By Michael Every of Rabobank

For years, some analysts talked about the problems associated with ‘financialization’ and only a small subset talked about a looming backlash ‘definancialization’. What did you think it meant? Vibes? Papers? Essays? “Because markets”?

In the big picture, an FT op-ed notes that Trump’s new ‘Great Game’ is “mining, mapping, and mercantilism,” where “the contest for resources between the US and China will continue after the president is gone and affect us all.” All true, and flagged here for over a decade now – recall 2017’s ‘The Great Game of Global Trade’? Yet as think tanks and global media notice that Venezuela and Beyond: Trump’s ‘America First’ Rhetoric Masks a Neo-Imperialist Streak, which we warned of in November 2024, markets are still brushing it all off. Apparently, they think this is all just Marco Rubio memes.

NATO Secretary General Rutte is likewise portrayed by Politico as the dog-with-coffee-in-a-house-on-fire meme for saying ‘Chill out, this is fine’ re: Greenland and that the alliance is “not at all” in crisis. Actually, he’s right given NATO is NO without the US.

But if Greenland is not a crisis, Iran could be. We don’t know if the regime will survive; if the US or Israel will strike it; if it will strike Israel and US bases; if something could happen with the remnants of its nuclear programme; who comes next if the regime collapses; if the country will hold together if it does; and what that unleashes as Great Powers abhor a vacuum: Turkey – Israel tensions are already rising. And note this is all MUCH closer to Europe than the US.

What one can say is that Venezuela and Iran are precisely what was flagged in the 2026 Financial Markets Outlook titled ‘Who Has the Cards?’: disruption of upstream commodity supplies heading to China to mirror China’s hold on rare earths, mid-stream processing, and downstream industrial and consumer goods. Much more of this is yet to come as the Great Game goes on.

For Europe (and the UK and Australia/NZ and Canada), this backdrop is beyond ‘challenging’. Via Greenland, Trump is pointing out that ‘rules-based’ sovereignty doesn’t mean a thing if you can’t defend said territory – which they can’t; and the UK government is trying to give away the geostrategic Chagos Islands, prompting a rare House of Lords rebuke… will Trump do more if the actual Chagossians, who oppose this deal, offer to name an island after him?

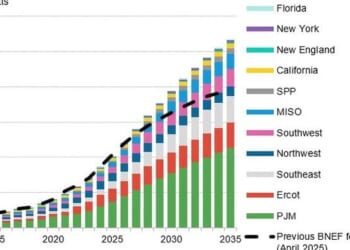

If it wants to get serious about defense, Europe is said to need a 100,000 strong army. The EU defense spending boost penciled in by 2035 is not enough, and it’s against moving targets – Trump wants to boost his military budget by 50% in 2027, China is forging ahead, Russia is ‘all in’ Moreover, you can’t have 27 armies acting as one, so who runs it? Even assuming it gets there, in an age of maps, mining, and mercantilism, where is Europe going to be getting its raw materials from *cheaply*, as the US is aiming for in the Western Hemisphere, at least?

Australia and the UK don’t sit prettier despite political unity. Indeed, we just saw a warning that the Brits are so short of the ability to deliver on the military front that AUKUS is potentially at risk; that’s as the UK is looking to China to build the Falsane base tugboats it will need for the new nuclear submarines it might not be able to help deliver to Australia. Taken like this, it’s the status quo ante of financialisation and neoliberal free trade that is arguably running on vibes, papers, and essays rather than any kind of hard power.

Moreover, as Politico notes, “In Venezuela, Trump expands his anti-climate empire: The U.S. president’s fossil fuel-powered world vision is a bet on the energy transition failing.”

But let’s bring this down to markets:

The US just imposed a 25% tariff on all the countries who do business with Iran, mostly aimed at China and Russia; it just invited Qatar, the UAE, and India, to join its “Pax Silica’ to create a non-China tech supply chain; it is also to hold a G7 meeting about rare earth supply chains, as Japan latter begins underwater mining for them at a test site. The US is also reportedly close to a trade deal with Taiwan, which is more a geopolitical signal than an economic one.

On the other hand, the Hong Kong press underline that China will prioritise export controls and supply-chain security to shield its economy in 2026. It has also said it’s going to double down on its current model.

Europe is apparently close to signing an FTA with India, and may have reached an agreement with China over EV tariffs that will perhaps enable minimum prices to be set instead. Indeed, the different worlds the EU and US now inhabit are best summarized by Europe celebrating the conclusion of an FTA with Mercosur that took 45 years to achieve just as the Donroe Doctrine tore up 45 years of neoliberalism and effectively trumped that achievement on the ground in Latin America. (As hedge funds prowl for Donroe Doctrine bargains.)

Within the US itself, we have now seen President Trump attack multiple targets from the meat-packing industry, to health insurance companies, to defense firms; ban Wall Street from buying single family homes; force credit card companies to cap interest at 10%; take stakes in Intel, US steel, rare earths producers, and nuclear power; and now threaten to take stakes in oil companies (presumably to get them to invest in Venezuela). On top of that, the FTC has stated that it will block M&A deals that raise the cost of living for consumers – an anti-Borkian trend that the Biden White House also favored. Moreover, Trump just told AI firms they are not allowed to pass on their soaring costs of electricity to consumers, and must “pay their own way.”

And so, to the Fed. As the Wall Street Journal warns ‘Trump’s Investigation of Powell Is Also a Warning to the Next Fed Chair’, three past Fed chairs decry the “unprecedented” assault, some media warn of the risks of a 1970’s-style inflation crisis, and even the Treasury Secretary reportedly says it’s created “a mess” (says Axios), the FT states: ‘The next Fed chair is… Donald Trump.’ Very few media are asking if it’s possible if Powell is actually guilty: is this presumption of innocence or a reflex reaction that central banks aren’t capable of sin?

Of course, as Reuters summarizes it today, ‘Trump crosses Fed Rubicon, market shrugs.’ And that is logical to the extent that we are clearly in a world where the US is going to ‘run things hot’ in some sectors. Effectively, it is what I have dubbed as using legacy US financial fartcraft to prepare for a near-future world of warcraft.

Yet at the same time gold is tipped by some to crack $5,000 ahead, as the latest exceptionally-small US trade deficit helping to see the Atlanta Fed GDPNow estimate hit 5.4%(!) was helped by bullion exports (showing the US is not accumulating it), and an Italian parliamentary panel approved the “people’s” claim on its central bank’s bullion with the ECB, which may crack other things people now tip. Silver is also up to a new record near $86, and copper is near a record high at $13,273. By contrast, oil is at $64, up significantly in the past week over Iran, even if the geostrategic play is clearly lower due to US action in Venezuela.

So, definancialisation doesn’t mean peace – it means prep for war. It doesn’t mean free trade – it means trade blocs. It doesn’t mean free markets – it means freeing markets from a focus on short-term profits. It doesn’t mean higher rates and lower fiscal spending – it means lower rates and higher fiscal spending for different things: consumers, and ‘maps, mining, and mercantilism.’ It doesn’t mean legacy correlations – it means new ones.

Loading recommendations…