Authored by Lance Roberts via RealInvestmentAdvice.com,

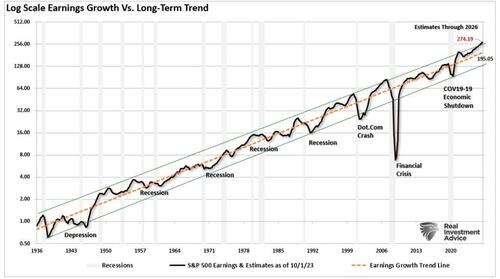

It would seem evident that most investors would understand that consumer spending drives economic growth, ultimately creating corporate earnings growth. Yet, despite this somewhat tautological statement, Wall Street appears to ignore this simple reality when forecasting forward earnings. As discussed recently, S&P Global’s current estimates show earnings are growing far above the long-term exponential growth trend from 1936. Unfortunately, with regularity, earnings tend to repeatedly revert to the long-term trend due to economic recessions, financial crises, or other events that crimp economic activity. In the chart below, earnings haven’t stayed at the top of the long-term growth trend channel for long. The current exponential growth trend for earnings is $195/share.

The obvious question is, what would cause earnings to revert so drastically from current levels? Unfortunately, there is no exact answer as the cause of every previous reversion was somewhat unique from a historical perspective. For example, since the turn of the century, there has only been one “Dot.com crash”, one “Financial crisis,” and thankfully, just one “COVID pandemic.” While unique and unexpected, each event led to similar earnings growth reversals.

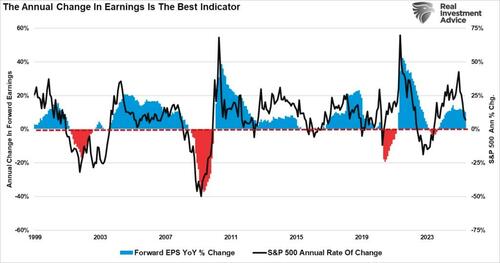

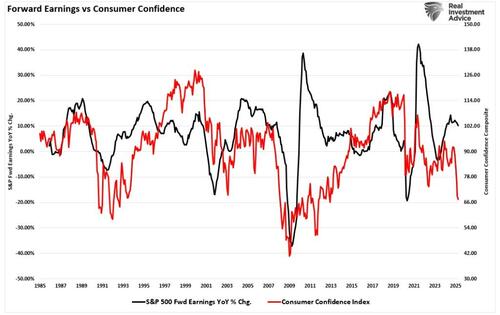

For investors, the market’s price is highly correlated to the expectation of forward earnings. As such, each of those events, as shown below, led to a rather sharp price reversal to adjust forward valuations for expected earnings.

Therefore, if forward earnings are so important to market outcomes, investors need to understand where future earnings growth will come from.

Where Do Earnings Come From?

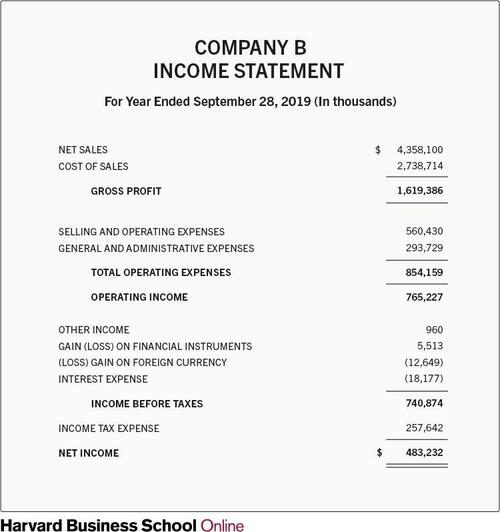

As noted above, earnings come from consumer spending. If you look at an income statement, revenue is the top line, and “earnings” or “net income” is the bottom line. The income statement is broken down into three primary sections: revenue, operating expenses, and other expenses (interest and taxes). One term you may hear often is EBITDA. That is an acronym for “Earnings Before Income Taxes, Depreciation and Amortization,” which gives you a better understanding of the company’s operational profitability and potential for generating cash flow from its core business activities. However, once we include those items, we get to the net income or earnings for the company. The final step is to divide those earnings by the number of shares outstanding to get to “earnings per share.”

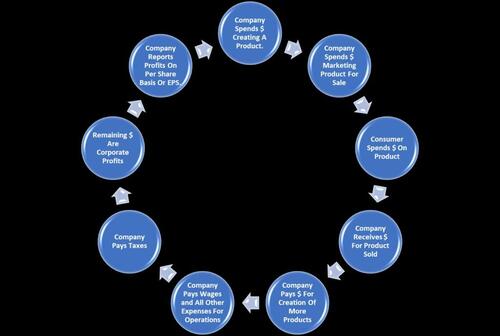

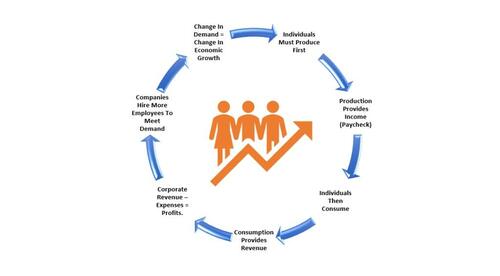

With that understanding, we must return our focus to the first line item—net sales (aka revenue, sales, gross sales, etc.). A company must sell a product or service to customers to generate revenue. The basic diagram below shows a company’s revenue cycle. Therefore, to understand what to expect in terms of future, or forward, earnings with some degree of accuracy, we must understand the direction of consumer spending.

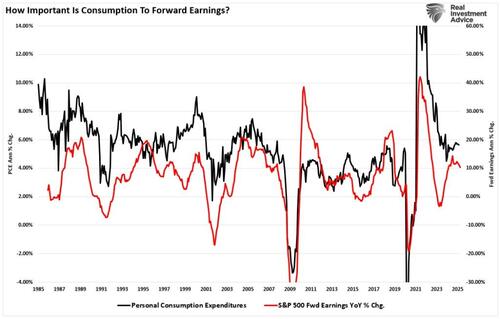

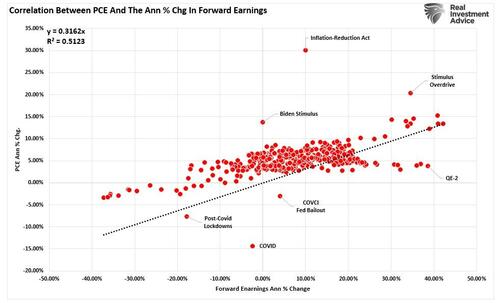

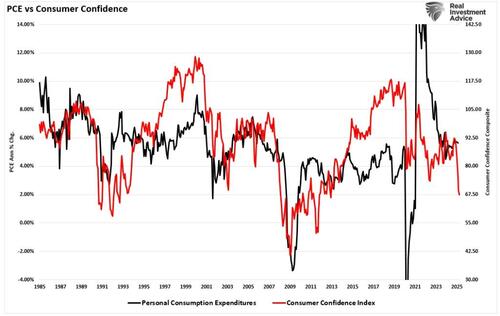

One of the better measures for developing a framework for future earnings growth is personal consumption expenditures (PCE), since they comprise nearly 70% of the economic equation. The annual percentage change in forward earnings tracks the yearly percentage change in PCE fairly closely.

For you “data geeks,” the correlation between the two measures is slightly more than 51%, so the correlation is not insignificant. You will notice that the outliers have mostly been recent anomalies caused by the COVID lockdown and subsequent fiscal and monetary interventions.

Therefore, while unsurprising, the strength of consumer spending has much to do with the expectation for forward earnings.

Earnings Manipulation

However, I would be remiss not to address the other impact on bottom-line earnings that income statement manipulation has. We addressed this point more deeply in “Beating Estimates.” To wit:

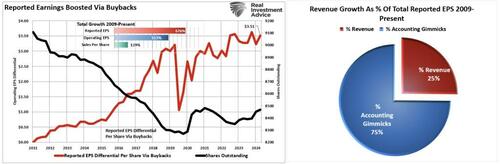

While Wall Street hopes for an improvement in earnings, there may be more to the story. Many companies have offset earnings growth with cost-cutting measures. The problem with cost cutting, wage suppression, labor hoarding, and stock buybacks, along with a myriad of accounting gimmicks, is that there is a finite limit to their effectiveness.

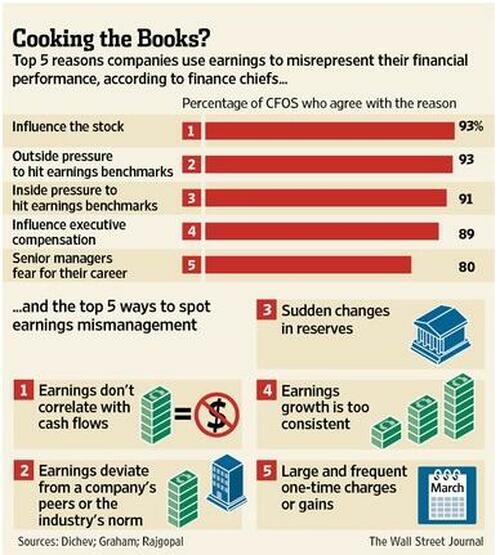

More importantly, Wall Street knows this already, and it should not be surprising that companies manipulate bottom-line earnings. By utilizing “cookie-jar” reserves, heavy use of accruals, and other accounting instruments, they can either flatter or depress, earnings.

While none of this should be surprising, a previous WSJ survey of CFOs was the most revealing regarding the depth of the manipulation.

“The tricks are well-known: A difficult quarter can be made easier by releasing reserves set aside for a rainy day or recognizing revenues before sales are made, while a good quarter is often the time to hide a big “restructuring charge” that would otherwise stand out like a sore thumb.

What is more surprising though is CFOs’ belief that these practices leave a significant mark on companies’ reported profits and losses. When asked about the magnitude of the earnings misrepresentation, the study’s respondents said it was around 10% of earnings per share.“

Of course, I would be remiss in dismissing the “elephant in the room” of stock buybacks.

Today, more than ever, many corporate executives have a large percentage of their compensation tied to company stock performance. A “miss” of Wall Street expectations can lead to a significant penalty in the company’s stock price. Unsurprisingly, 93% of the respondents pointed to “influence on stock price” and “outside pressure” as reasons for manipulating figures through accounting gimmicks and buybacks.

Note: For fundamental investors this manipulation of earnings skews valuation analysis particularly with respect to P/E’s, EV/EBITDA, PEG, etc. Revenues, which are harder to adjust, may provide truer measures of valuation such as P/SALES and EV/SALES.

However, even with the accounting gimmicks and buybacks, understanding the impact of consumer spending on forward earnings is crucial.

Consumer Sentiment And Spending

As shown above, if personal consumption expenditures correlate with forward earnings growth, and expected earnings growth drives market pricing, understanding where PCE is likely heading can be crucial for investors. So, what drives PCE? As discussed in “Employment Data,” consumers can NOT consume without producing something first. Production must come first to generate the income needed for that consumption. The cycle is displayed below.

Therefore, if consumers become more concerned about their financial situation, whether due to potential job loss, lack of access to credit, or the increase in the cost of living, this will be reflected in consumer sentiment. Unsurprisingly, the composite consumer confidence index has declined over concerns about tariffs, rising recession risk, and slowing employment in recent months. (Notably, with recent tariff negotiations reducing that risk, confidence will likely improve in the next reading.) However, even if that is the case, it suggests that we should see some weakness in future PCE reports.

Furthermore, given the correlation between PCE and forward earnings, and PCE and consumer sentiment, it should be unsurprising that there is a decent correlation between consumer sentiment and forward earnings.

Conclusion

While forward earnings projections defy historical norms, investors must remain grounded in the fundamentals that ultimately drive those earnings—consumer spending. Despite Wall Street’s frequent detachment from economic realities, the evidence is clear: corporate revenues, and ultimately earnings, are inextricably tied to the financial health and confidence of consumers.

Though earnings can be flattered in the short term through accounting gimmicks and buybacks, such tactics are unsustainable and often obscure underlying weaknesses. With personal consumption expenditures comprising the majority of economic activity and showing a strong correlation to forward earnings, monitoring shifts in consumer sentiment becomes crucial.

To offset the potential risk of downward earnings revisions, investors should consider several strategic actions:

-

Manage investment risk by regularly rebalancing, controlling over-concentration, and reducing laggards.

-

Focus on companies with strong, transparent revenue growth rather than those reliant on financial engineering or aggressive cost-cutting.

-

Incorporate valuation metrics based on revenue (P/S, EV/Sales) rather than easily manipulated earnings figures like P/E or EBITDA.

-

Maintain a flexible portfolio allocation that can adjust to economic shifts, emphasizing defensive sectors when consumer confidence wanes.

-

Use hedging strategies or increase cash levels to protect capital during earnings-driven market downturns.

Ultimately, long-term investment success will depend not on hopeful forecasts but on a clear-eyed understanding of what fuels corporate profitability, and that fuel remains the consumer.

Loading…