By Peter Tchir of Academy Securities

Together We Stand… Ratings… UMich

We already covered the Trump PIVOT and the Trump PUT as positives in the past week. We got to kick off the first half hour of Bloomberg TV on Tuesday and published the Around the World Podcast on Thursday. Neil Wiley, formerly from the Office of the Director of National Intelligence, represented the Geopolitical Intelligence Group.

While questions remain about:

- Trade deals. While we have outlines for China and the U.K., and the market is operating under the assumption of 10% or so for the rest of the world, more official announcements would be welcomed (in so far as to reduce the uncertainty).

- The impact of tariffs is starting to show up. PPI showed margin declines, presumably as companies, at least initially, absorb the cost of tariffs (typically, it takes time to pass on price increases). We are seeing some large retailers lay the groundwork for higher prices. While tariffs (after all the reductions and backpedaling from Liberation Day) should be manageable, there will be impacts.

- The peace processes in the Middle East and in Europe seem to be homing in on deals, but reaching a definitive deal has been elusive.

- Concerns about the impact on The American Brand have diminished, but this is still a potential issue that is not being priced in.

But today, I wanted to turn the focus to navigating domestic issues/hurdles.

Budget 2026 will be a crucial steppingstone for the growth that this administration is expected to deliver.

It may not be smooth sailing, as the nation itself is far from putting unanimous support towards every initiative. We have “picked a fight” with the rest of the world on trade, which is one thing, but there is also a lot of domestic friction to navigate.

U.S. Ratings Downgrade

Moody’s, the last remaining NRSRO (Nationally Recognized Statistical Rating Organization – officially they are not Rating “Agencies”), dropped the U.S. from AAA.

I don’t expect a major market reaction (in either the bond or equity market) from this action.

- Treasuries are typically included in investment guidelines specifically not by ratings. There should be very few (if any) buyers of Treasuries who can no longer buy Treasuries, or even need to reduce their allocation, because one agency changed their rating.

- Some ratings “derived” from the U.S. government rating could be changed due to this downgrade, but again, the impact should be minimal. Most bond indices rely on 2 out of 3 agencies, and S&P and Fitch both had the U.S. rated below AAA for some time.

The timing seems odd.

- The U.S. rating isn’t something I spend a lot of time thinking about (since I think any downgrade impact is minimal, at most) but this seemed a bit “out of the blue.”

- DOGE, while not wildly successful (we didn’t reach the trillions hoped for), saw some progress.

- Yes, higher yields mean the debt we roll over has an average coupon that is higher than what is being replaced, but this is nothing new.

- Budget 2026 is working its way through the system. While it does look like it will increase the deficit, it is not yet a done deal, so it seems a bit premature to cut the rating until that is decided.

- The Inflation Reduction Act, which was never going to reduce inflation, didn’t seem to trigger the action. Spending at record highs, while unemployment was low and inflation was high, seemed more “frivolous” (or dangerous) than anything that has happened in the past few months.

We have to assume that this wasn’t a political decision, but the timing (ahead of finalizing the budget) seems odd. It is unlikely to be the sort of action they will reverse quickly.

It does highlight that we have domestic issues to overcome, and we need to make sure those get the attention that they need and deserve.

CONsumer CONfidence

Longtime readers know that the T-Report tends to refer to the report that was issued on Friday as the CONsumer CONfidence report, because it is fraught with issues (see November 2021 T-Report).

But this is now getting ridiculous

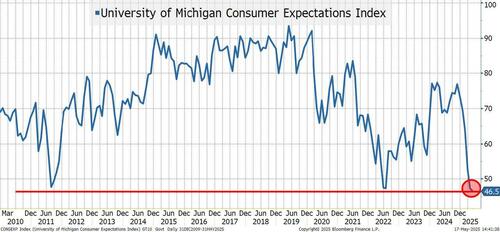

That is not the “ridiculous” part. Believe it or not, the fact that expectations are the lowest since the GFC is not what I find the most ridiculous about the UMich Report.

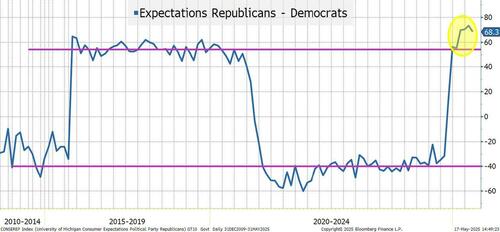

What I find amazing is the differential between Democrats and Republicans.

Democrats came in at 22.5! Seriously, 22.5! Republicans came in at 90.8! Seriously, 90.8! Even Republicans, in this survey, are down from 106.8 in the aftermath of the election, but this divergence is abnormally high.

Yes, there is always a divergence between the two parties, and it is weirdly large (at least weirdly large from my viewpoint), but this is getting crazy.

How do we consistently have large differences that are getting larger?

This cannot make it easy to govern or get policy through! Maybe it isn’t meant to be easy, but as the U.S. is pressuring countries across the globe, it cannot be helpful that there is such a divergence of views here.

One Curious Chart

Retail was better at buying the dip, it seems, than most of Wall Street

Since that was the case at the lows, it is worth noticing that retail (TQQQ as a 3x daily leveraged Nasdaq 100 ETF is geared towards aggressive retail traders) has been taking profits here.

For the first time ever, the T-Report wishes we had access to fund flows by party affiliation.

Given the extreme divergence, do Republicans buy the dip far more than Democrats? Is that too crazy to be even possible? If true, does the wealth effect affect one party more than the other?

Also, tripling-down on shorting the faceripping rebound really won’t help the blue line pic.twitter.com/UI8OZHe704

— zerohedge (@zerohedge) May 14, 2025

I’ve never really thought about people allowing extreme views on politics to dramatically change their investment views, but is it possible? Or is it just easy to say something extreme on a survey, while being more balanced in one’s asset allocations?

That latter point makes more sense to me, but it would be great to see investment allocation by party!

Bottom Line

On rates:

- Clarity on tariffs makes it easier, not more difficult, for Powell to cut rates. Markets had the opposite reaction on the China deal, but with lower tariffs, and lower risk of tariff-generated price increases, it will be easier for Powell to cut rates if employment data weakens (which is my base case).

- We need to bump up the range on 10s. We’ve been thinking 4.1% to 4.5% as a wide range. With the state of the deficit, they should be pushed up to 4.3% to 4.7%, with a greater probability of pushing to 5% than to 4%. While the timing of the rating downgrade seems odd, the reality that the deficit is far from being resolved seems reasonable. Nothing dramatic for rates, but a 20 bps increase to the range seems appropriate (as we are bumping up against the 4.5% top end of our previous range).

On equities, the move higher has been propelled by a policy pivot and what seems like clear evidence that the President is now associating himself with the stock market, compelling him to drive policies to help stocks. That all makes sense, but a LOT has now been priced in, and it is interesting that the “smart money” (retail) is backing off their bets!

Foreign investors have an easier time being underweight Treasuries (they can buy their own domestic bonds), but they have less ability to reduce exposure to credit (U.S. corporate debt offers the most opportunities to diversity across rating, industry, and maturity) and equities (40% of the revenue of the S&P 500 comes from overseas sales – since most of the companies are global in nature). The global nature of the biggest “U.S. Companies” may remain a point of periodic friction between the companies (acting for their shareholders) and the government (acting for the people).

Crypto is doing well, and it seems very likely that it will get some form of adoption by this administration. Not sure I see the point, but would not fight it, or even embrace it.

Day-to-day volatility should be lower. We will see smaller responses to every announcement (policies that sound bad can be retracted, and good news is very priced in).

The one sentiment that seems universal, from asset managers to corporate decision makers, and from domestic to foreign participants, is that everyone is hoping that the last 2 months aren’t representative of the next few years!

Markets and the economy will continue to be driven by policy, but the volatility (or violence) of the moves should be reduced.

Together we stand is true, which is why we wanted to highlight not just the risk of “friction” internationally, but also the potential for “friction” domestically that may impact markets negatively from here.

Loading…