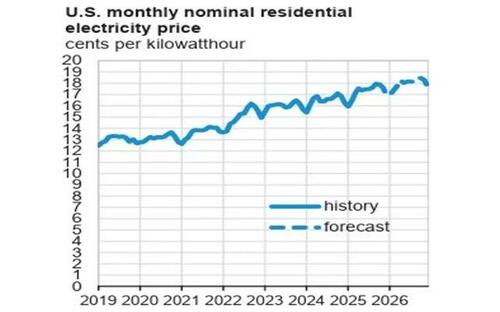

There is very little good news this week for those hoping to see relief in electricity prices next year, and more states took steps to put guardrails on data center development.

At the same time, new renewable generation projects continue to face delays and cancellations.

Here’s the story the data told this week in the electric power sector.

By the Numbers

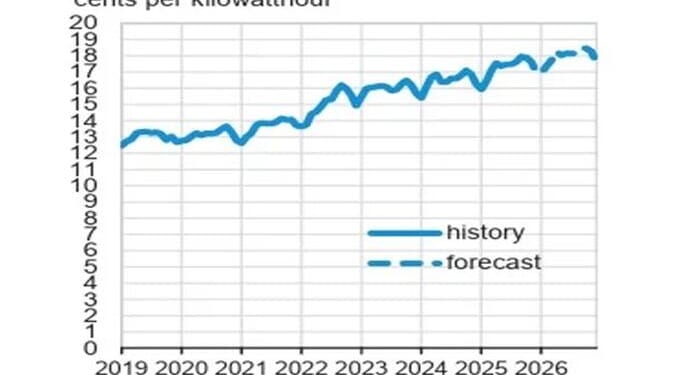

$51/MWh

The forecast price of wholesale electricity across the country in 2026, according to the U.S. Energy Information Administration. That number, 8.5% higher than this year, is the load-weighted average across 11 regional markets, but the increases will not be felt evenly. Much of the rise in demand and price is centered on Texas and driven largely by data centers, cryptocurrency mining facilities and other energy-intensive commercial customers, EIA said.

80%

The minimum percentage of contracted monthly demand that data centers and other large load customers will be required to pay Evergy and Consumers Energy, regardless of how much they use, under new rules adopted by regulators in Kansas and Michigan. The rules are intended to shield existing ratepayers from the costs of interconnecting data centers and other large loads, especially if the demand fails to materialize after the investments are made. AEP Ohio has said its data center pipeline shrank considerably after regulators there approved a similar tariff; many states are weighing like-minded proposals.

2.4 GW

The capacity of the planned Leading Light Wind project offshore New Jersey that developer Invenergy has canceled. It cited financial, supply chain and regulatory obstacles as reasons the project is no longer viable. The cancellation of the large generation project comes as rising power prices have begun to exert political pressure on elected officials. Gov.-elect Mikie Sherrill, a Democrat, campaigned on keeping down electricity prices.

$105B

The upper end of Duke Energy’s expanded five-year capital spending plan, which it expects to roll out early next year. Executives attribute the rise in spending to rapid load growth, including many data centers, which they say is likely to continue into the early 2030s. Additional generation added to Duke’s system could exceed 13 GW in the next five years, including 7.5 GW of new gas facilities. Duke is one of many utilities that have bumped their spending in response to projected load growth from artificial intelligence, manufacturing and electrification.

20%

The percentage of planned solar capacity for which developers reported a delay in the third quarter of 2025, a decrease from 25% in the same period of 2024. The decline in delays could be related to a rush to finish solar projects before clean energy tax credits expire following the passage of the One Big Beautiful Bill Act in July. The law provided a safe harbor provision for wind and solar projects that commence construction before July 4, 2026.

Loading recommendations…