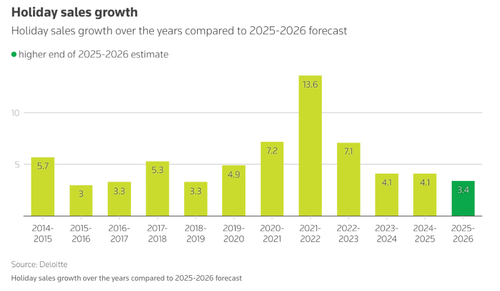

The Labor Department’s record annual negative revision of jobs data through March indicates the business cycle may have peaked in spring 2024. Complementing this, Deloitte’s holiday sales forecast indicates that the upcoming holiday shopping season could have one of the slowest growth rates since the pandemic, further highlighting evidence of a consumer-led slowdown taking shape.

Deloitte forecasts holiday sales will rise just 2.9% to 3.4% between November 2025 and January 2026, compared with a 4.2% increase last year, marking the slowest pace since the pandemic. That translates to $1.61 trillion to $1.62 trillion in sales, up from $1.57 trillion the previous year.

“Consumers may be front-loading purchases again, especially if they consider tariffs and other inflationary costs,” said Brian McCarthy, partner at Deloitte, who was quoted by Reuters.

McCarthy added, “Inflation itself pushes the price of items a bit higher, so that’ll manifest itself in a bit of an increase in overall holiday spend.”

The projected slowdown in consumer sales is a warning sign ahead of Black Friday and the Christmas shopping season, particularly since consumer spending accounts for about 68% of U.S. GDP. Shoppers are also contending with elevated borrowing costs, depleted savings, maxed-out credit cards, persistent inflation, and broader macroeconomic uncertainty.

A recent PwC survey forecasted that the steepest drop in holiday spending will be amongst Gen Z shoppers.

The latest earnings season has shown consumer companies, including Best Buy, Target, Walmart, Macy’s, and Mattel, have issued mixed forecasts heading into the back-to-school fall season.

Some of that macroeconomic uncertainty stems from what we described one year ago – fake job data…

Why 1 million jobs will be quietly removed from the payrolls? Because as noted below, 57% of all YTD jobs are statistical fakes from Birth/Death adjustment which assume the same new business vibrancy as just after covid (which was mostly to facilitate PPP fraud) https://t.co/YHvKRyYFds

— zerohedge (@zerohedge) August 20, 2024

… now confirmed with a historic negative jobs revision that showed nearly a million jobs were revised away.

Worst Revision In History: BLS Admits A Record 911K Fewer Jobs Were Added https://t.co/fV72WIoNid

— zerohedge (@zerohedge) September 9, 2025

Which only prompted Bloomberg’s chief economist Anna Wong to warn that the U.S. economy likely “entered a recession late last year“, around the time the autopen puppet in White House stopped giving a shit and pretending that all is well. So the Fed was right to cut rates aggressively in September 2024, and then the labor market rebounded shortly afterward – before falling back into a slump in the first quarter of this year, around the time the Fed refused to cut rates further despite continued economic weakness.

Wong’s bottom line: “The preliminary job revisions flag a strong possibility that the economy entered a recession last year, and recovered after the Fed cut rates in late-2024. Our interpretation of recent data — factoring in our estimate of future revisions — is that the labor market may have re-entered another slump in 1H25, with a low in June. We think we’re either still in recession, or in the early phase of a new business cycle.”

All eyes will be on consumer sales this upcoming holiday shopping season to gauge consumer health. Also, prepare for rate cuts…

Loading recommendations…