Authored by Terri Wu via The Epoch Times,

The U.S.–China trade war may be transitioning to a monetary standoff.

As U.S. President Donald Trump’s tariff policies kickstart a reshuffling of global supply chains and trade, Beijing is looking to another battleground: the Chinese yuan versus the U.S. dollar.

Last month, Pan Gongsheng, head of China’s central bank, reiterated the regime’s interest in promoting the internationalization of the yuan, also known as the renminbi, at the Lujiazui Forum, a leading economic forum in Shanghai.

Tune in to China Watch, a podcast on Chinese politics, technology, and business.

The dominance of currencies, especially in the digital world, will be the next focus of the U.S.–China trade war, according to Mike Sun, a U.S.-based businessman with decades of experience advising foreign investors and traders doing business in China. He uses an alias to avoid reprisals from the Chinese regime.

William Lee, chief economist at the Milken Institute, concurred.

Lee told The Epoch Times that the fear of sanctions has spurred the regime to try to expand the use of the yuan in an alternative cross-border payment system. Now, China is concerned about potential sanctions before its digital currencies can gain traction and become more widely adopted, he said.

The concerns that Lee mentioned are front and center for policymakers in Beijing.

In a June speech in Shanghai, China’s central banker expressed concerns that the “traditional cross-border payment infrastructures can be easily politicized, weaponized, and used as unilateral sanction instruments” as the geopolitical tension escalates.

Another prominent chief economist in China, Lian Ping, wrote in late May, “Financial sanctions and countermeasures will probably become a battlefield of U.S.–China competition in the next phase.”

These economists are not just scholars, but a well-connected brain trust of senior Chinese Communist Party (CCP) officials, Sun told The Epoch Times. Hence, these experts don’t make recommendations; they foreshadow and interpret the regime’s actions.

Lian also warned that the United States might start imposing sanctions on a few Chinese entities, then expand the scope, eventually excluding China from the U.S. dollar-based system.

As the world’s reserve currency and primary medium for financial transactions, the U.S. dollar is the linchpin of the U.S.-led global order.

By exporting commodities to China and then buying electric vehicles from China, the member countries of BRICS can form an alternative trading system denominated in yuan, according to Lee.

BRICS is a China- and Russia-led bloc designed to counterbalance U.S.-led Western democracies that also includes Brazil, India, South Africa, Saudi Arabia, Egypt, the United Arab Emirates, Ethiopia, Indonesia, and Iran.

The “BRICS philosophy of dethroning the dollar” is a real and credible threat to the United States, and that’s why Trump is imposing extra tariffs on these countries, according to Lee.

Heads of state and government from member, partner, and observer countries pose for a family photo during the BRICS summit in Rio de Janeiro, Brazil, on July 7, 2025. The China- and Russia-led bloc, seen as a counterweight to U.S.-aligned democracies, may play a key role in the growing currency rivalry between the Chinese yuan and the U.S. dollar. Pablo Porciuncula/AFP via Getty Images

During its latest summit in Brazil, the BRICS member states issued a joint statement on July 6 criticizing tariffs without naming the United States.

Shortly afterward, Trump said on Truth Social that “any Country aligning themselves with the anti-American policies of BRICS” would receive an additional 10 percent tariff. Days later, he threatened a 50 percent levy on Brazil, a founding member of BRICS, citing the ongoing trial of its former president, Jair Bolsonaro, a Trump ally.

At a Cabinet meeting on July 8, the U.S. president said BRICS wants to “destroy the dollar so that another country can take over and be the standard.”

“If we lost the world-standard dollar, that would be like losing a war, a major world war,” Trump said. “We would not be the same country any longer.”

Winding Up Tariff Battles

Tariffs were a “completely foreign language for most people” when the Trump administration launched global reciprocal levies, Lee said.

“Now, the whole world has come to accept a minimum 10 percent tariff,” he told The Epoch Times.

Lee said final tariff numbers aren’t as significant as the establishment of a new trade order.

“What matters is we have a new building in place, and the new building is much more of a decentralized trading system, incentivizing capital inflow to the United States,” Lee said. “And that’s something that has been missing from the WTO.”

At the beginning of Trump’s second term, the average tariff rate imposed by the United States was 3.4 percent, according to the World Trade Organization. The global trade system was characterized by low tariffs for exports to the United States, as well as significantly higher tariff rates or non-tariff trade barriers imposed by other countries.

Currently, the administration has extended the deadline for tariff negotiations from July 9 to Aug. 1, with no further extensions. During the interim, baseline tariff rates remain at 10 percent.

Trump has since issued tariff letters to dozens of countries, setting their rates at between 20 percent and 50 percent.

Sun described this approach as a “blind box” method, meaning that the tariff rate is revealed only upon receipt of the letter. He said that in his view, such an approach is “very effective” with the “lowest cost.”

Trump sends a message that he’s the decision-maker, and other countries can only provide input under his framework, according to Sun.

“I think all countries will eventually agree with Trump’s framework, including China,” he told The Epoch Times.

Yeh Yao-Yuan, a professor of international studies at the University of St. Thomas in Houston, said he views the trade negotiations as a prelude to a new cold war, resulting in the world being split into two camps: one led by the United States and the other by China.

He noted that in the U.S.–UK trade framework agreement, the two countries agreed to enhance mutual economic security by addressing “non-market policies of third countries.” Although China is not named, it is known for protecting its state-owned enterprises with industrial policies and dumping its overcapacity into the global market.

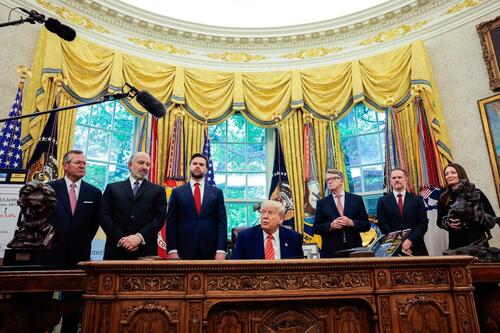

President Donald Trump, joined by (back L–R) Secretary of Commerce Howard Lutnick, Vice President JD Vance, British Ambassador to the U.S. Peter Mandelson, and U.S. Trade Representative Jamieson Greer, speaks to reporters in the Oval Office on May 8, 2025. Anna Moneymaker/Getty Images

There’s little room left for tariff rate negotiations between the United States and China, the experts said in interviews with The Epoch Times.

The ongoing discussions involve China trading its rare earths for U.S. chips and opening up its service industry, particularly banking and investments, to the United States.

China has had a near-monopoly on rare earths for decades, mainly because of predatory practices that have driven foreign businesses out of the sector. Therefore, it has been using its leverage on these critical minerals as a trade weapon.

However, the United States has made significant strides in removing this chokepoint through public and private partnerships, as well as by fast-tracking the permitting process.

MP Materials, the company that owns the only active rare earth mine in the United States—located in Mountain Pass, California—announced on July 10 a $400 million investment and a $150 million loan from the Department of Defense. For 10 years, the U.S. government will also guarantee the purchase of the company’s rare-earth output at a minimum price and ensure a minimum profit margin.

In effect, the public–private partnership ensures that a U.S. national champion will remain vital, regardless of what China does.

The United States has a trade surplus with China on services. Last year, China’s giant trade surplus on goods of nearly $296 billion with the United States was offset by a service trade deficit of about $33 billion, according to the U.S. Census Bureau.

Beijing has been exploring further opening the service industry as a bargaining chip for its trade negotiations. Opening up China is a beneficial strategy to Beijing as well, according to Lian.

He wrote in his article that opening up the financial market more would increase China’s “stickiness” and make it “too big to sanction.”

However, according to Sun and Lee, the tariff battle will mainly focus on the currencies, as the United States has an oversized vulnerability: its nearly $37 trillion debt.

Ramaco Resources plans to extract over 450 tons of rare earths from its 4,500-acre Brook Mine near Ranchester, Wyo., on July 11, 2025. China’s long-standing dominance in the sector, achieved through predatory practices, has enabled it to wield rare earths as a trade weapon. John Haughey/The Epoch Times

Defending Dollar Supremacy

Currently, the U.S. dollar’s status as the global reserve currency and the primary currency used in international trade allows the United States to borrow more at a lower interest rate.

The U.S. debt level is so high now that the annual interest payment surpasses the nation’s defense spending.

In fiscal year 2024, which ended on Sept. 30, 2024, the United States spent $882 billion on interest on its debt, compared with $874 billion on defense expenses, according to the Treasury Department.

That makes the U.S. dollar’s role even more crucial because any diminishing or significant doubt of the currency could lead to the nation’s default.

China holds $756 billion of U.S. Treasury bonds, according to the Department of the Treasury, which collects the data through U.S.-based brokers. Hong Kong has an additional $253 billion.

Still, Sun believes that China is the top U.S. Treasury bond holder in the world—surpassing Japan’s $1.1 trillion—because of the unknown amounts that Beijing purchases through European institutions.

An April report by J.P. Morgan Chase states that, contrary to common belief, “China has not reduced its holdings of U.S. Treasurys; the holdings are just more under cover,” according to a translation of the original Chinese text.

So Beijing could potentially sell off U.S. Treasurys at a crucial moment when the market loses confidence in the U.S. dollar and force the interest rate to increase if no buyers can take in China’s dumping.

If the reserve currency status of the U.S. dollar is shaken, it could also lead to the weakening of Washington’s borrowing power.

The CCP is aware of this and has been working for years to replace the U.S. dollar with the yuan.

In 2015, Beijing launched its own Cross-border Interbank Payment System, or CIPS, for transactions in Chinese yuan. Although CIPS is not comparable to the U.S. dollar-denominated global payment system—called the Clearing House Interbank Payment System, or CHIPS—in terms of scale and global reach, it’s getting bigger.

A woman walks past the headquarters of the People’s Bank of China in Beijing on July 9, 2024. The central bank recently warned that traditional cross-border payment systems risk being “politicized” and “weaponized” amid rising geopolitical tensions. Adek Berry/AFP via Getty Images

Each month, the financial transaction volume through CIPS is approximately 700 billion yuan, nearly double the amount in 2021, according to the Peterson Institute for International Economics (PIIE). That scale is still trivial compared with the $1.8 trillion in daily transactions, or more than $50 trillion in monthly transactions, through CHIPS, according to its official website. And CIPS still largely relies on the U.S.-led SWIFT, or the Society for Worldwide Interbank Financial Telecommunication, to send payment messages, according to the PIIE.

The CCP also took notice that the digital currency world offers a new field for competition, and in 2022, China introduced its digital yuan.

The current situation calls for the United States to find more non-China parties to hold U.S. debt and defend its reserve currency status in both the physical and virtual worlds, according to Sun.

He said a type of cryptocurrency referred to as “stablecoins” are a “creative” response to the challenge.

“Stablecoins can theoretically enable unlimited purchase of U.S. Treasurys,” he said. “The sky is the limit.”

Stablecoins are digital money pegged to a fiat currency at a one-to-one ratio. The issuers guarantee holders that they can convert the money back at any time. Therefore, stablecoins can provide the decentralization and cost-effectiveness of digital money, combined with the stability of a traditional fiat currency.

So far, 98 percent of stablecoins are pegged to the U.S. dollar, and 80 percent are issued outside the United States, according to the Atlantic Council, a Washington-based think tank. Owners can bypass banks and even the unreliable currencies of their home country. For example, a coffee shop in Argentina or a small business owner in Vietnam can do business in the digital currencies directly pegged to the greenback.

Last year, the transaction volume via stablecoins reached $27.6 trillion, 7.7 percent more than the combined transaction volume of Visa and Mastercard, according to crypto exchange CEX.io.

Signage of the Chinese digital currency is seen near a coffee store in the New Actuation Fintech Center in Beijing on Feb. 17, 2022. Jade Gao/AFP via Getty Images

Stablecoin issuers generate revenue by investing the dollars that they receive in exchange for the digital tokens, and they have already emerged as a significant holder of U.S. debt. They hold more than $120 billion in Treasury bills and are poised to hold more than $1 trillion in Treasurys by 2028, according to an April report by the Treasury Borrowing Advisory Committee. This means that stablecoin issuers may become the largest holders of Treasury bills, over China and Japan.

Two months ago, Hong Kong passed stablecoin legislation, although it hasn’t issued its own stablecoins yet. Chinese conglomerates, such as Ant Group and JD.com, Inc., have announced that they will submit their applications to become issuers as soon as the legislation takes effect on Aug. 1, according to China’s state-run media.

The U.S. Congress on July 17 passed a landmark crypto bill that establishes a regulatory framework for stablecoin issuers. The GENIUS Act, signed into law the next day, requires stablecoin issuers to back the digital tokens with either cash or U.S. Treasury bonds.

Treasury Secretary Scott Bessent in June posted on X that “stablecoins can reinforce dollar supremacy.”

By leveraging stablecoins, the U.S. dollar has extended its dominance from the physical to the virtual world and found more buyers of U.S. debt at a collective level comparable to China and Japan, according to Sun, who called the strategy “a genius move.”

Loading recommendations…