The last few weeks have seen Ethereum dramatically outperform Bitcoin, with the ratio of the two cryptocurrencies bouncing strongly off the 2019 lows…

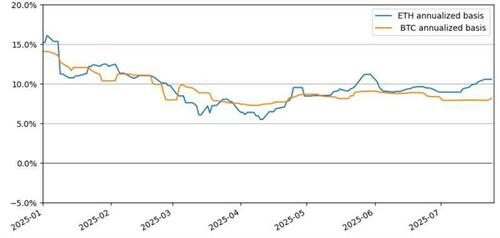

Ethereum CME futures annualised premium to spot has been trading >10%, overtaking that of Bitcoin, prompting the rotation of the basis position out of Bitcoin and into Ethereum…

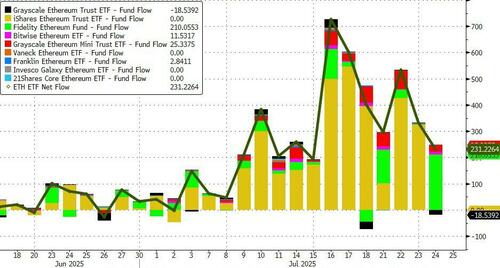

In line with the price action since May, the US ETH spot ETFs have seen a steady stream of inflows.

Spot Ether ETFs recorded a net inflow of nearly $2.4 billion in the past six trading days, far above spot Bitcoin ETFs, which recorded only $827 million during the same period.

Ether ETF inflows also outpaced Bitcoin ETFs for each of the last six trading days…

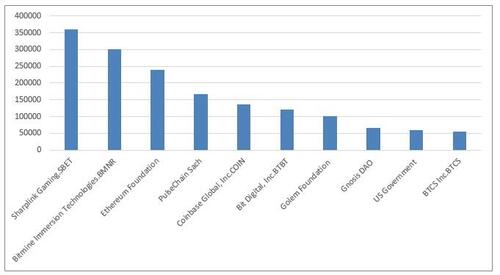

Finally, as Goldman Sachs crypto team notes (full details available here to pro subs), analogous to increasing number of corporates allocating Bitcoin exposure to their treasury holdings, a newer phenomenon have been several publicly traded US companies establishing Ethereum reserves.

It is estimated that such companies bought over $1.5b of ETH in the last month.

BitMine Immersion Technologies bought ETH worth $2 billion in the past 16 days, which propelled the company to become the largest corporate holder of ETH.

Top 10 holders of Ethereum (including the US Government) now account for >1.6m ETH (~$6b), with some surpassing the holdings of the Ethereum Foundation.

This is still a relatively low proportion of the Ethereum free float supply of ~$400b or of the $175b of ETH that moved in the past 1 year period (Coinmetrics).

Galaxy Digital CEO Michael Novogratz has predicted that the price of ETH will touch $4,000. He further said that ETH will outperform BTC in the next six months.

Novogratz pointed out that both BitMine Immersion Technologies and SharpLink Gaming have bought large amounts of ETH that can create a supply shock.

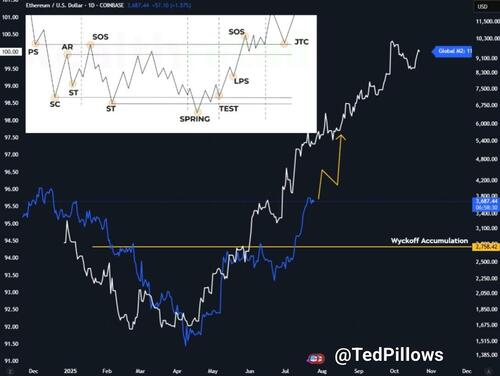

Global liquidity supply, or M2, aggregates US dollar-adjusted liquidity from major economies including the US, eurozone, Japan, the UK and Canada.

A rising M2 implies that more money is circulating in the economy, including in bank accounts, checking deposits and other liquid assets. Such surplus liquidity can increase capital inflow into riskier assets like crypto.

Ether appears to be following a similar M2 supply trajectory, defined by the Wyckoff accumulation method, in 2025, albeit with a significant lag period.

“Comparing with M2 supply growth, ETH should be trading above $8,000 by now,” said analyst TedPillows in an X post on Thursday.

The analyst added:

“This shows how undervalued ETH is right now, and is probably one of the best trades out here.”

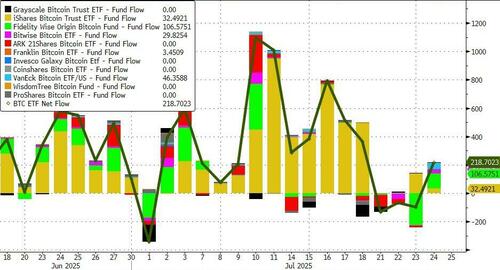

On Monday, spot Bitcoin ETFs broke a 12-day inflow streak, as BTC ETFs collectively saw a net outflow of $131 million. Before Monday, the 12-day net inflow collectively stood at $6.6 billion.

Swissblock research expects this trend to continue, as the research firm said, “ETH is rotating into leadership as the next leg of the cycle unfolds.”

Loading recommendations…