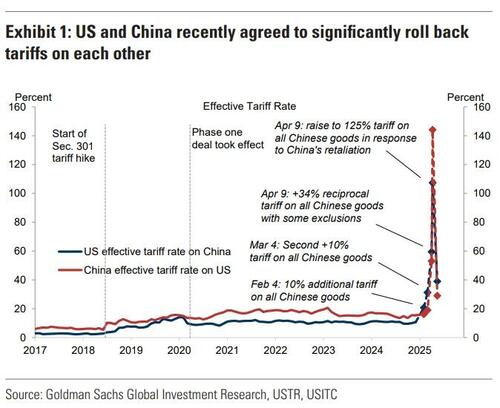

While today’s CPI will be far less relevant now that the entire macro picture has been reset after this weekend’s trade war truce – which cut tariffs between US and China by 115% for 90 days…

…thus making any pre/post CPI number comparisons meaningless apples to oranges, the machines will certainly be reacting to what Bloomberg prints in the flashing red headline at 8:30am ET.

As we detailed here, higher-than expected inflation data is likely to accelerate the increase in yields spurred by the easing in trade tensions with China.

As Bloomberg’s Alyce Andres notes, survey data ahead of Tuesday’s April CPI report sends a clear message that firms passed rising tariff-linked costs on to consumers.

Higher Prices

-

ISM Manufacturing prices expanded to 69.8, the highest since June 2022.

-

ISM Services ticked up to 65.1 in April, the highest since January 2023.

-

S&P Global US Manufacturing firms increased their output prices by the greatest degree since early 2023.

-

S&P Global US Services prices advanced.

-

Richmond Fed manufacturing showed prices received rose to 2.65 from 2.34 in March.

-

New York Fed manufacturing prices received edged up to 28.7 from 22.4 in March.

-

Philadelphia Fed manufacturing report showed prices received gained to 30.7 compared to 29.8 in March.

-

Kansas City Fed manufacturing prices received surged to 29, up from 15 in March.

-

Kansas City Fed non-manufacturing showed selling prices rose in April.

-

Dallas Fed manufacturing outlook report showed prices received for finished goods advanced to 14.9, up from 6.3 in March.

-

Dallas Fed services selling prices rose to 8.4 from 5.2 in the prior month.

-

Chicago PMI showed prices expanded at a faster pace in April.

Lower Prices:

-

New York Fed services report showed prices received declined to 26.0 from 28.7 in March.

-

Philadelphia Fed non-manufacturing data reflected a plunge in prices received to -0.1 from 8.4 in in the prior month.

-

Richmond Services prices received nudged down to 3.03 compared to 3.68 in March.

Optically, inflation indicators (hard, not soft survey) have notably deflated in the last month…

Source: Bloomberg

So, what did we get – did the ‘soft’ survey data once again completely decouple from the reality of ‘hard’ actual data?

SHOCKER – Despite the panic from the establishment, headline CPI disappointed, rising 0.2% MoM (below the +0.3% exp), pulling the headline down to +2.3% YoY (below the 2.4% exp) – the lowest since February 2021…

Source: Bloomberg

Core CPI also rose 0.2% MoM (below the 0.3% exp) leaving it up 2.8% YoY as expected (lowest since April 2021)…

Source: Bloomberg

And drilling down even more, the so-called SuperCore CPI (Services Ex Shelter) dropped to +3.01% YoY – the lowest since Dec 2021…

Source: Bloomberg

Finally, as Goldman noted ahead of the print, whatever we do learn about tariff-related inflation today lags the rapidly-changing policy reality… so choose the size of the salt crystal to take as you react to the algos initial reaction to this data.

Brace for an avalanche of this statement repeated ad nauseum all day from establishment economists – “…we’re sure the inflation from tariffs will hit next month…”

The new narrative: “lack of tariff inflation is transitory”

Loading…