.

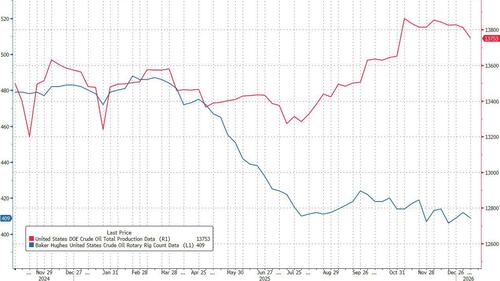

Yet there is some hope that US production is finally moderating: while US Crude production hovers near record highs despite the continuing decline in rig count, last week saw a notable drop in total production, dropping by 58K barrels to 13.753 million, the lowest since the end of October.

Despite the sizable build in crude stock, WTI is holding gains as attention remains glued to what happens in Iran next…

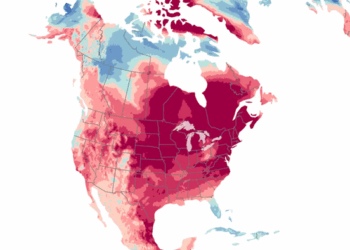

On the bright side, the broadly weaker trend on crude oil prices has dragged gas (pump) prices down to their lowest since May 2021…

While it’s not exactly ‘drill, baby, drill’, it’s certainly what Trump wanted (the question is, will the lower price push shale producers to cut production… and round and round we go).

Loading recommendations…